What happened

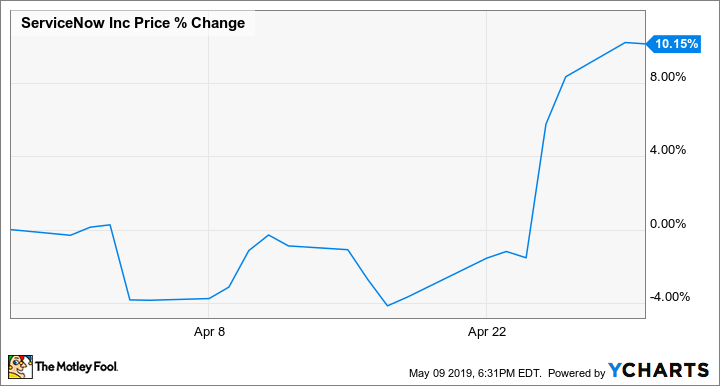

Shares of ServiceNow (NOW 3.33%), the enterprise cloud service provider, were moving higher last month after the company delivered another impressive earnings report showing solid growth on the top and bottom lines. According to data from S&P Global Market Intelligence, the stock finished April up 10%.

As the chart below shows, all of the gains came following the company's first-quarter earnings report on April 24.

So what

Shares of ServiceNow rose 7% on April 25 after the company's earnings report came out. Revenue jumped 34%, to $788.9 million, easily outpacing estimates of $767.2 million, and subscription revenue, the company's core business, was up 36%, to $740 million.

Image source: Getty Images.

ServiceNow said it currently serves more than 5,400 enterprise customers, including 75% of the Fortune 500, and it's reached 717 million customers with more than $1 million in annual contract value, up 33% from a year ago. On the bottom line, adjusted earnings per share rose from $0.56 to $0.67, beating estimates of $0.54, though without adjustments for share-based compensation and other special charges.

CEO John Donahoe said, "Our performance shows the strength of our product and platform portfolio, and the core strategic partner role we are playing in enabling digital transformation for large public sector agencies, Fortune 500 companies and leading global enterprises."

Now what

ServiceNow says it expects strong revenue growth to continue for the year and is projecting an increase of 34% in subscription revenue, to $3.235 billion-$3.25 billion. It expects a non-GAAP operating margin of 21%. For the second quarter, the company sees a similar revenue growth rate but an operating margin of 17%.

Like other SaaS stocks, ServiceNow shares have surged in recent years, up 300% over the last three years as more companies move to the cloud for its scalable benefits. They also seek software that can help them manage things like customer service and human resources in ServiceNow's case.

ServiceNow continues to spend heavily on sales and marketing to drive growth, but margins should expand, thanks to its subscription model, as the company grows. After the latest report, the stock looks set to deliver more growth for investors.