Global agriculture and construction equipment manufacturer Deere & Co. (DE -2.14%) recently reported on its fiscal fourth-quarter and full-year 2018 results. Strong organic growth and the acquisition of road construction equipment giant Wirtgen Group combined to boost Deere's full-year revenue and earnings by 26% and 10%, respectively.

In its current fiscal year (which began on Oct. 29, 2018), Deere projects that revenue will exceed 2018's total of $37.4 billion by 7%. Net income is forecast to improve roughly 50% to $3.6 billion. Below, let's review comments made by management during the company's Nov. 21 earnings conference call, which illuminate both the tailwinds Deere will enjoy and the challenges it will grapple with over the current 12-month period.

Deere's 1170G wheeled harvester. Image source: Deere & Co.

Rising yields will be mostly positive for Deere's agricultural business in 2019

In the US, overall, both farmer and dealer sentiment remains cautiously optimistic. While there is uncertainty in the soybean market, there is optimism around improved fundamentals...in the corn, wheat and cotton markets.

In addition, we're seeing notable excitement from dealers and customers in our core Midwest markets concerning the 2018 crop, where there are record yields in both corn and soybeans. Dealers believe this crop will positively influence equipment demand for 2019.

--John Lagemann

In the commentary above, John Lagemann, vice president of Deere's agriculture and turf segment, provided some clarity for investors worried about the effect of the U.S.-China trade dispute, which has led to the imposition of bilateral tariffs. U.S. soybean exports to China have plummeted, as Chinese buyers have turned to Brazil and Argentina for supply after the Chinese government imposed a tariff of 25% on U.S. soybeans in July.

Brent Norwood, Deere's manager of investor communications, provided additional insight into agricultural demand heading into fiscal 2019. Norwood observed that the record yields in corn coupled with higher prices are expected to offset weak soybean prices in the near term. Firming cotton and wheat prices will also contribute to expected crop cash receipts. Deere sees U.S. principal crop cash receipts at $120 billion next year, approximately even with the current year.

So, despite trade uncertainty, the company expects that decent cash receipts for farmers and record yields in the 2018 crop will function as firm equipment demand drivers in the new fiscal year.

Agriculture sales will benefit from aging equipment fleets and improved technology

[I]t is still a replacement market. That's because the fleet age has reached its highest point since 2013, and customers are increasingly [signalling] a need for newer [equipment] due to hours and the age on their machines. Further, to the second point, we see evidence that replacement demand has been amplified by the latest precision technology with many examples across our entire large Ag portfolio.

--John Lagemann

An aging farm equipment fleet represents a revenue tailwind for Deer's "ag & turf" segment in fiscal 2019. Lagemann makes a slightly subtle additional point above. Growing utilization of precision technology can induce farmers to replace older equipment before it reaches replacement age if they see an economic benefit from buying higher-tech equipment.

During the call, Lagemann cited "guidance, telematics, onboard computing and [our] digital operations center, all of which represent up to 20 years of investment" as components of precision technology which are delivering a return on investment to buyers. These and other systems guide planting, spraying, and harvesting to improve crop yield (and farmers' profits) beyond the capabilities of traditional mechanical machinery.

Lagemann also extolled the company's upgraded support systems, including John Deere Connected Support, which allows the company to remotely monitor customer equipment and send predictive maintenance alerts to a customer's local dealer. This extends the useful life of equipment and helps justify a commercial farmer's investment in a more sophisticated fleet.

A bright construction and forestry outlook

For 2019, US GDP and total construction investment are forecast to grow, while housing starts and oil activity remain at supportive levels for equipment demand. Importantly, our US customer base remains quite optimistic on next year's prospects, starting backlogs extending through much of the year.

--Brent Norwood

Sales in Deere's second-largest division, construction and forestry, or C&F, jumped 65% in the fourth quarter, to $2.7 billion. Roughly 45 percentage points of this growth can be traced to the company's $5.3 billion acquisition of the world's largest manufacturer of road construction equipment, Wirtgen Group Holding GmBH, on Dec. 1, 2017.

In fiscal 2019, Deere expects C&F sales to improve 15% due to higher equipment demand spurred by an expanding economy and two months of comparative contribution from the Wirtgen acquisition before the acquisition is "lapped."

In addition to favorable conditions in the U.S., Norwood relayed that global transportation investment is expected to increase approximately 5% in 2019. Demand-related growth has already pushed Wirtgen's order book out six months into calendar 2019.

Operating margin to increase over the next few years

[I]n our recent review of the John Deere strategy, we revised our 2022 financial aspirations to reflect our higher expectations for the business. As a result, we raised our mid-cycle operating margin target from 12% to 15%, and modified our operating asset turn aspiration to keep us focused on managing assets effectively. These goals reflect our continued drive to make further improvements and overcome headwinds, such as currency or inflation. Also, the new goals incorporate Wirtgen's potential contribution and will keep us focused on its successful integration.

-- Rajesh Kalathur, CFO and CIO

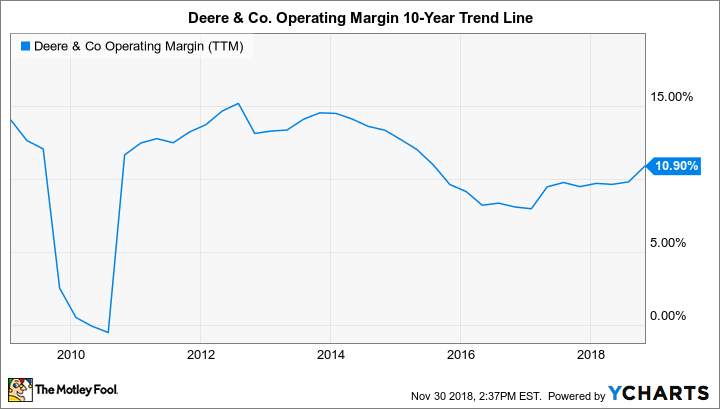

Deere's goal of hitting 15% in operating margin within the next few years is ambitious. It represents a margin level that the company has bumped up against historically yet never maintained for long. You can see this in the chart below of the company's operating margin over the last 10 years (on a trailing 12-month basis):

DE Operating Margin (TTM) data by YCharts.

The company believes that its gradual shift into technology-empowered equipment, continued growth in C&F propelled by Wirtgen, cost cutting, and faster sales cycles will help it find that elusive staying power to remain above the 15% level. For the current fiscal year, I believe shareholders can expect a modest single percentage point of growth above fiscal 2018's full-year 12% operating margin.