What happened

Shares of AppFolio (APPF +0.46%) gained 22.3% in April, according to data from S&P Global Market Intelligence. The S&P 500, including dividends, returned 4.1% last month.

AppFolio is a software-as-a-service (SaaS) provider that focuses on the real estate and legal markets.

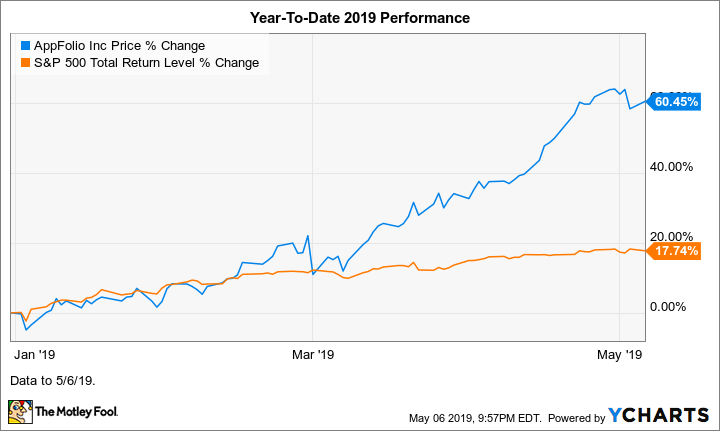

Shares are up 60.5% in 2019 through Monday, May 6, versus the S&P 500's 17.7% return over this period.

Image source: AppFolio.

So what

AppFolio didn't release any notable news in April, nor was it the specific subject of any such news. So, we can probably attribute the stock's rise last month to a continuation of the momentum that it's enjoyed for some time, as more investors discover the fast-growing company.

Data by YCharts.

Moving beyond April, the company released material news this month. On May 2, it announced its first-quarter 2019 results. Revenue soared 35% year over year to $57.1 million, and net income came in at $3.7 million, or $0.11 per share, down from $4.3 million, or $0.12 per share, in the year-ago period. On the earnings call, CFO Ida Kane attributed the decline in profitability to "higher investments in growth initiatives that we believe will positively impact long-term shareholder value."

Shares fell 3.4% on May 3, which we can attribute to EPS of $0.11 missing Wall Street's consensus estimate of $0.18. Revenue came in slightly above expectations.

Shares are down 2.1% so far in May, a negligible dip for a stock that's gained more than 60% this year.

Data by YCharts.

Now what

AppFolio shares are very pricey, trading at 68 times projected forward EPS. But we'd expect that for the stock of a company that Wall Street forecasts to grow 2019 EPS nearly 79% year over year.

Growth investors comfortable with stocks that sport high valuations may want to put AppFolio on their watchlist.