National Retail Properties (NNN 0.36%) is a real estate investment trust, or REIT, that as the name implies, focuses on retail properties. But you won't find malls or shopping centers in its portfolio -- the company invests in one kind of property only.

All 2,969 of the properties in National Retail Properties' portfolio are single-tenant (freestanding) retail properties. Think of businesses like car washes, restaurants, and convenience stores, just to name a few examples.

Unlike some other leaders in the net-lease space, National Retail Properties is a pure play on single-tenant retail. In other words, that's the only property type you'll find in its portfolio.

Image source: Getty Images.

A strategy designed for steady, increasing income

National Retail Property has two components to its strategy that allow it to generate income that is worry-free and steadily growing in any type of retail environment.

First, the company invests in freestanding properties occupied only by certain types of retail businesses. Generally, when you hear about retail bankruptcies and store closures, they generally apply to companies who sell full-retail priced products, sell discretionary goods, or things you can easily buy online for a lower price.

National Retail Properties invests in retail businesses that don't fit into any of these categories. Many sell nondiscretionary goods, such as convenience stores, which make up 18% of the portfolio. Others are service-based businesses, meaning businesses that can't be readily duplicated online such as restaurants, automotive service centers, and fitness centers. And some are discount-oriented businesses like warehouse clubs -- these businesses offer deals better than what's often available online, and if you've been to a Costco or Sam's Club recently, you know this business model isn't struggling.

In addition, virtually all of National Retail Properties tenants sign triple-net leases (this is where the company's "NNN" stock symbol comes from), which means that the tenant covers the costs of property taxes, building insurance, and most maintenance expenses. In other words, the variable expenses of owning a property are largely taken care of. Plus, triple-net leases generally have long (think 15 years or more) initial lease terms, with annual rent increases, or "escalators," built right in. Also, the company has an 80%-85% renewal rate at the end of these already long lease terms.

To sum it up, all National Retail Properties has to do is put a high-quality tenant in place or purchase a property that is already occupied and enjoy year after year of worry-free income.

The combination of recession- and e-commerce-resistant tenants and the desirable triple-net lease structure is why National Retail Properties runs extraordinarily high occupancy rates every year. The portfolio ended 2018 with a 98.2% occupancy rate and never fell below 96% even in the depths of the financial crisis.

Dividends, total returns, and valuation

Thanks to the company's business model that's designed for worry-free, growing income, it's tougher to find a stock with a better combination of a high payout and an excellent track record of dividend increases.

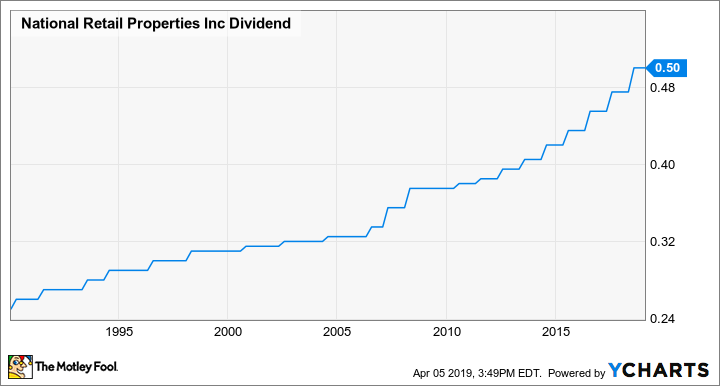

Based on the current share price, National Retail Properties pays a dividend yield of 3.7% in quarterly installments -- and the company has increased its dividend for 29 consecutive years, with the annual payout rate nearly doubling during that time period.

NNN Dividend data by YCharts.

The combination of dividends and value creation has produced some impressive total returns over the years. In fact, over the past 25 years, National Retail Properties has generated 12.8% annualized total returns versus the 9.9% REIT average and 9.1% from the S&P 500.

REITs have delivered excellent performance recently, thanks mainly to lower-than-expected interest rates. And National Retail Properties is no exception, up by a staggering 35% over the past year, so it's obviously not as attractively valued as it was not too long ago.

However, that doesn't necessarily mean that it's expensive. At 19.2 times expected 2019 FFO (the REIT version of "earnings"), it's not exactly cheap, but this isn't a high multiple for a company with National Retail Properties' record of consistent double-digit total returns.

Is it a buy?

To be perfectly clear, I wouldn't call National Retail Properties a screaming bargain. However, with a near-bulletproof business model, it is an excellent and reliable long-term return generator that could be a smart addition to your portfolio if you plan to hold on to it for a while.