In 2017 NRG Energy's (NRG +1.94%) leadership took a look at the company and decided that changes needed to be made. The energy company's three key priorities were reducing costs, slimming down the business, and reducing debt. With a lot of the heavy lifting already done, is it worth adding NRG Energy to your portfolio, or should you continue to wait on the sidelines?

Progress toward a new mix

The 2017 reorganization plan at NRG Energy was scheduled to last three years, with 2020 being the ultimate end date. It has made material progress on the plan, reducing costs, jettisoning assets, and trimming leverage. For example, it beat its articulated plan targets across the board in 2018. And while 2019 isn't over yet, the energy company appears confident that it remains on track to achieve its 2019 goals as well. That should make completing the plan by the target date an easy success.

Image source: Getty Images

It is always good to see a company publicly lay out a plan and then hit or exceed its targets. If the company continues to execute as well as it has so far, by the end of 2020 it will have completed its reset. At that point it will be a mix of two businesses: One side of NRG will be a competitive energy company selling power directly to end customers, with a heavy focus on Texas. The other piece of the puzzle will be an independent power producer that sells electricity to utilities. The hope is that the two sides will create a steady revenue and earnings stream.

But is new NRG a buy?

Before deciding to rework the business, NRG owned a sprawling collection of assets. That included renewable power, a headline-grabbing niche within the energy space. Part of the 2017 plan actually involved reducing its commitment to renewables, which is going against the broader energy market's direction and a reversal of a previously stated goal.

At the end of 2018, roughly 45% of NRG's capacity was tied to natural gas, 35% to coal, and 15% to oil. In other words, the bulk of the company's energy is derived from fossil fuels, and coal and oil are two of the worst environmental offenders with regard to CO2 emissions. The rest of its capacity was clean energy, but only around 2% was attributable to renewable power, since nuclear power rounds out the total. That means that investors looking to own a clean energy company, or at least an energy company that is working to clean up its carbon footprint, should probably avoid NRG.

One of the biggest draws for investors in the energy space is often income, with some of the larger utilities offering yields in the 4% range today. In early 2016, however, as the company was coming to grips with the fact that it needed to rethink its business, NRG trimmed its dividend by a massive 80%. That shouldn't have been a surprise based on the company's heavy leverage and weak payout ratio, two key indications that a dividend may be at risk. The dividend has remained at $0.03 per share per quarter since the cut. The yield, meanwhile, is a minuscule 0.3% today. Income investors, then, should also be avoiding NRG Energy.

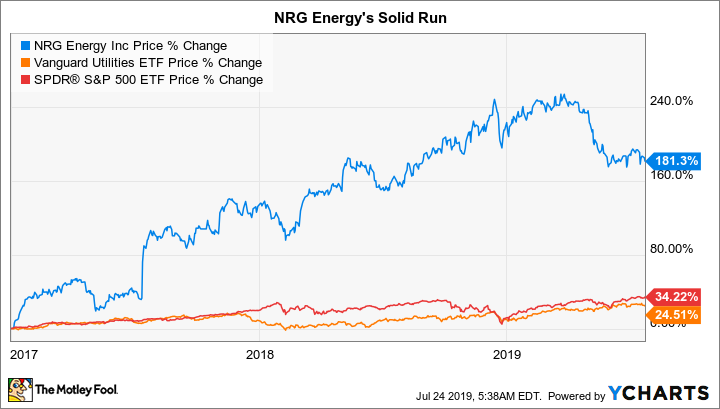

That leaves the transformation plan as the big draw, and makes NRG something of a special situations play. As noted, the company appears to be executing well, so there is some allure here for more aggressive investors willing to bet that the company can remake itself. However, since the start of 2017 the stock is up over 180%. Over that same span the broader utility sector, as measured by Vanguard Utility ETF, only advanced 25%. The S&P 500 Index rose just 34%.

Wall Street has basically rewarded NRG very well for the progress it has made. A string of red ink makes it hard to use price to earnings as a valuation tool, but the company's price to sales ratio of 1.09 times is well above its five year average of 0.64. Because of the massive overhaul, it is difficult to pinpoint what a fair valuation would be for the new NRG Energy. However, it is fair to suggest that after such a good run the stock is likely at least fully valued. As such, its allure for a special situations investor is probably limited as well.

Getting better, but not worth owning

When you add up all of the variables, NRG Energy isn't a compelling investment for most investors. It has done a great job of following through on its plan, but that alone doesn't make it a worthwhile purchase. It is going against the grain environmentally speaking, it offers little income, and the price advance suggests investors have already priced in the successes the company has achieved. For now, most investors are likely to be better of watching NRG than owning it.