Following a string of surprisingly strong earnings reports from lululemon athletica (LULU 0.22%) , analysts had high expectations heading into the retailer's first-quarter release. With the chain's introduction of new products in the core yoga line, its expansion into fresh categories like outerwear, and the growth rates of both its physical and digital sales, everything seemed to be working out for the athletic apparel specialist.

In fact, analysts again underestimated how well lululemon would perform. The retailer last week revealed that its operating momentum is still improving, despite fierce competition and tough comparisons to a booming prior-year period.

Image source: Getty Images.

Five straight beats

For the fifth consecutive quarter, the chain blew past management's aggressive growth targets. Rather than expanding comparable-store sales in the low double-digit range, as lululemon predicted they would back in late March, comps jumped 16% after factoring in foreign currency exchange shifts. That market-thumping growth was comprised of a 6% increase in sales at physical stores and a 35% spike in digital sales.

As a result, revenue rose 22% to $782 million; management had issued a target sales range of between $740 million and $750 million. CEO Calvin McDonald said the results reflected "strong momentum across the entire business," but e-commerce was a particular standout, as that segment's growth pushed it to nearly 27% of the broader business.

Bucking profit trends

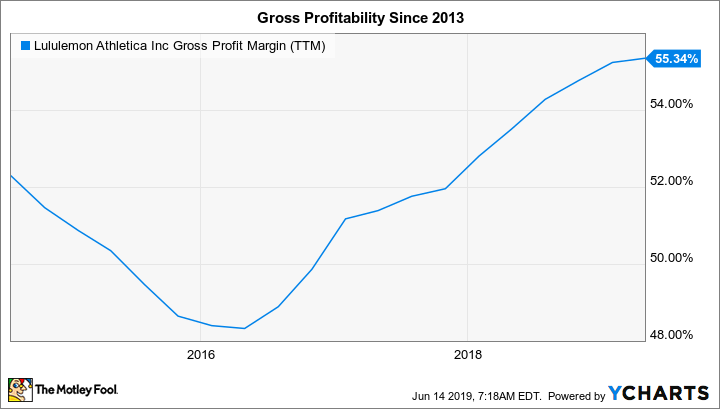

At many retailers, the shift toward digital sales has been eroding margins, but at lululemon, the trend is moving in the opposite direction. Its gross profit margin has risen by more than 7 percentage points since 2012, in fact, and management forecasts further growth on that metric for many more years, thanks mainly to the higher profitability it's achieving in its online channel.

LULU Gross Profit Margin (TTM) data by YCharts

The latest results support that bullish reading, as gross profitability rose from 53.1% of sales a year ago to 53.9%. The gains more than offset rising selling costs, and pushed operating profit up to $129 million, or 16.5% of sales, compared to $104 million, or 16.1% of sales, last year.

Playing catch-up

Many consumer-focused businesses resist making major changes to their annual outlooks in the first quarter. With so much of the year ahead, especially the key holiday shopping season, there's ample opportunity for conditions to change dramatically. Yet lululemon -- for the second year in a row -- significantly lifted its annual forecast following the Q1 report.

McDonald and his team now forecast sales will land between $825 million and $835 million in the second quarter, with comps rising in a low double-digit percentage range. Annual sales are now on pace for a total of between $3.7 billion and $3.8 billion, up from the prior target range of $3.7 billion to $3.74 billion. Investors had been expecting a modest upgrade to lululemon's targets, and this outlook largely delivered that. It's early going yet, but the retailer is off to a positive start on the path toward its recently announced five-year growth targets.