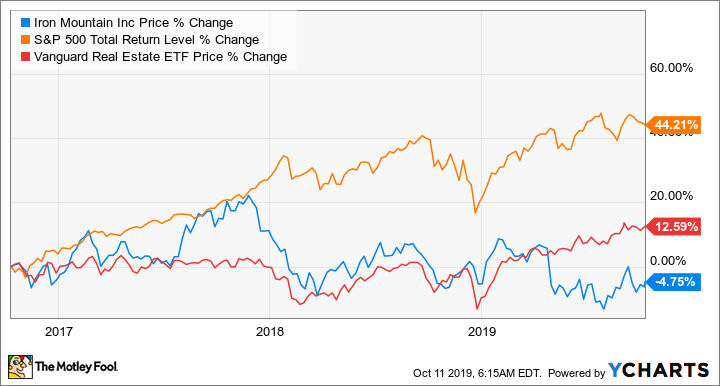

For the past three years, Iron Mountain (IRM 2.74%) has struggled to deliver great returns, underperforming both the S&P 500 and the Vanguard Real Estate ETF on a total return basis. Management has been actively trying to change this, working to diversify away from the slow-to-no-growth business of paper records management to faster-growing segments like data center operations and digital storage in developed markets and paper storage in emerging markets.

In recent weeks Iron Mountain has shown investors concrete signs of progress by adding data center capacity, reducing costs, and refinancing debt, potentially setting itself up for improved returns in the longer term.

Image source: Getty Images.

It added a good amount of megawatts

As it migrates from the sleepy business of records management to a revenue mix with more data center leasing activity, Iron Mountain has scored some recent wins.

The company said it expects its data center business to contribute 10% of its adjusted EBITDA by the end of 2020. This depends on success in opening new facilities, an area in which the company has really built momentum in recent weeks.

In September the company completed the development of nearly four megawatts of data center capacity in Amsterdam and London and opened its first data center in Asia, bringing an additional one-and-a-half megawatts online. The capacity additions followed on the integration of nearly four megawatts in Phoenix in August and a six-megawatt deployment in Virginia in July. In a September 12 investor presentation, Iron Mountain said it has a "clear line of sight" to achieving its fiscal 2019 leasing target of 15 megawatts to 20 megawatts.

It cut costs

The company hit investors with a Q1 surprise when high labor costs related to its shredding business undercut its adjusted EBITDA by $10 million.

Management took swift action to make sure the company could still meet full-year financial targets. On its Q1 conference call on April 25 the company said it had put in place over two dozen operating initiatives to reduce expenses, including working to improve transportation costs, furthering labor productivity initiatives and consolidating vendors to reduce supply costs.

In the September presentation, the company said its initiatives had paid off. "Q1 cost issues fully corrected; driving improved efficiencies across the organization," the company said in one of the presentation slides.

If the company's actions translate to no more cost-related surprises for a few quarters, Iron Mountain may win back investor confidence, which could in turn drive share price. Cost-cutting actions as extensive as those that management listed may also have a positive impact on revenue that is worth sticking around to see.

The market liked its debt offering

On Sep. 4 Iron Mountain said it was launching an $800 million private placement and would use proceeds to pay down its revolving credit facility. Later that day the company said it was able to upsize the offering to $1 billion, demonstrating strong investor demand for the notes maturing in 2029. Pricing also indicated positive investor sentiment, with the notes priced to yield 4.875%, the tight end of the guided range between 4.875% and 5%.

Iron Mountain's most recent trip to the financing market was more successful than the company itself expected, indicating a degree of Wall Street support for its longer-term growth plan.

Stay tuned for Q3 earnings

Iron Mountain had somewhat disappointing Q1 results and the company moved quickly to turn things around. Q2 results were largely in line with expectations and the company made it clear it expects to see more fruits of its labor in the second half of the year.

Management is making decisive and disciplined moves to steer the company to increased profits, but the company's high dividend yield suggests Wall Street is still doubtful. Investors considering buying Iron Mountain should keep the company on the radar for now and look carefully at Q3 earnings for more encouraging elements. Earnings are expected around Oct. 29.