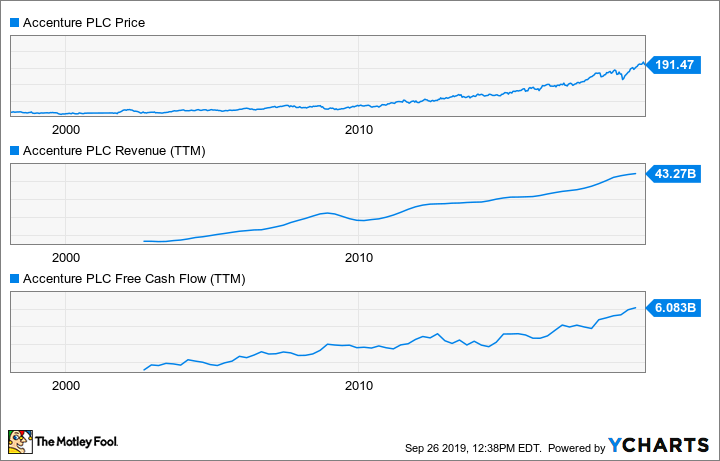

When it comes to technology, not all companies have to have high-octane growth and earth-shattering breakthroughs. Slow-and-steady is an option too, and Accenture (ACN 0.46%) fits that ticket. The multinational consultancy and outsourcing services firm has been a winning investment for years, steadily increasing revenue and returning cash to its shareholders.

Data by YCharts.

The company recently put a wrap on its 2019 fiscal year, and all indications are that Accenture's momentum will continue. It may not be the cheapest of stocks right now, but with organizations around the globe looking for some help dealing with digital change, this services firm has a lot going right for it.

Image source: Getty Images.

Breaking down the pieces

In today's world, tech wins. Businesses have to race to gain the upper hand by putting digital-based systems to work. For many organizations that aren't technologically focused themselves, hiring a strategist is key. That's where Accenture comes in.

The company breaks its revenue down into two basic categories: consulting and outsourcing. Of the $43.2 billion it earned in the last year-long stretch, 56% came from consulting and 44% outsourcing. Within those sweeping sales categories, Accenture also offers some insight on what kinds of industries it caters to.

|

Segment |

Fiscal Year 2019 Revenue |

YOY Change (in U.S. $) |

|---|---|---|

|

Communications, media, and technology |

$8.76 billion |

6% |

|

Financial services |

$8.49 billion |

(1%) |

|

Health and public service |

$7.16 billion |

4% |

|

Products (retail and consumer goods) |

$12.0 billion |

6% |

|

Resources (energy, chemicals, utilities) |

$6.77 billion |

14% |

YOY = year over year. Data source: Accenture.

Accenture is there to help no matter what industry is experiencing tech disruption, and no matter the source of the disruption -- from banking and payments to manufacturing and energy, application development and customer service optimization to research and AI. With such a broad scope of services, that means no single area is going to provide outsized business growth, but Accenture will continue its solid advance as long as digital transformation continues.

As boring as this tech giant may appear, though, its consulting and outsourcing solutions are fueling some pretty good returns. Operating margins have been climbing higher over time, as have earnings per share. Accenture has been generous with all that extra cash, doling out higher dividends along the way as well as repurchasing shares (when stock is bought and retired, effectively boosting earnings for remaining shareholders). Over the last 12 months alone, Accenture's dividends and share repurchases equated to $4.6 billion, over two-thirds of its total free cash flow (money left over after operating and capital expenditures are paid) of $6.0 billion.

Data by YCharts.

No shortage of opportunities, but at primo pricing

For the 2020 fiscal year, the company expects more modest but consistent growth -- 5% to 8% when excluding currency exchange rates. Operating margins should be 14.7% to 14.9%, yet another annual increase from the year prior, and earnings per share $7.62 to $7.84, up 4% to 7%. With another $5.7 billion to $6.1 billion in free cash flow in the pipeline, investors can expect more cash returned as well. Accenture just moved from a bi-annual dividend payment to a quarterly one, hiking the annualized payout by 10% while doing so. As of this writing, the stock yields 1.7% after the pay raise.

Paired with ongoing share repurchases, this makes Accenture an attractive stock for investors of all types. Revenue growth is nothing spectacular, but it is translating into even higher bottom-line growth over time. At the forefront of businesses' digital transformation, Accenture is a high-quality play on the world of tech. As such, however, shares trade for a quality price: 12-month trailing price to free cash flow currently sits at 20.5, and one-year-forward price to earnings is at 22.0. Compared with the S&P 500's forward PE ratio of 18.3, Accenture stock is going for a premium.

At this particular juncture and valuation, I'm hesitant to say this tech giant is going to provide market-beating returns. But Accenture is a slow-and-steady play on technology that has demonstrated stable and consistent results for a while now. Quality deserves a place in portfolios, and this stock is worthy of at least keeping on watch lists.