What happened

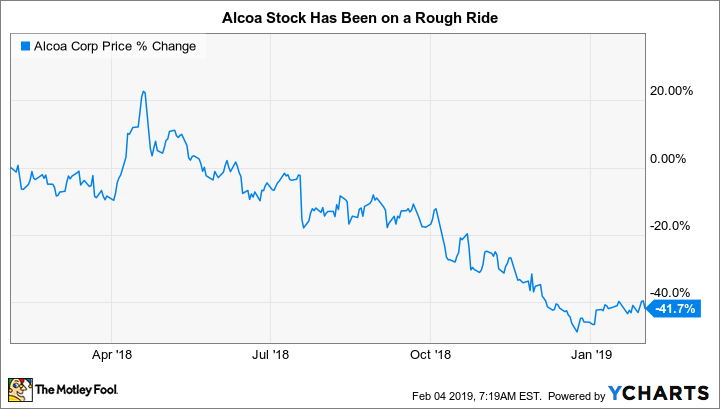

Shares of Alcoa Corporation (AA) rose just under 12% in January, according to data provided by S&P Global Market Intelligence. That's a notable change in direction, since the stock was down around 40% over the past 12 months. The truth is, 2018 was a pretty disastrous year for the stock, which has been cut in half after reaching near-term highs in April. But don't get too excited about the January reprieve.

So what

The company reported mixed earnings in mid-January. Year over year, there was a notable earnings improvement, with a roughly 19% advance in adjusted earnings in 2018. But commodity price weakness was a headwind in the back half of the year. Although volume gains were more than enough to offset the impact, because it's a producer of commodities across the aluminum value chain, Alcoa's stock and financial results are heavily influenced by commodity price trends.

Check out the latest Alcoa earnings call transcript.

Image source: Getty Images.

The outlook that management provided for 2019, meanwhile, was also somewhat mixed. Alcoa believes there will be an aluminum supply deficit during the year, leading to demand growth of between 3% and 4%. That's not a bad backdrop for the aluminum industry. However, it believes that inputs bauxite and alumina will see surpluses. Those surpluses suggest that price weakness could continue to be an issue. Management is expecting its shipments of bauxite and alumina to be flat to just a little higher. That's not bad, given the industry outlook, but not exactly exciting. With regard to aluminum, meanwhile, Alcoa is projecting shipments to fall because of the expiration of a tolling agreement despite positive market fundamentals. In all, Alcoa isn't exactly painting a great picture for 2019.

The upturn in January, then, is most likely related to a shift in broad investor sentiment. Simply put, investors were in a risk-averse mood in December, when stocks, including Alcoa's, fell hard. In January, investors got more positive, pushing stocks higher -- including Alcoa's shares. That said, there's nothing on the horizon at this point to suggest that Alcoa's fundamental outlook has improved greatly or that investors should expect continued stock gains.

Now what

Alcoa is a commodity company, and the stock will be pushed up and down along with the price of aluminum. The current outlook from the company, meanwhile, isn't really all that inspiring for the broad industry or the company itself. Yes, the stock is down materially over the past year, so it might be of interest to investors looking for bargains. But that's only true if you have a positive long-term outlook for the aluminum group. If that's not the case, you should probably view January's stock advance as market noise that is best ignored.