2018 was a rough patch for video game giant Electronic Arts (EA 0.25%), but 2019 has been far kinder. No longer in high-growth mode, investors have had to reset expectations as EA adapts to new gaming trends. Gamers are looking for engaging titles that they'll play for years rather than weeks and months, and online events and spectating are emerging trends the company is looking for ways to crack.

A few titles did the trick during the fiscal 2020 second quarter (three months ended Sept. 30, 2019), and though it wasn't a return to big sales growth, investors can take solace that the company is back on the mend.

Image source: Getty Images.

The quarter in numbers

As far as metrics go, an important one to keep an eye on in this digital age are digital net bookings, or net revenue plus the change in deferred revenue from online games and fees. Over the trailing 12 months ending in Q2 2020, EA hit a new high-water mark of $3.88 billion, up 8% from a year ago. Highlights leading to the revenue jump were a 22% increase in unique players of the popular soccer title FIFA Ultimate Team, a 19% increase in players of Madden NFL Ultimate Team, and a 40% increase in monthly average players of the perennially popular The Sims 4.

When adding in the sale of physically packaged games, it's shaping up to be a good year for EA.

|

Metric |

Six Months Ended Sept. 30, 2019 |

Six Months Ended Sept. 30, 2018 |

YOY Change |

|---|---|---|---|

|

Revenue |

$2.56 billion |

$2.42 billion |

6% |

|

Gross profit margin |

76.8% |

73.9% |

2.9 pp |

|

Operating expenses |

$1.28 billion |

$1.23 billion |

4% |

|

Earnings per share |

$7.66 |

$1.77 |

333% |

YOY = year over year. Pp = percentage point. Data source: Electronic Arts.

It's solid progress, but some investors have been offering up shoulder shrugs. Why? Bear in mind fiscal 2019 revenue was down 4% and earnings were flat, so 2020 is a rebound year -- one that some expected to have a more dramatic upside. Plus the big earnings surge is, in part, due to some tax benefits the company realized, adding up to an extra $5.74 in earnings per share. Excluding these one-time benefits, earnings are only up 8.5%. Nevertheless, it's still solid growth due to better profit margins (thanks in part to more digital and less packaged goods) and better control over operating expenses.

Great timing for sports and sci-fi

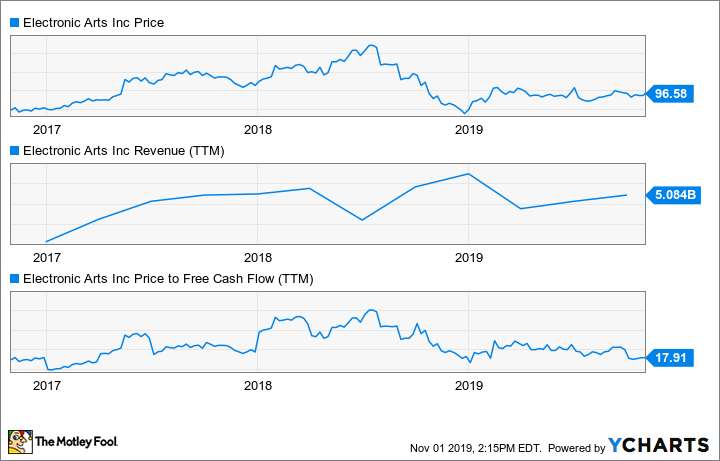

Here's the good news: Last year's tumble paired with the bottom-line rebound means EA has gone from a high-flying growth valuation to something resembling a value stock. With a price to trailing 12-month free cash flow (basic profits after operating and capital expenditures are paid for) value of just 17.9, there's still a bar to clear, but it's been lowered dramatically.

Data by YCharts.

The busy holiday retail season could mean good things for this gaming stock. The company's video game streaming service EA Access is now available via Microsoft's Xbox and Sony's Playstation 4, and it's coming to PC gamers soon. Being able to play games across different platforms with people around the world has advantages. Take FIFA, for instance: Soccer is the most popular sport in the world, and when a fan of the game isn't watching it they love to play it, physically and digitally. Total in-game matches were up more than 30% year-over-year last quarter, hitting a record high. EA is building on that with FIFA 20 online competitions beginning in November, with millions of expected participants worldwide. Similar things are happening over at the Madden football franchise. EA Access can help drive higher engagement with those online events.

Then there's Star Wars Jedi: Fallen Order coming out in November. This probably couldn't have been released more strategically. Star Wars: Galaxy's Edge opened at Disney (DIS +0.55%) theme parks earlier this year, the upcoming Disney+ streaming service will feature the Star Wars spinoff The Mandalorian, and of course there's the final movie in the film saga in December with Star Wars: The Rise of Skywalker. EA CEO Andrew Wilson had this to say on the earnings call:

"The one fantasy that many of those fans have been telling us they want is to experience the journey of becoming a Jedi, and we're set to deliver that with Jedi: Fallen Order. The response team have been pouring their passion into creating this new gaming partnership with Lucasfilm, with characters old or new, and a story that is now an authentic part of the Star Wars Universe. It's going to be a thrilling adventure to play and with more than 140 million views to date of trailers and videos for the game, the community is eager to jump into Star Wars Jedi: Fallen Order in just a few more weeks."

140 million trailer views won't translate to nearly that many buyers, but the game could nonetheless be a huge seller. Guidance for the rest of the fiscal year was for revenue of $5.41 billion and earnings per share (minus the $5.74 per share in tax benefit) of $3.83 -- a 9% and 15% increase, respectively, over last year.

Given where the stock is after the last quarterly report, that's a rock solid outlook for a stock trading at a reasonable valuation. I'm interested in buying here.