Expectations were fairly strong going into Intuitive Surgical's (ISRG 0.42%) Q3, and the company did not disappoint. Revenue grew to $1.13 billion, climbing 23% year over year on the back of impressive growth in surgical procedures using its flagship da Vinci surgical robot. This boosted adjusted earnings per share (EPS) to $3.43, up more than 21% from the $2.83 it generated in the prior-year quarter. Both numbers easily surpassed analysts' consensus estimates, which called for revenue of $1.06 billion and EPS of $2.96.

While knowing the headline metrics is important, investors can gain further insight into the healthcare company by hearing what management has to say on Intuitive Surgical's conference call. Here are three key takeaways that point to a bright future for the robotics pioneer.

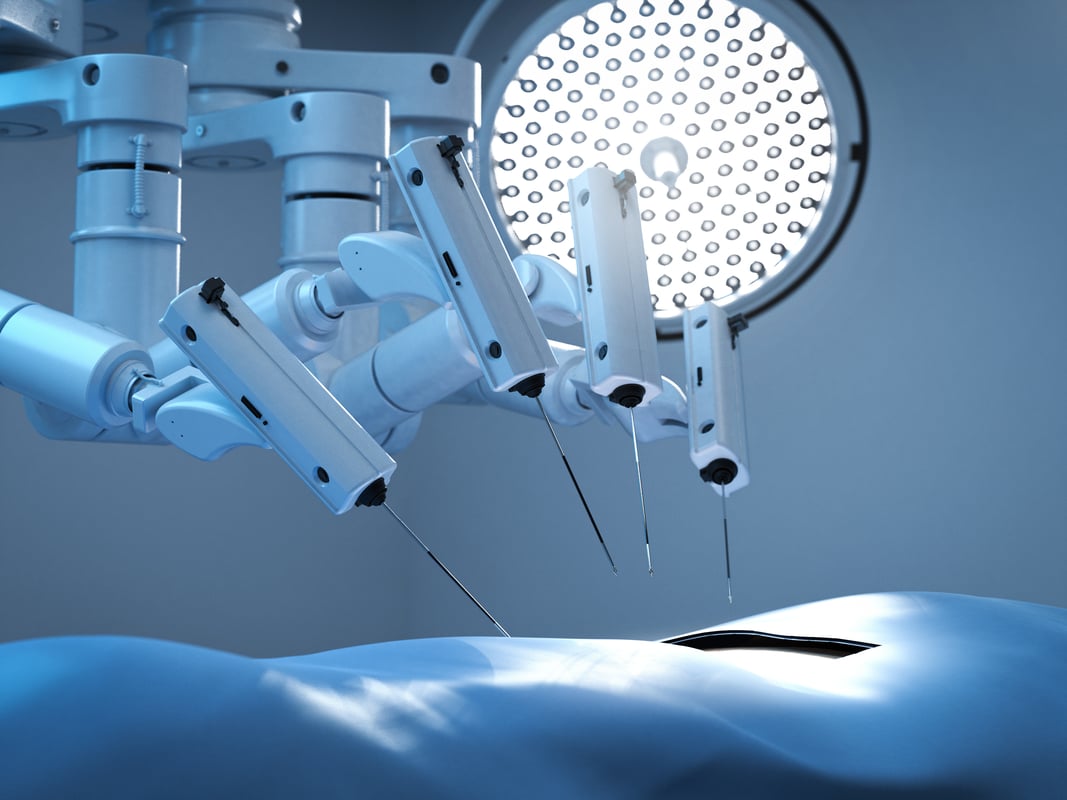

Image source: Getty Images.

1. System shipments and the installed base continue to grow

The key catalyst for Intuitive Surgical's success is the number of procedures accomplished using the da Vinci, and the biggest factor driving procedure growth is the number of systems being deployed. Intuitive Surgical shipped 275 additional systems during the quarter, bringing the installed base to 5,406.

That strong growth is likely to continue. On the conference call, CEO Gary Guthart explained that the company is "in our phase 1 launch of da Vinci SP as we work to expand clinical clearances and build SP products at scale." The latest model of the device employs a single port (SP) entry point (the previous systems operate in multiple entry points simultaneously) and is thereby targeting new and expanded use cases in areas with confined surgical spaces.

This should help Intuitive Surgical continue its trajectory of steady growth.

2. Leases are gaining traction

One of the key roadblocks for hospitals using the da Vinci is the monumental cost, with a price tag that can be as much as $2 million per system. Intuitive Surgical addressed this by introducing alternative financing arrangements -- including operating leases and usage-based arrangements -- which allows hospitals to avoid the one-time capital outlay in favor of a lower monthly cost.

That decision has been a boon to Intuitive Surgical, attracting hospitals and departments that might not otherwise use the system. There's been an uptick in adoption of those financing arrangements in recent quarters. While the number can vary substantially from quarter to quarter, Guthart said on the call, "We completed 92 operating lease transactions, representing 33% of total placements compared with 58 or 25% of total placements in the third quarter of 2018."

While these leasing arrangements tend to generate less revenue in the quarter the system is initially placed, they produce reliable recurring revenue for the life of the agreement. By the end of Q3, Intuitive Surgical had 560 operating leases outstanding that generated $27 million in quarterly revenue, nearly double the $14 million it produced in the prior-year period.

Intuitive Surgical's SureForm stapler. Image source: Intuitive Surgical.

3. Research and innovation continue

Another factor that's been instrumental in Intuitive Surgical's success has been its willingness to spend heavily on research and development. This not only yields newer generations of its flagship robotic surgical system, but also leads to the introduction of new tools that help surgeons while improving patient outcomes.

During the quarter, Intuitive Surgical received clearance from the Food and Drug Administration (FDA) for the single-use SureForm 45 Curved-Tip stapling instrument; and the SureForm 45 Gray reload, a new, single-use cartridge that contains multiple staggered rows of implantable staples and a stainless steel knife.

Additionally, the company continued the rollout of its Ion platform, a system that gained FDA clearance earlier this year, that allows doctors to conduct minimally invasive lung biopsies. Guthart said there are currently nine systems in the field.