Real estate investment trust (REIT) Kimco Realty (KIM +1.54%) owns retail properties. With the retail industry in a state of flux, often referred to with the hyperbolic term "the retail apocalypse," investors haven't been too keen on the company's shares of late. In fact, the shares are 45% off of the highs reached in mid-2016, and the yield is over 6%, higher than it has been since 2011 despite annual dividend hikes since that date. For those who can see past the retail apocalypse hype, though, Kimco is worth a deep dive.

Enclosed malls, not shopping centers, are the risk

The first thing to realize here is that the real pain in retail is being felt at enclosed malls, specifically enclosed malls in weak locations or with old facilities. Kimco doesn't play in that space; it owns shopping centers. These are the local strip malls that house everyday necessity businesses like grocery stores, hair salons, dry cleaners, and restaurants. These types of facilities have held up relatively well compared to enclosed malls. To put a number on it, Kimco's occupancy was a very strong 95.8% in 2018.

Image source: Getty Images.

But that deserves a little more examination. First off, the overall occupancy number includes the hit from bankruptcies like Toys R Us and Kmart, which lived in some of Kimco's properties. So the "apocalypse" is having an impact, but it's not a particularly big one. However, that starts to look even better when you break Kimco's customers into large and small lessees. The so-called anchor tenants in Kimco's portfolio had an occupancy of 97.4%, a strong number. The smaller stores that rely on the anchor to drive foot traffic had an occupancy rate of 91.1%. Don't think that's a bad figure, though, because it's an all-time high for the company.

All in, don't lump Kimco in with struggling regional mall operators. It isn't the same animal.

What's going on

That said, Kimco has been making some aggressive changes to its business in recent years. For example, in 2010, it owned more than 800 properties, but by the end of 2018, it owned just 437. Since the end of the 2007-to-2009 recession, which led to a dividend cut in 2010, the company has shifted in a new direction. It has chosen to focus all of its efforts on the top 20 U.S. markets. Today, more than 80% of its rents come from these core markets, compared to around 60% in 2010.

There are two takeaways here. First, management has made a lot of progress. Second, it's still not done selling assets. So look for divestitures to continue. That's a mixed blessing, in that it can depress rental income even as it makes Kimco a better REIT. To put some numbers on that, Kimco's asset sales have increased the average population around its shopping centers by 13%, household density by 15%, median income by 13%, and average income by 16%. Selling that much of the portfolio is hard; the total rent roll fell slightly year over year in 2018 because of the sale of 68 properties. But overall, Kimco has vastly improved the core of the business over time.

That core, meanwhile, is also getting a makeover, as Kimco has embarked on an upgrade cycle even while it has sold off less desirable properties. This is a multipronged approach. Kimco is, of course, making sure its properties look nice...that's table stakes. It is also enhancing its remaining high-quality assets by building from the ground up. This can be as simple as adding a few stores on adjacent land or far more complex, such as creating mixed-use space, which can include things like offices and housing.

Building on adjacent land and property upgrades to keep an asset looking nice should produce solid results and support slow and steady long-term growth. There's some additional risk with the mixed-use developments, which are relatively new to Kimco. However, there's material upside if the properties work out as planned. And with just a handful of projects like this in the works, the risks should be contained. The worst-case scenario is that Kimco sells the assets and goes back to focusing on smaller projects. Such a move wouldn't be great news, but it wouldn't be a devastating financial blow, either. The upside opportunity, meanwhile, could be material and, notably, increase the diversification of its properties.

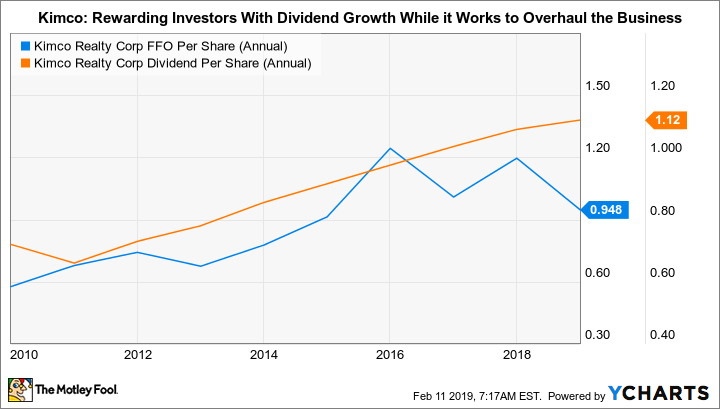

KIM FFO Per Share (Annual) data by YCharts.

The only real problem here is that Kimco is currently paying out all of its funds available for distribution. Weak dividend coverage, however, has to be balanced against the company's growth plans. At present, management expects distribution coverage to start improving in 2020, with a longer-term payout target in the 80% range. With the success it has had so far in upgrading its portfolio, it deserves the benefit of the doubt here.

Check out the latest Kimco earnings call transcript.

The best part

Kimco has spent the last few years creating a better portfolio. It has a pipeline of smaller projects that should keep the company growing, with a few larger projects that have additional risk but could really boost the value of the REIT's assets. Meanwhile, investors are worried about the changes facing the retail sector (which don't really have that big an impact on Kimco), the increased risk of the big projects, and the currently weak payout ratio. This has led to a fat 6%-plus yield and price to projected 2019 funds from operations, or FFO, of around 12.5 times. That looks like a very reasonable price to pay while you sit back, collect the big dividend, and watch Kimco continue its so-far-successful business makeover.