The stock of electric vehicle maker Tesla (TSLA 1.81%) may be the most controversial in the market. Founded in 2003 and a public company since 2010, Tesla is the first new car company in the U.S. to go public since 1956. As you might have heard by now, Tesla's entrance has shaken up the entire U.S. and global auto industry by making electric vehicles "cool." But its disrupter status has also attracted a fair amount of naysayers, who point to the company's lack of profitability as it tries to upend an entire established industry from scratch.

Tesla made its initial big splash with the luxury Roadster in 2008, then followed up this concept car with the 2012 release of the Model S, a high-end sedan at prices starting around $75,000. Three years later, in 2015, Tesla released the Model X, a luxury SUV starting at just over $80,000. But the biggest product release came in mid-2017, when Tesla released its first mass-market vehicle,the Model 3, which starts at $35,000. The next model will be the Model Y, a crossover vehicle, or "CUV," which will have a slightly higher price than the Model 3, but will also be more profitable. Its production is set for the fall of 2020. Then there are also plans for a future Tesla pickup truck and a Tesla semitruck as well.

So if you're an investor thinking about purchasing Tesla's stock, how should you think about the company? While many on Wall Street tend to focus on each quarter's deliveries, that probably isn't the best way to look at Tesla as a long-term investment. Here are four charts that show Tesla's huge accomplishments, its potential risks, and the state of the business from a 10,000-foot view.

Tesla's Model 3 is the key to understanding its recent financials. Image source: Tesla.

1. Booming revenue growth

TSLA Revenue (TTM) data by YCharts

As you can see, Tesla has executed incredible revenue growth over the past five years, growing over sevenfold, from just $3.2 billion in sales in 2014 to $24.9 billion over the 12 months ended in June. As you can also see, much of the gain has come in the past two years, as production of the mass-market Model 3 rose to meet high demand. Last quarter, Tesla grew its automotive revenue 44%.

However, as you'll also see, the massive increase in Model 3 units hasn't come easy.

2. Debt, capital spending, and Tesla's big build

TSLA Net PP&E (Quarterly) data by YCharts

Here you can see the big increase in Tesla's capital spending during 2017 as it built its giant "Gigafactory" in Nevada, production capabilities in Fremont, California, for the Model 3, and new service centers and infrastructure to support the influx of new customers from a mass-market vehicle.

Higher spending produced an increased debt load, including secured senior notes as well as convertible debt -- a point on which Tesla bears tend to focus. However, as you can also see, many of these expenditures were one-offs, or at least elevated compared to Tesla's baseline levels of spending. In addition, the company's net debt has begun to flatten out -- at least for now.

Of course, 2018 didn't mark the end of Tesla's capital spending, as it will soon be expanding into Model Y production and moving its China Gigafactory toward higher production levels this year. However, according to management, capital expenditures for 2019 will be only $1.5 billion to $2 billion, down from previous guidance, and down from $2.3 billion in 2018 and the high of $3.4 billion in 2017. Even more encouraging is that management claims it isn't putting off any projects, but rather finding more efficiencies in its construction and manufacturing processes due to past experience.

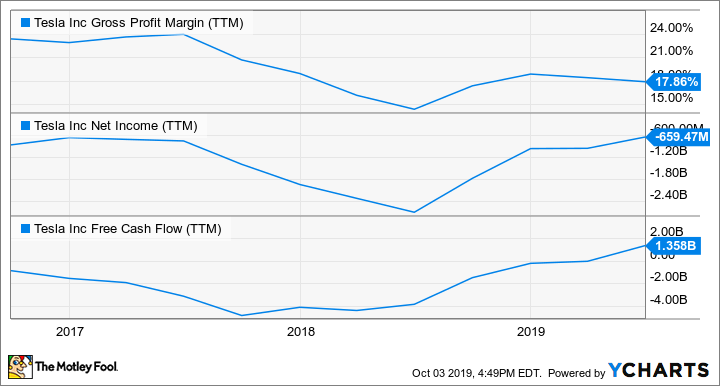

3. Gross margins, earnings, and cash flows

TSLA Gross Profit Margin (TTM) data by YCharts

As spending went up, you can also see that the Model 3 has hit Tesla's margins. That's not only because the Model 3 has lower gross margins than the Model X and Model S, but also because of the high fixed costs needed to mass-produce a car. Like capital spending, Tesla's net losses have piled up over the past year; however, as the company is now reaching scale, you can also see that its net losses are narrowing. So while Tesla's net income is still firmly in the negative, it's moving in the right direction.

Additionally, you may also notice the more encouraging sign on the bottom part of the graph: soaring (and positive!) free cash flow in 2019. Tesla has achieved positive free cash as capital expenditures have come down and sales have surged. However, before you get too excited, beware of a big asterisk next to that cash flow story.

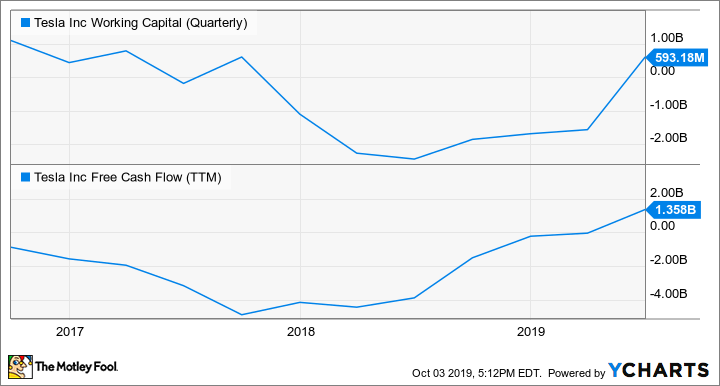

4. Working capital plunged

TSLA Working Capital (Quarterly) data by YCharts

Tesla calculates free cash flow as operating cash flow minus capital expenditures, but embedded in that operating cash flow story are both earnings and changes in working capital. Working capital includes inventory and accounts receivable, which use cash, subtracted from accrued liabilities and salaries, which produce cash, as they are costs that have not yet been paid. In Tesla's case, it really ramped up production in the latter half of 2018, but also generated lots of cash by incurring negative working capital -- basically, increasing its accrued liabilities and payables to suppliers.

That longer payment schedule may have been perfectly legitimate, as suppliers often agree to longer payment schedules for bigger and bigger payments, which Tesla incurred as it ramped up Model 3 production. However, investors shouldn't take this increase in operating cash as the norm -- a big increase in payables to suppliers and employees is more like a short-term loan than actual cash generation, and eventually these employees and suppliers will have to be paid.

The big picture

The overall picture for Tesla is one of a company that has reached the summit of a huge production ramp for the Model 3 -- a very impressive feat. Now that this big spending period has ended, it looks as if net losses are turning the corner and could even turn into gains soon.

However, bulls shouldn't be celebrating just yet. As the company's dip into working capital last year showed, Tesla is pulling all sorts of minor miracles to keep its debt-fueled mass production ramp going, and the company is not done introducing new models, even though it's not yet profitable. After all, the company just raised even more convertible debt and issued equity in May to fatten its balance sheet.

Investors need to figure out if Tesla can continue its massive revenue growth without as much expense growth or the need for more capital. It will be hard to figure out, as the Model 3 is growing and maturing while the Model Y and China Gigafactory will also be ramping up their production levels at the same time. Therefore, investors should try to isolate the economics of just the Model 3, and filter out the new "growth" spending on future vehicle makes. Hopefully, management can separate these different buckets of spending for investors.