Hannon Armstrong Sustainable Infrastructure Capital (HASI +1.58%) is a renewable power and energy efficiency investor that stands out through its status as a real estate investment trust (REIT) and its strategy of investing in assets that have a lower risk profile. In recent weeks, however, the company has diversified its portfolio further through partnerships in fast-growing sectors that could grow returns and its dividend over time.

What makes the company different

Hannon Armstrong was approved for REIT status in 2012 in a private letter ruling issued by the Internal Revenue Service.

Image source: Getty Images.

It maintains REIT status based on its investments in buildings, even though the investments are energy-related, as well as transactions in which the company owns the land around a power project rather than the project itself. REIT status enables the company to enjoy a lighter taxation rate than typical corporations and requires the company to stay focused on making distributions to shareholders.

The company targets three main asset classes. The first is behind-the-meter technology, which may include investing in a government or corporate building to improve heating or lighting, adding energy storage, or installing small-scale, on-site power generation. The second is grid-connected power, which includes solar, wind, and storage projects that are connected to the mainstream power grid for utility or corporate buyers. The third line of business is the one that really separates Hannon Armstrong from other finance players in the space: sustainable infrastructure. In this target area, the company looks to finance assets like stormwater remediation and environmental restoration. Both are segments Hannon feels have the potential for significant growth as communities adapt to severe weather events.

Hannon Armstrong seeks investments different than a typical wind or solar project that may face permitting, construction, resource, and counterparty risk. Instead, the company favors putting its capital where it finds a more stable revenue stream, like solar project land leases. Like many others, it describes itself as a specialty finance company that provides debt and equity for sustainable infrastructure projects, but two recent partnerships demonstrate the company's knack for choosing transactions that are not on the radar for others.

What's new

On Oct. 7 Hannon Armstrong revealed an expansion of Sunstrong Capital Holdings, its partnership with solar panel manufacturer SunPower (SPWR +0.00%). The companies plan to acquire 200 MW of solar panels that have been "safe-harbored," meaning that under Internal Revenue Service guidance the projects they are used for will be able to preserve the full 30% federal investment tax credit (ITC). The projects will have the cost advantage of the significant subsidy even if they are not complete when that subsidy begins stepping down at the end of this year.

The credit will decrease to 26% in 2020, 22% in 2021 and then level at 10% for commercial customers and zero for residential customers in 2022 and beyond. By taking advantage of the tax credit longer than competitors can, SunStrong should be able to build its solar projects at a cheaper price point, which could, in turn, provide investors with more profit over the next few years.

Earlier this month the company also invested in GridPoint, a provider of smart technology for buildings. The investment from Hannon Armstrong is expected to enable GridPoint to offer a more accessible behind-the-meter energy efficiency product for small to mid-sized buildings. Hannon Armstrong's role will be to will provide long-term financing for energy management-as-a-service projects across GridPoint's clients' portfolio of sites as its partner evolves to be able to attract new customers with offers like zero capital down and a monthly pricing structure.

GridPoint's platform is installed in over 15,000 location and the company has seen some big wins recently, signing up fast food restaurants, government agencies, and retail operators for its energy management products. For Hannon Armstrong investors, the company's involvement with GridPoint could provide a revenue boost that also leads the company into new sectors, adding further diversification to its investment portfolio.

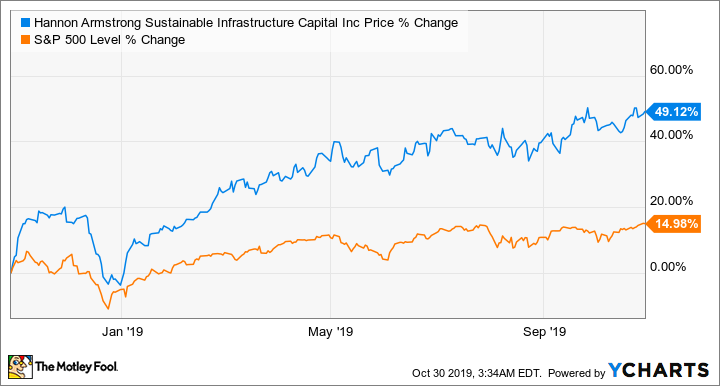

What this unique strategy could mean for investors

When Hannon Armstrong posted Q2 earnings in August, its core funds from operations came in lower than expected, at $0.30 per share versus the Capital IQ expectation of $0.34. However, the company affirmed its prior guidance expecting 2018 to 2020 annual core EPS growth between 2% to 6%. The company also saw a 15% increase in interest and rental revenue for the quarter. With a dividend yield of 4.8%, even the investor with significant renewable energy holdings may have room to add Hannon Armstrong based on its increasingly diverse portfolio. Investors would be wise to keep an eye on Hannon Armstrong to see if the company's tax savvy and low-risk appetite will generate the growth the company expects.