NextEra Energy (NEE +1.28%) just joined an elite club, the Dividend Champions. That means it has increased its dividend each and every year for 25 consecutive years. It takes a serious commitment to returning value to shareholders and a strong business to reach that milestone. But that's not enough to say NextEra is worth buying. You need to dig a little further before making that call. Here's a primer to help you decide if this utility deserves a place in your portfolio.

Some background

NextEra's core business is Florida Power & Light, the largest utility in the Sunshine State. FP&L is also the largest utility in the United States by retail megawatts sold. In addition, NextEra owns Gulfwest Power, a much smaller Florida utility and recent acquisition from Southern Company. These two businesses generated roughly $4.55 per share in earnings in 2018.

Image source: Getty Images.

The other piece of NextEra is NextEra Energy Resources, a somewhat boring name for what is actually one of the largest renewable-power companies in the world. It has 23 gigawatts of power-generating capacity, with wind making up roughly two-thirds of the total and solar about 10%. The rest of its generation is a mixture of nuclear (12% of the total and a clean energy source) and carbon-based generation (about 10%). This division, a merchant power company selling electricity under long-term contracts, is the utility's growth engine. In 2018 it generated roughly $9.75 per share in earnings, but if you pull out investment gains and losses that number comes down to $3.73 per share -- still a substantial number.

NextEra has basically married the old and the new in the utility space, using the foundation of FP&L to build up a massive renewable power operation. Along the way it has rewarded investors with a steadily growing dividend. What's perhaps even more impressive is the rate at which the company's dividend has grown, posting roughly 9.5% annualized dividend growth over the past decade. That's about three times the historical rate of inflation growth, notably increasing the buying power of the dividend over time.

Time to buy?

Don't jump aboard this well-run and successful utility just yet, though. There are other factors to consider. For example, the dividend yield of around 2.6% is toward the low end of the utility industry. And it's not all that much more than what you could get from an S&P 500 index fund, even though the stock is from a sector that's supposed to be known for generating income. The swift pace of dividend growth is a piece of that puzzle, since higher-yielding peers generally have dividend growth in the low to mid single digits. However, that doesn't change the fact that NextEra's yield is less than impressive. This is not a great option for investors looking to maximize the income their portfolios generate.

NEE Dividend Yield (TTM) data by YCharts.

It is, however, an interesting option for investors looking to create a dividend-growth portfolio. But the impressive past isn't enough to decide if NextEra can keep that pace of growth going. To figure that out, you need to examine NextEra's growth plans. It's currently projecting earnings growth of around 6% to 8% a year through 2020, with annual dividend growth of as much as 14% (using 2017 as the base). A relatively low payout ratio is what allows the company to increase the dividend at a faster rate than earnings.

Supporting that growth will be a continued focus on investing in the business, on both sides. During NextEra's fourth-quarter 2018 earnings conference call, the company estimated that it would spend around $12 billion on capital investments in 2019. And while not providing an explicit outlook beyond that, CEO John Ketchum noted, "[W]e're going to continue to do what we have done for more than a decade, which is invest smart capital at FPL." In other words, growth spending isn't going to suddenly dry up -- continuing to grow the business is part of the plan.

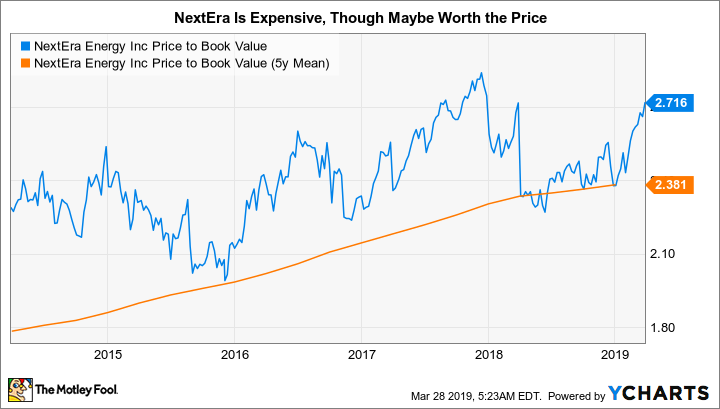

NEE Price to Book Value data by YCharts.

So far so good for investors looking to find a dividend-growth stock. But there's another problem, which goes back to the dividend yield: a premium valuation. The 2018 investment gains at NextEra Energy Resources noted above make price to earnings a tough comparison point, so let's go with price to book value instead. The company's current P/B ratio is around 2.7 versus a five-year average of 2.4. The average for the utility industry, using Vanguard Utilities Index ETF as a proxy, is roughly 2. Clearly this is not a cheap stock; investors are paying a premium for the robust dividend-growth expectations.

Now what?

If you are looking to generate as much income as possible from your portfolio, then you should probably avoid NextEra. The yield is too low, even if the dividend-growth history and potential is robust. If you are a dividend-growth investor, you have to make a harder call. While the yield isn't exactly impressive, the dividend-growth projections really are. The problem is that you'll be paying a premium for that growth. That might be OK with you, but most dividend-growth investors would be better off waiting for the stock to trade a little closer to its longer-term average book value. In other words, put this one on your wish list and try to be patient.