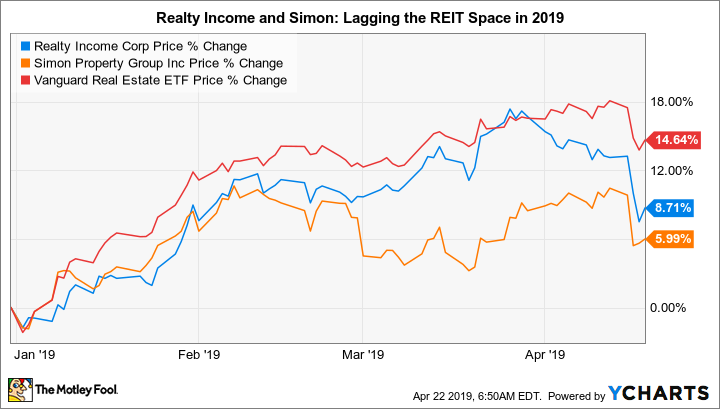

The retail sector has been hit hard by the so-called retail apocalypse, as online shopping continues to gain share of retail sales. Although the overall impact of this trend is real, the hyperbole surrounding the transition is likely to be overblown. That said, there's no question that financially weak stores with predominantly physical locations are going bust in high numbers. And that's had a huge impact on retail landlords in the real estate investment trust (REIT) space, which is why many investors will prefer Realty Income's (O 0.52%) net lease business model over Simon Property Group's (SPG -0.68%) focus on enclosed malls. But is it really a better buy?

A better mousetrap

Although both Realty Income and Simon Property own retail properties, there's a fundamental difference in their businesses. Simon owns enclosed malls and outlet centers, and Realty Income mainly owns net lease single-tenant retail properties. With a net lease asset, the lessee is responsible for most of the property's expenses.

Image source: Getty Images.

This is no small difference. First off, Simon has to maintain all of its roughly 200 malls so they remain attractive destinations for shoppers and lessees. This is important because malls offer shoppers a collection of stores in one location. Realty has to put very little toward the roughly 5,800 assets it owns (82% of rents are retail related), since its lessees are responsible for most of the costs. Moreover, each property is largely independent, so a problem at one doesn't inherently lead to problems at another.

This is why bankruptcies and store closures are a much bigger headache for Simon. Malls with too many vacancies can quickly lose appeal. So not only does Simon have to ensure it has modern, desirable assets, it also needs to keep them full of stores. That hasn't been an easy task lately, with Simon's overall occupancy falling from 96.8% in 2016 to 95.9% in 2018 (up from 95.6% in 2017). For reference, Realty Income's occupancy has remained above 98% in each of the last five years.

Although occupancy at Simon is hardly in a death spiral, largely because Simon focuses on top-quality assets, the impact of online retail is hardly over. For example, Simon currently has 10 redevelopment projects under way to deal with vacancies left behind as anchor tenants reset their businesses and, in some cases, go bankrupt. Management needs to remain nimble because trouble at any one retailer can lead to a cascading effect at an entire mall. There's no question that Simon is an industry-leading mall operator, but there's simply more risk involved in running malls than in owning net lease assets like Realty Income does. That's doubly true today, as the retail sector adjusts to online shopping.

This brings up another important issue: The types of companies that occupy Simon assets are inherently different from those that fill Realty Income's properties. Simon's business is heavily dependent on shopping that could easily be delayed (buying new shoes or clothing, for example). Realty Income is focused more on necessities (drugstores) and assets that are likely to be less impacted by online shopping (convenience stores and discount stores).

Is anyone buying?

So, investors looking to jump aboard one of these two retail landlords will need to make sure they understand the very different businesses. Simon is dealing with a far more challenging operating environment. However, that doesn't instantly make Realty Income the better buy. An industry bellwether, Realty's strong operating history is well known to investors. For example, it has increased its dividend (which is paid monthly) every quarter for more than 21 consecutive years. That's an incredible record built upon strong execution. (Simon, by contract, cut its dividend during the 2007 to 2009 recession, though it has raised it at a rapid clip since.)

O Dividend Per Share (Quarterly) data by YCharts

As you might expect, Realty Income's strong history has drawn investors to the name. Based on its 2019 adjusted funds from operations projections, the REIT currently trades at price-to-AFFO multiple of almost 21 times. That's a multiple you'd expect to hear for a technology company, not an income stock (REITs are designed to return value to shareholders via dividend payments) that's focused on safety and slow growth. To put that statement into perspective, dividends have grown around 4.5% annually over the past decade -- beating the roughly 3% historical rate of inflation, but not by enough to justify such a lofty price-to-AFFO multiple.

In other words, Realty Income, with a miserly yield of just 3.7%, is pretty dear today, and investors would likely be better off waiting for a pullback before investing. Simon's price-to-projected 2019 AFFO ratio of around 14 times and 4.5% yield look far more enticing. But when you examine the business model difference, there's a lot more risk at the moment as it deals with the still brewing troubles in the retail environment. Conservative investors should probably wait until there's a little more clarity on that front before jumping aboard Simon, even though it is one of the best-run mall REITs.

No good choices

It's tough to suggest Simon or Realty Income. This is particularly true when you layer in their relatively modest yields by historical REIT standards. That said, for those willing to take on a little uncertainty, Simon's relatively low valuation and higher yield is likely to make it the more rewarding option here -- if you insist on buying one of these two industry-leading landlords. Most investors, however, would probably be better served putting these names on the wish list in the hopes of a pullback.