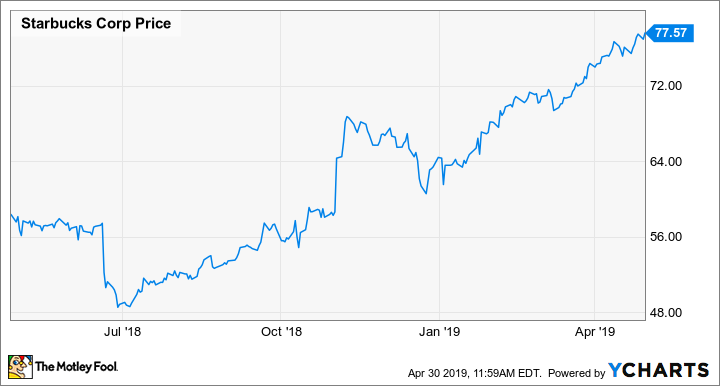

Last June, Starbucks (SBUX +0.38%) cut its earnings guidance for fiscal 2018 and warned investors about a significant slowdown in comp sales growth -- particularly in China, one of the coffee giant's key growth markets. That news caused Starbucks stock to plunge. The share price bottomed out below $50 in late June.

At the time, I wrote that the slowdown was likely to be temporary, creating a buying opportunity for long-term investors. But I still wasn't prepared for what came next. Starbucks stock has gone on a massive run over the past 10 months, rising about 60% from its nadir.

Starbucks Stock Performance, data by YCharts.

Starbucks shares recently touched a new all-time high after the company reported strong results for the second quarter of fiscal 2019. However, the stock now looks too expensive relative to Starbucks' growth opportunities.

Another good quarter

In the second quarter, comp sales rose 3% globally at Starbucks, building on the company's nascent turnaround. This was the third consecutive quarter with comps up at least 3% year over year. Total revenue rose 4.5% to $6.31 billion, roughly in line with analysts' estimates.

The U.S. outperformed the companywide average last quarter, with 4% comp sales growth. Starbucks also posted a 3% comp sales gain in China, accelerating from a 1% comp increase in each of the two previous quarters. This was particularly impressive given that Starbucks has increased its store count in China by 17% over the past year. It also suggests that fast-growing rival Luckin Coffee isn't hurting Starbucks as much as some investors had feared.

The solid comp sales growth allowed Starbucks to post strong earnings growth last quarter. Adjusted earnings per share rose 13% year over year to $0.60, including a $0.01 positive impact from one-time tax items. That blew past the average analyst estimate of $0.56.

Starbucks reported better-than-expected earnings for the second quarter of fiscal 2019. Image source: Starbucks.

Starbucks also raised its full-year earnings forecast. It now expects full-year adjusted EPS to come in between $2.75 and $2.79, compared to its previous guidance range of $2.68 to $2.73. About half of the improvement in its outlook appears to be driven by a lower expected tax rate, with the rest stemming from better margins in the Americas region.

While Starbucks stock was already trading at all-time highs prior to the earnings report, the stock has continued to move higher in the past few days.

Traffic trends remain subdued

In light of the recent surge in Starbucks stock, it's important for investors to recognize that the company still hasn't fixed its No. 1 problem: stagnant traffic. In all major regions of the world, Starbucks' comparable-store transaction counts were flat year over year last quarter. Instead, Starbucks has been relying on price increases -- along with a gradual mix shift toward food and higher-priced beverages -- to drive comp sales growth.

The lack of traffic growth, particularly in the U.S., is somewhat discouraging. Starbucks has slowed its store expansion in the domestic market despite a buoyant economy, yet existing stores still aren't seeing a bump in transaction counts. As a result, further traffic declines seem virtually inevitable if economic growth slows.

Starbucks stock is too expensive

Based on the midpoint of its updated guidance, Starbucks stock now trades for 28 times its projected fiscal 2019 earnings. That's quite pricey for a company that doesn't expect to achieve double-digit revenue growth going forward.

Additionally, Starbucks has repurchased a huge amount of stock over the past few quarters, primarily using the proceeds of selling its packaged coffee business to Nestle. Starbucks is halfway into a three-year plan to return $25 billion to shareholders, but it has already completed $17.6 billion of that capital return program, including $12.3 billion in the last three quarters. As a result, Starbucks' share count was down 11% year over year last quarter, driving nearly all of the company's EPS growth. (Adjusted operating income inched up just 2.3% year over year.)

Going forward, this tailwind will virtually disappear. Starbucks' capital return plan implies less than $5 billion of buybacks over the next six quarters. Based on Starbucks stock's current (higher) price, its share count would fall by just 5% over that period.

Thus, while Starbucks is on track to deliver EPS growth of up to 15% this year, earnings growth is likely to slow going forward. Starbucks is certainly a solid company, but investors should wait for a better price before considering buying the stock.