The eye-catching term "retail apocalypse" continues to linger in the headlines, with a new round of store closures in 2019 taking its toll on real estate investment trusts (REITs) that own malls. Although the hype here is likely overblown, that doesn't mean that there aren't real implications for companies like Simon Property Group (SPG +0.80%), Washington Prime Group (WPG +0.00%), and Tanger Factory Outlet Centers (SKT +0.31%), among other large mall owners. Managing through the changing retail landscape won't be easy, but here are the issues that will help determine which REITs come out the other side in one piece.

Dealing with the internet

The proximal cause of the problems facing brick-and-mortar stores is the internet. Companies like Amazon.com have reshaped the way consumers buy products. Some niches have been hit harder than others (like books and apparel), but even sectors once thought to be immune are starting to see an online shift (for example, hardware and groceries). To be fair, online sales still make up a relatively small portion (about 10%) of overall sales in the U.S. market. But some areas are definitely feeling the pain more than others.

Image source: Getty Images.

That's where the real issue comes in for malls, which tend to be heavily focused around apparel. With companies from Gap to Ascena Group recently announcing plans to trim store counts or shutter entire brand concepts, key mall tenants are clearly deciding to pull back. Not to mention the raft of bankruptcies that have hit the space, including 2019's filings by Charlotte Russe, Payless ShoeSource and the U.S. arm of Diesel. Interior stores closing wouldn't be so bad if it weren't for the fact that large anchor tenants like Sears (which was forced to file bankruptcy), J.C. Penney, and Macy's are also struggling and shutting locations. Losing an anchor can materially diminish mall traffic, making internal store closures more likely and more difficult to bounce back from.

Can mall REITs survive the transition?

All in all, it has been a brutal few years for mall owners. The stocks of mall REITs have performed about as well as you might expect given the circumstances: They have largely nosedived. The best performer of the past three years is Simon Property Group, which is down "just" 20% or so. At the other end of the spectrum is CBL & Associates (CBL +0.00%), which has declined a sickening 89%.

History suggests, and the still-small size of overall online sales confirms, that consumers continue to shop in physical stores. Humans are, by their very nature, communal animals, and malls provide a way to connect and interact. It is highly unlikely that the internet will completely replace the mall. That said, there are big changes taking place, and they are having a disproportionate impact on malls. Some malls will survive, while others will die. The difference between which mall REITs come through this transition period in one piece will likely boil down to two key factors.

Location helps

The first issue to watch is quality. The old maxim of "location, location, location" is still true. Better-positioned malls will likely manage through the retail changes better than weaker malls. REITs that focus on top-tier malls (A-quality malls) will be better able to adjust than those with second- and third-tier assets (B and C malls). Although it seems pretty obvious, retailers will want to put their stores in malls that are doing well and avoid those that are struggling.

There are a couple of factors to look at here, including sales per square foot and the actual location of a mall. The highest-quality malls tend to be near large, wealthy populations with little competition, thus allowing the mall's tenants to produce sizable sales per square foot. Malls in poorer regions, serving sparsely populated areas, or that have low sales are likely to see the most store closures. Simon, Taubman (TCO +0.00%), and Macerich (MAC +1.45%) have some of the best-positioned malls in the industry. As you might expect, CBL's portfolio has assets that are less productive. All of the mall REITs are looking to fill empty spaces today, and the best malls have the best shot at success.

Heavy debt load doesn't help

Getting through an industry transition like this isn't easy, even for the best-positioned companies. Which is why you'll also want to look at the balance sheet of any mall REIT you are considering. It doesn't take a rocket scientist to figure out that entering a period of rapid change with a heavy debt load will make life harder.

The dichotomy here is huge, with Pennsylvania Real Estate Investment Trust's trailing debt-to-EBITDA ratio coming in at a troubling 18 times. CBL's figure here is better but still high at 11 times. These companies are not only trying to reposition their malls but also to fix their weak balance sheets. Doing either would be hard, but doing both at the same time could easily spell disaster.

SPG Financial Debt to EBITDA (TTM) data by YCharts.

At the other end of the spectrum is Simon, which has a debt-to-EBITDA ratio of roughly 5 times. It's little wonder that Simon's shares are down less than those of peers, given that it has among the strongest portfolios and strongest balance sheets. Simply put, it is well positioned to survive the retail apocalypse. Following close behind Simon is Tanger Factory Outlet Centers, with debt to EBITDA of roughly 6 times.

Tanger is an interesting outlier because it doesn't own enclosed malls; it is focused on outlet centers, as its name implies. Outlet centers generally have lower operating costs because they are outdoor structures, have generic and easily updatable store spaces, and don't have anchor tenants to worry about. Simon's portfolio contains a significant number of outlet centers, as well. That said, Tanger's business is more focused around apparel, so the REIT is not immune to the impact of online shopping. But with low leverage and a distinct business model, it stands out from other mall REITs.

Note, too, in the chart above that while Taubman and Macerich both have generally strong mall portfolios, they also make use of more leverage than Simon or Tanger. So there's a notable trade-off here that investors need to think about carefully before picking which company to back.

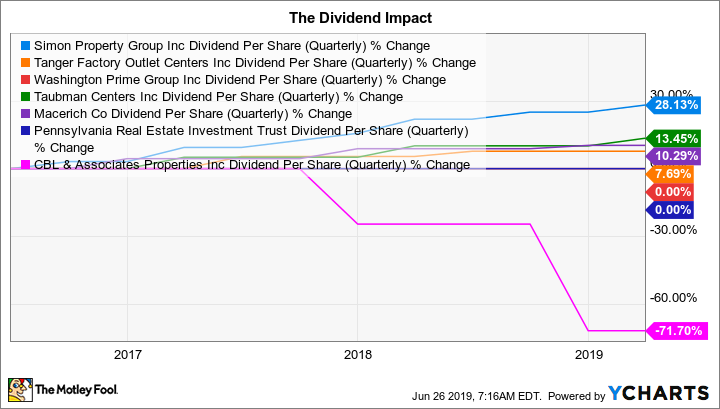

SPG Dividend Per Share (Quarterly) data by YCharts.

It's pretty clear that the best-positioned mall REIT is Simon. Simon has, not surprisingly, rewarded investors with notable dividend hikes in recent years despite the industry's headwinds. CBL, by contrast, has been forced to cut its dividend more than once already, while Pennsylvania and Washington Prime have simply held the line. In between these extremes, you'll find Tanger, Taubman, and Macerich. The differences between these mall REITs are showing up in a very dramatic fashion for income-focused investors.

Stick to the best of breed

All of the mall REITs are working to fill vacant space today. Better-positioned malls will have an easier go of it. But it will still take time to manage this transition, since finding new tenants and rejiggering space doesn't happen overnight. And that means that the mall REITs with the strongest balance sheets have an edge because they don't face the material financial headwinds that heavily leveraged competitors must deal with.

Stepping back, most investors looking at this space should find Simon attractive. For those with a little more tolerance for risk, Tanger's differentiated business model and low leverage might be of interest. Whatever stock you choose, however, you'll need to keep a close eye on your investment. Even the best of breed here isn't a "set it and forget it" investment today.