What happened

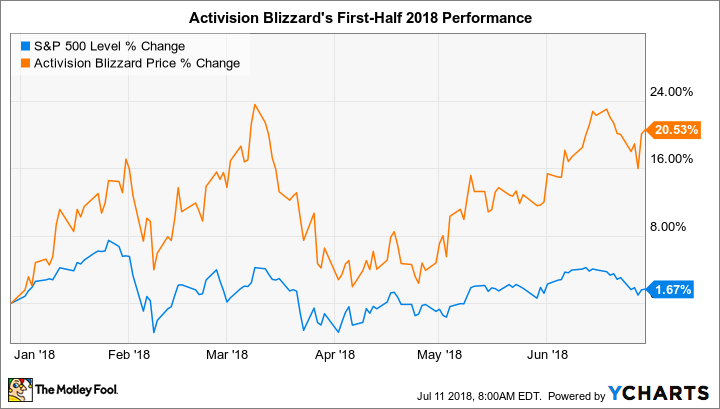

Activision Blizzard (ATVI) has outperformed the market through the first six months of 2018, jumping 20.5% compared to a 1.7% uptick in the S&P 500, according to data provided by S&P Global Market Intelligence.

The rally added to significant gains for long-term shareholders, who have seen their investment rise by roughly 200% in the past three years.

So what

Activision's most recent quarterly report didn't include particularly impressive headline numbers. In fact, its pool of active gamers shrank during the period.

However, that drop was driven by the cadence of its gaming releases, and not by any decline in user engagement in franchises like Call of Duty and World of Warcraft. On the contrary, these core titles are attracting plenty of player investments while new franchises like Overwatch set new monetization and audience records.

Image source: Getty Images.

Now what

Activision has formidable assets that position the company to reap huge financial rewards as the video game industry grows and shifts more toward a digital sales model. It all starts with an industry-leading portfolio of intellectual property, and the developer is extracting maximum value from those brands through initiatives that promote subscription services and microtransactions.

Looking further out, Activision's investments in areas like esports, advertising, and consumer products all look promising as additional revenue streams that might lift revenue higher over the next few years even as profit margins continue rising thanks to the digital fulfillment shift.