If you're investing in dividend stocks, understanding payment timing and mechanics is essential for managing your income expectations and portfolio strategy. Here's what you need to know about when and how you'll get paid.

How often companies pay dividends

The vast majority of U.S. dividend-paying companies issue quarterly payments: four times per year. Each company's board of directors determines its dividend schedule, but quarterly payments have become the standard practice.

- Monthly dividends: A small number of companies pay dividends every month, with Realty Income being the most notable example. The company has marketed itself as "the monthly dividend company" and has paid monthly dividends since its founding in 1969. Monthly payers are most common among certain real estate investment trusts (REITs).

- The vast majority of U.S. dividend-paying companies issue quarterly paymentsour times per year. Each company's board of directors determines its dividend schedule, but quarterly payments have become the standard practice.eholders. Costco Wholesale provides a notable example, having paid substantial special dividends four times over the past decade alongside its regular quarterly dividend.

Critical dates every dividend investor needs to know

There are three important dates to understand if you invest in any dividend stocks:

- Ex-dividend date: The first day a stock trades without the upcoming dividend included in its price. If you buy shares on or after this date, you won't receive the next dividend payment. To be entitled to the dividend, you must own shares before the ex-dividend date.

- Record date: The date you must be the recorded owner of shares to receive the dividend. Thanks to T+1 settlement (implemented in May 2024), trades now settle the business day after the transaction. This means the ex-dividend date and record date are typically the same day, unless the record date falls on a non-business day.

- Payment date: When the company actually distributes the dividend to shareholders. Depending on your broker, the cash may appear in your account on this date or a day or two later. Payment dates can range from a few days to over a month after the dividend is declared.

Real-world example: How dividend timing works

Let's look at Apple's dividend from August 2025 to see how these dates work in practice.

On July 31, 2025, Apple declared a dividend of $0.25 per share with a payment date of August 14 to shareholders of record as of August 11.

Here's what that means: To receive the August 14 dividend payment, you needed to own or buy Apple shares before August 11 (the ex-dividend and record date). If you bought shares on August 11 or later, you missed that dividend payment.

Under the current T+1 settlement system, when you buy stock on a given day, you become the owner of record the next business day. Before May 2024, it took two business days for trades to settle (T+2).

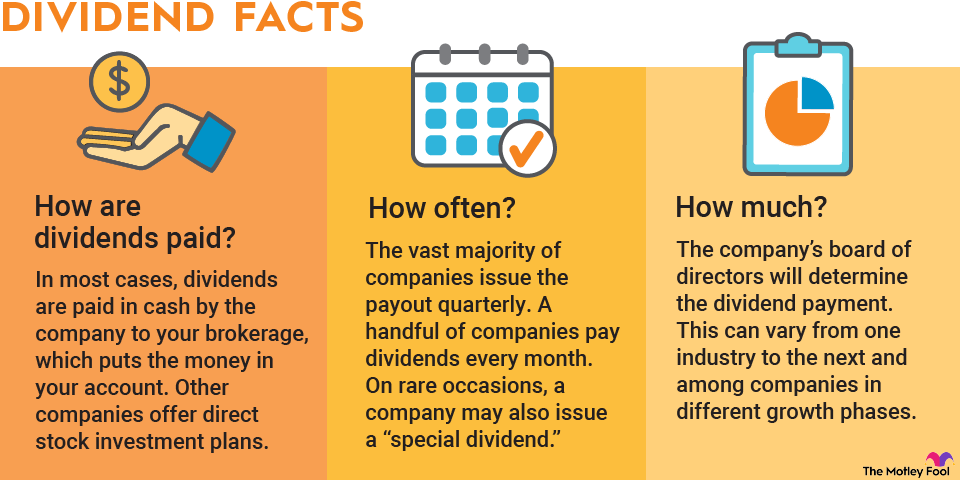

How are dividends paid?

Cash payments

In the vast majority of cases, companies pay dividends in cash. The money flows from the company to your brokerage account, which deposits it into your account on or shortly after the payment date. If you need that cash for living expenses, factor in an additional few days to transfer it from your brokerage to your bank account.

Stock dividends

Some companies pay dividends in additional shares rather than cash. This is rare but does happen. Companies typically make it clear when dividends aren't paid in cash. If you receive a stock dividend but want actual cash, you'll need to sell those shares and wait for the trade to settle (one business day) before your broker will allow you to withdraw the proceeds.

Direct investment plans

While some companies offer direct stock investment plans that bypass brokerages, the widespread availability of zero-commission trading has made these programs less attractive. Most investors find managing dividends through their brokerage simpler and more convenient.

Planning around dividend payments

Understanding dividend timing helps with several practical considerations:

- Income budgeting: If you rely on dividends for living expenses, know that there's typically a lag between the payment date and when you can access the cash in your bank account. Build this delay into your budget.

- Tax planning: You owe taxes on dividends in the year you receive them, even if you reinvest them automatically. The payment date determines which tax year the dividend falls into.

- Portfolio management: Tracking ex-dividend dates helps you understand why a stock's price might drop slightly on that date -- the market adjusts for the dividend that's no longer attached to new purchases.

The bottom line

Most dividend-paying companies follow a quarterly schedule, with payments arriving three to four times per year. The key to receiving dividends is owning shares before the ex-dividend date, which now aligns with the record date thanks to T+1 settlement.

Whether you're building a dividend portfolio for growth or relying on dividend income, understanding these mechanics helps you plan purchases, manage cash flow, and set realistic expectations about when money will arrive in your account.