Brookfield Asset Management (BAM +0.89%) and Brookfield Infrastructure Partners (BIP +0.00%) are joined at the hip, but they have very different goals. That distinction is vital to an investor's decision-making process here. This is what you need to know to decide which is the better buy.

Some basic stats

Brookfield Asset Management's yield is a tiny 1.4%, backed by seven years of annual dividend increases. Brookfield Infrastructure Partners' yield is 5%, with 11 years of annual distribution increases under its belt. Even more telling, Brookfield Infrastructure's distribution has increased at an annualized rate of 11% since 2009, compared to a 10-year dividend growth rate of just under 8% at Brookfield Asset Management.

Image source: Getty Images.

For dividend investors, the answer should be pretty clear: Buy Brookfield Infrastructure Partners over parent Brookfield Asset Management. That's true, but the differences here tell an important story. Brookfield Infrastructure's goal is to own and operate physical infrastructure assets with the purpose of passing on a steady and growing income stream to investors. The target is to grow distributions between 5% and 9% a year, over time. Brookfield Asset Management's goal is, essentially, to grow its asset management business, with a key determinant of success being how well it runs entities like Brookfield Infrastructure Partners.

Check out the latest earnings call transcripts for the companies we cover.

What success looks like

In the case of Brookfield Infrastructure Partners, Brookfield Asset Management has clearly done a good job. The entity has actively managed its portfolio over time, buying and selling opportunistically, while continuing to grow its business and reward investors. Today the partnership has operations spread, roughly evenly, around the world, with businesses in the utility, midstream energy, data center, and transportation sectors.

It targets returning 65% of funds from operations, or FFO, to investors via distributions. The remaining 35% gets put back into the business, maintaining its assets and being invested in growth projects. If it needs extra cash for a big acquisition or growth project, it can tap the capital markets, and usually count on parent Brookfield Asset Management to chip in, too. However, the clear preference is to jettison slower-growth, lower-return (6% to 10% internal rates of return) assets so it can bring faster-growing and higher-returning (12% plus IRRs) businesses into the portfolio.

Last year was a transition year for Brookfield Infrastructure Partners. It sold a business for $1.3 billion and bought six new ones for a total cost of $1.8 billion. The internal rate of return on the business sold was 11%, which makes it a pretty successful investment. The new businesses, meanwhile, all provide the partnership with growth potential via incremental investment and further expansion via acquisition.

That's not the only one

The partnership's results so far suggest that Brookfield Asset Management is doing a pretty good job running Brookfield Infrastructure Partners on behalf of income focused investors. However, this is just one of several entities that Brookfield Asset Management operates. It also runs publicly traded Brookfield Renewable Partners, Brookfield Property Partners, and Brookfield Business Partners, each focusing on buying exactly what its name implies. In addition to these businesses, Brookfield Asset Management also runs private money. At the end of 2018, the company had $138 billion in fee-bearing assets, up from $86 billion in 2014.

To be fair, the company is making hay while the sun is shining, taking advantage of a long bull market to raise capital. However, a large portion of the total is what is often called permanent capital -- comprised largely of the above-mentioned publicly traded partnerships. The value of those entities will wax and wane over time (the combined value fell 11% in 2018 because of shifting unit prices), but the capital won't go away. So there's a strong core underlying Brookfield Asset Management's business.

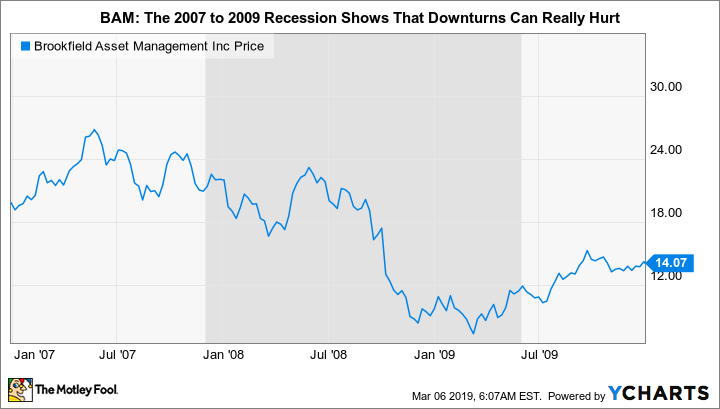

That said, a market downturn would likely lead to relatively weak top- and bottom-line performance, as fee revenues would fall. For example, in 2008, the worst part of the deep 2007-to-2009 recession, cash flow from operations dropped a massive 25% on a 5% decline in the company's assets under management. Investors were not pleased, pushing the stock down roughly 50% by the time the recession ended (which was actually an improvement from the interim recession lows).

Which gets to the crux of the issue here: Brookfield Asset Management is really a growth-focused investment. If you invest in this stock, you are betting that Brookfield Asset Management can continue to expand its asset management business over time and that the market will reward success with a higher price. If you invest in Brookfield Infrastructure Partners you are looking to collect a robust, and growing, distribution. A stock price decline may be troubling, but income investors are more likely see it as a buying opportunity because distributions are viewed as the main source of return.

Which is the better buy?

The real answer here is that both Brookfield Infrastructure Partners and Brookfield Asset Management are solid investment options. The choice between them really depends more on what an investor is looking for. Income investors will be best off with Brookfield Infrastructure Partners and its distribution-focused business. Growth-oriented investors will probably favor Brookfield Asset Management but need to recognize that market gyrations could have a material impact on both its results and the market's perception of the stock.