What happened

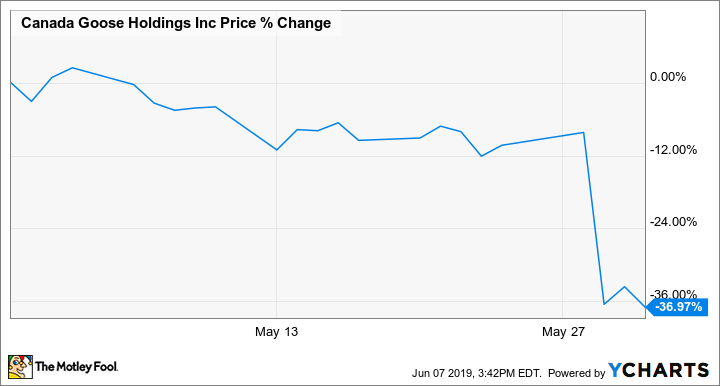

Shares of Canada Goose (GOOS +3.99%) were getting stuffed last month after the high-end winter coat company turned in a disappointing fourth-quarter earnings report and gave long-term revenue growth guidance that didn't live up to Wall Street's expectations. As a result, the stock finished the month down 37%, according to data from S&P Global Market Intelligence.

As the chart below shows, the bulk of the stock's losses came on May 29 after it released the earnings report.

So what

Coming into the report, Canada Goose had been the rare growth stock in apparel retail as its expensive coats have become fashionable across North America, Europe, and Asia, and the stock had nearly quadrupled from its 2017 IPO.

Image source: Canada Goose.

But revenue growth in the fiscal fourth quarter, a seasonally slow period, decelerated to just 25%, the company's slowest pace as publicly traded company, and its sales of $156.2 million Canadian ($115 million) missed estimates at CA$158.9 million. That growth rate was significantly slower than the 44.5% the company experienced in the first three quarters of the year. Adjusted earnings per share in the quarter were flat at CA$0.09, but the focus remained on the top line as investors see this as a growth stock.

The market also seemed unhappy with the company's guidance as management called for annual revenue growth of at least 20% for the current fiscal year and the next three years, and for adjusted earnings per share to grow by at least 25% annually for the next three years. That top-line forecast indicates that the days of 40% to 50% revenue growth are likely over.

Nonetheless, CEO Dani Reiss touted the company's performance during the fiscal year and its long-term opportunity, saying, "We entered the year with a very ambitious agenda of global growth, and we have surpassed it with flying colors."

Reiss added: "Our business and our people have never been stronger. I believe that we are still just scratching the surface of our long-term potential as we continue to define performance luxury globally."

Now what

I've been skeptical of Canada Goose in the past as the stock has been treated more like a tech company than an apparel brand. But the recent sell-off could offer a reasonable entry point as the stock now trades at a P/E of about 34, less than Lululemon Athletica, and management is projecting EPS to double over the next three years. If Reiss can manage the brand effectively and execute on that promise, the stock could move higher from here.