Stocks were flat last week as second-quarter earnings season kicked off and trade-war fears continued to filter through the markets.

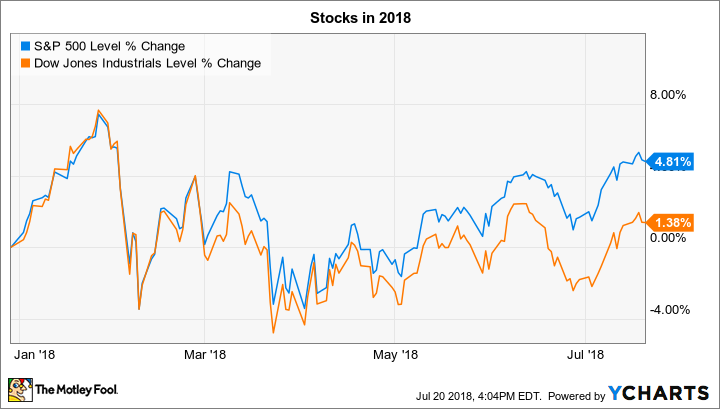

Both the S&P 500 (^GSPC -0.30%) and the Dow Jones Industrial Average (^DJI -0.46%) gained less than 0.2%, to leave the indexes modestly higher so far in 2018:

S&P 500 and Dow Jones Industrial Average Year-to-Date Performance, data by YCharts.

Earnings season hits full swing over the next few trading days, with highly anticipated reports on the way from iRobot (IRBT -10.35%), Facebook (META -2.29%), and McDonald's (MCD 1.14%). Below, we'll look at the big trends investors will be watching for in these announcements.

iRobot's market share

Given the recent rally in the stock, investors seem to be optimistic about iRobot's Tuesday earnings release. The robotic-vacuum specialist has been growing at a strong pace lately, with sales up 29% in the most recent quarter. Profitability also expanded nicely in the first quarter, as gross profit margin improved to 53% of sales from 52% a year ago.

Those good times might not last long, though. After all, iRobot is facing a surge of competition from companies aiming to chip away at its dominant market share. Management has warned that earnings growth could suffer as the company defends its positioning while the robotic-cleaning industry enters the mainstream. "... [O]ver the next three years," CEO Colin Angle said in February, "the true winners of the consumer robot industry are going to be determined for the next decade."

To meet that challenge, iRobot needs continued fast sales growth, but also significant profits that it can plow back into defending its leadership position in vacuums, while extending into new areas like mopping.

Facebook's user growth

Social-media titan Facebook will post its results on Wednesday afternoon, and investors have a few good reasons to follow this report closely. Its last announcement was embraced by Wall Street after the company turned a 49% revenue spike into a 63% jump in net income. Facebook managed double-digit increases in its daily and monthly active user bases, and 2.2 billion people now log on to the service at least once a month.

Image source: Getty Images.

We'll find out this week whether negative press surrounding the company's data-sharing policies had any impact on those user growth or engagement trends. Expenses will be key to watch, too. Management has predicted a 50% to 60% increase in this arena in 2018, as the company spends heavily to strengthen its network and to make aggressive bets on growth initiatives like streaming video and virtual reality. CEO Mark Zuckerberg believes these moves should support the company's broader mission of connecting users around the world, while also lifting Facebook's long-term earnings potential.

McDonald's customer traffic

McDonald's has been on a roll lately, with sales jumping at its existing locations and profitability surging. Following a 5.3% comparable-restaurant sales gain in 2017, the fast-food chain announced a 5.5% comp increase in the fiscal first quarter. This left rivals, including Starbucks and Yum Brands, far behind.

Mickey D's recent results weren't all good news, though. The company saw customer traffic slip back into modestly negative territory in the key U.S. market last quarter. Investors will be watching that metric in Thursday's results for any signs of a continued slowdown.

Shareholders will also get an important update on the chain's investment initiatives, which are especially bold this year. With $2.4 billion slated to be spent on store remodels, modernizations, and preparations for digital ordering and delivery -- up from $2 billion in 2017 -- the pace of change is speeding up at this iconic restaurant chain. Executives said in April that this quick adaptation is "what it takes to keep pace with today's rising customer expectations," and so it might become a new normal for McDonald's.