What happened

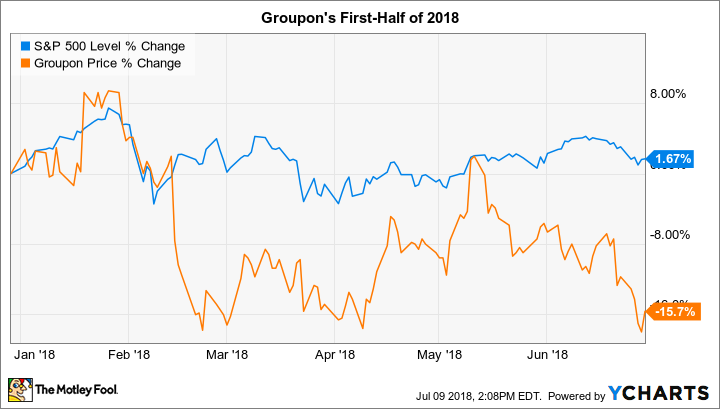

Groupon (GRPN 2.23%) stock trailed the market over the first half of the year, shedding 16% compared to a 2% uptick in the S&P 500, according to data provided by S&P Global Market Intelligence.

That slump contributed to intense volatility for the digital coupon specialist's shareholders, who've seen their stock returns range from 50% losses to 25% gains in the past three years.

So what

Investors aren't yet convinced that the company can build up a defensible position in the marketplace for local business advertising -- let alone one that throws off consistently strong profits. Groupon earned a tiny $14 million in 2017 and has posted a net loss in three of the last five fiscal years. Its most recent quarter included a modest loss, too, but management said it was happy to see profitability improve thanks to cost cuts.

Image source: Getty Images.

Now what

Groupon's global customer base has held steady at about 50 million over the past six months and even ticked down in the core U.S. market. The company will need those metrics to improve over time for its business trends to rebound. Instead, management is predicting that the customer pool will shrink slightly in the second quarter as it aims to shift its marketing toward higher-spending shoppers.