Tesla, Inc. (TSLA 3.76%) has had a tumultuous 2018, with CEO Elon Musk's penchant for creating media buzz seemingly causing more trouble than benefit. The electric-vehicle (EV) market, meanwhile, has simply kept moving right along, with most major automakers pushing the pedal to the metal in the EV space. That's why investors interested in the EV market might want to forget about Tesla and, instead, take a close look at Albemarle Corporation (ALB 1.16%), a key supplier to the entire EV sector. Here's why Albemarle is a better electric-vehicle stock than Tesla.

A big quarter

The third quarter was a big one for Tesla, with the company reporting a quarterly profit of $312 million. Fool contributor Adam Levine-Weinberg recently noted that key achievements included improved gross margins in the Model 3, its first "mass-market car," as well as declining operating expenses and better cash flow. Investors were justifiably impressed with the quarterly results and the company's strong guidance for the rest of the year.

Image source: Getty Images

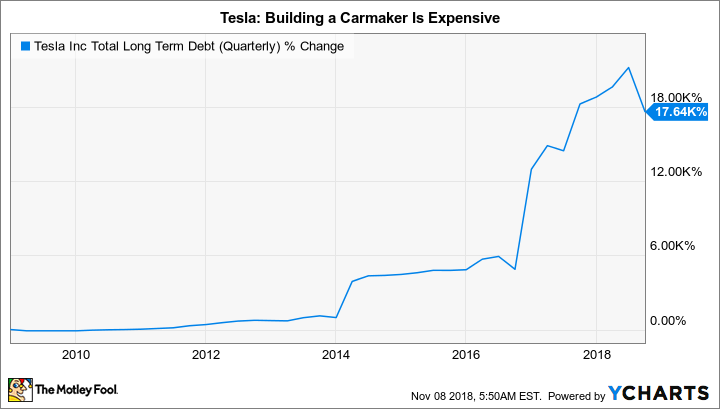

However, there are some other factors to consider here. For starters, Tesla is carrying a very heavy debt load. Long-term debt increased from roughly $600 million in 2013 to $9.4 billion in 2017 as it spent heavily to expand in the capital-intensive auto business. Long-term debt rose a little bit more through the third quarter, hitting nearly $9.7 billion and making up around 70% of the capital structure. The company covered its interest expense in the quarter, but has yet to do so on an annual basis.

And Tesla's big spending plans aren't over, though Musk is saying that the company's future is now on a sustainable and profitable path. For example, it intends to build a truck and a new manufacturing plant in China (neither will be cheap). One quarter doesn't make a trend, and Tesla still has a lot to prove. In the meantime, competitors with more established businesses have jumped into the EV market to compete with the upstart automaker and supply the growing auto niche. Simply put, building an automobile company from the ground up is a huge and costly undertaking. That's not to suggest that Tesla can't do it, but with increasing competition and a heavy debt load the task is that much harder.

Buy the supplier

If you are enticed by the idea of electric vehicles and the growth potential that Tesla offers, you might want to step back and think about what happens if things don't work out as planned. If the company can't handle the debt load it's taken on, it could easily go the way of the DeLorean. But the EV market won't follow it into the dustbin of history -- it will keep growing, supported by the major automakers that are increasingly focusing on their EV lineups.

TSLA Total Long-Term Debt (Quarterly) data by YCharts.

That's what will drive results at specialty chemicals company Albemarle, which has three divisions: Bromine, which is used in heat shielding in electrical products; Catalysts, used in the refining sector; and Lithium, which is used in automobile batteries. The first two are helping the company to fund its expansion in lithium, though the company notes that it may, at some point, end up focusing solely on lithium.

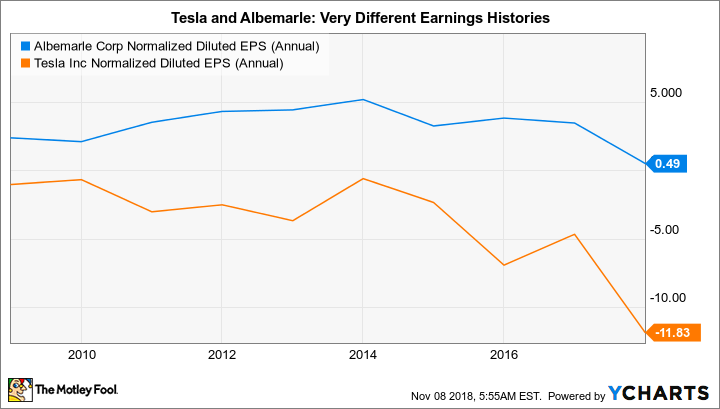

The growth potential for its lithium business is huge. It currently plans to increase lithium production by as much as 60% by 2021. The difference between Tesla and Albemarle is threefold. First, the company is sustainably profitable, with positive earnings in each of the last 10 years. Second, long-term debt only makes up about 30% of its capital structure. Essentially, it is in much better shape to support its growth plans than Tesla.

ALB Normalized Diluted EPS (Annual) data by YCharts.

The third key difference is that Albemarle doesn't have to succeed in building a new car brand. Demand for lithium will keep expanding as long as the EV market keeps expanding. Right now, Albemarle is projecting 35% compound annual growth in lithium demand between 2017 and 2025. Tesla is a piece of that demand, but the lithium maker has a lot of other customers looking for its product. So no matter what happens with Tesla, Albemarle looks set to benefit from the broader move toward electric vehicles.

That said, it's important to note that lithium is a commodity, so Albemarle's top and bottom lines can be volatile at times. However, if demand even comes close to the company's current projections, it should be able to keep growing its top and bottom lines with volume gains even if lithium prices move lower.

Not cheap, but neither is Tesla

To be fair, Albemarle is an expensive stock today. Its P/E is pretty high at nearly 36 times and its price-to-sales ratio is an elevated 3.7 times. Both, however, are below their five-year averages following a price pullback this year. Tesla's P/S ratio is a little lower at 3.3 times (also below its five-year average following a stock-price decline), but it doesn't have a trailing P/E because it wasn't profitable over the trailing-12-month period.

Clearly, Tesla still has a lot to prove, notably that it can truly build a sustainable business in the increasingly competitive EV market. Albemarle has already proven that it has a sustainable business and it will benefit as long as the EV market expands -- it doesn't matter what happens to any single car maker. If you are looking at the EV space and want a pure play on the auto niche's growth potential, Albemarle is a better option than Tesla today.