Investors don't have high expectations heading into the upcoming first-quarter earnings report from Lowe's (LOW +3.31%). That's in part because, at its last announcement in February, the home improvement retailer revealed soft sales growth and declining profitability. Management also suggested that profit struggles will continue into 2018.

Since then, the industry's growth picture has stayed bright despite rising mortgage rates. But there are still a few good reasons to expect weak results out of Lowe's in its earnings announcement on May 23.

Image source: Getty Images.

Aiming for a rebound

Lowe's outperformed management's modest growth expectations last quarter, and that win pushed comparable-store sales (sales at existing locations) up 4% for the year. Yet that figure implied stubborn market-share losses to the industry leader Home Depot (HD +3.38%) that executives are eager to stop. "We are moving forward with urgency to improve our results," outgoing CEO Robert Niblock told Wall Street analysts in a conference call.

That might be a hard turnaround in this sales period. Home Depot recently announced its own sales-growth slowdown in the first quarter that was driven by an unusually cold winter across many parts of the country. The weather dampened demand for its spring products, and pushed customer traffic into negative territory from a 2% increase in the prior quarter.

Lowe's was already struggling with declining traffic, and so that metric isn't likely to have turned positive, given the tough sales environment during the first few weeks of spring.

Profit challenges

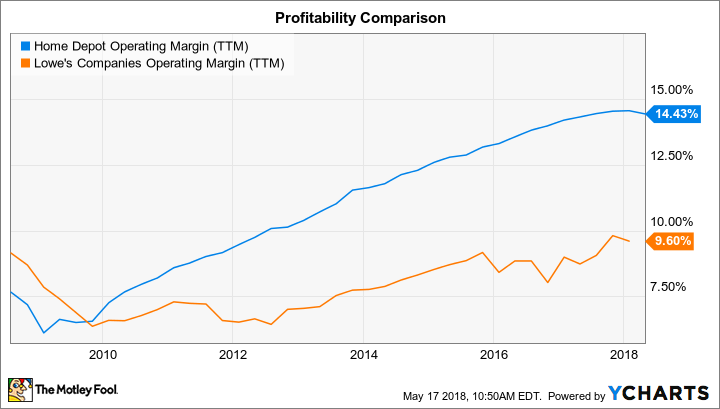

As part of its efforts to position itself for faster growth, Lowe's is pouring resources into areas like the digital sales channel, employee wages, and competitive price cuts. This spending should push operating margin down slightly from last year's 9.6% mark, even as Home Depot's comparable figure expands from its 14.4% rate in 2018.

HD operating margin data by YCharts. TTM = trailing 12 months.

We'll find out in the report just how aggressive Lowe's was in these spending initiatives. Management's comments, meanwhile, should highlight whether it thinks the strategies are working. Lowe's initial 2018 forecast called for operating margin to dip to about 9.3%, with gross profit margin expected to fall slightly. Both metrics should then begin marching higher next year — assuming everything goes according to plan.

The strategic update

Niblock is preparing to pass the reins to a new CEO, and the leadership transition might bring big changes to Lowe's business approach in the coming quarters. Executives said in February that they were reevaluating their long-term growth targets in light of quickly shifting industry trends. In plain terms, that update might include a lower profitability outlook, just as it has for other retailers, like Target, which are transitioning into a more digitally focused business.

On the bright side, the strategic review might also yield a big boost to Lowe's capital return plans. The company is expecting to generate over $6.5 billion in operating cash flow this year, as comps rise by a modest (but still healthy) 3.5%. Investors might not be excited if Lowe's simply affirms that sales guidance on May 23, but they'll likely take some solace in the fact that their returns are being bolstered by plenty of direct cash in the form of dividends and stock repurchases.