Once you reach retirement, you're likely to shift from building your nest egg to living off it. This is why retirees often favor dividend stocks, which throw off cash that can be used to cover daily expenses. But you have to be careful about the investments you add to your portfolio, since only searching out high yields can lead you into dangerous territory. Here are three dividend stocks that appear to be a good mix of yield, value, and dividend growth.

1. A midstream giant

With a roughly $60 billion market cap, Enterprise Products Partners (EPD +0.29%) is one of the largest and most diversified midstream players in North America. It owns a collection of energy pipelines, storage, processing facilities, and transportation assets that would be difficult, if not impossible, to recreate. The broader energy sector, however, is out of favor today, and that's left Enterprise's distribution yield at a tasty 6.4%. That distribution, meanwhile, has increased for 22 years and counting.

Image source: Getty Images

So far, so good, but it gets better. Unlike an oil driller that is subject to the ups and downs of energy prices, Enterprise simply gets paid for the use of its assets. Roughly 85% of its gross margin is generated from fees. So oil prices are much less important than energy demand. True, clean energy is a growing threat to carbon fuels, but demand for oil and natural gas isn't likely to disappear anytime soon.

Enterprise also happens to be one of the most conservative names in the midstream space. Its financial debt to EBITDA ratio of roughly 3.4 times is near the low end of its peer group. That's pretty much where it always sits, too. Meanwhile, it covered its distribution by an incredibly strong 1.7 times through the first nine months of 2019. The one knock is that distribution growth is modest, in the low- to mid-single digits lately. The entire package, however, is probably worth it for conservative investors.

2. Low, but growing fast

Next up is Hormel Foods Corporation (HRL 1.06%), which has a roughly 2% dividend yield. Before you protest about that number, this roughly $25 billion packaged food giant has increased its dividend for 53 consecutive years. And, more importantly, the annualized dividend growth rate over the past decade was a whopping 15%. To put a number on what that means, in fiscal 2010 the company paid $0.21 per share in dividends. In fiscal 2019 the dividend was $0.84 per share, meaning that over a decade shareholder dividends increased 300%. That's a lot of extra buying power, noting that the historical annualized growth rate of inflation is around 3%.

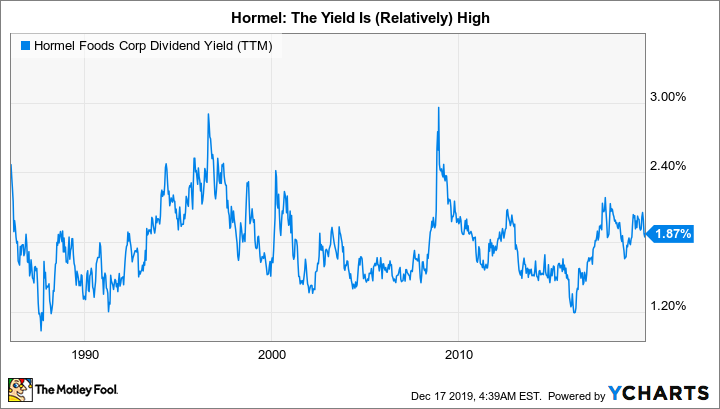

Adding a lower-yielding stock like Hormel that has a fast-growing dividend can help to offset the ravages of inflation that will crimp higher-yielding names with slower-growing dividends. What makes Hormel so attractive right now is that its yield, while modest on an absolute level, is actually relatively high compared to its own history.

HRL Dividend Yield (TTM) data by YCharts

As for its business, Hormel is a very conservative company. Although it has been growing and diversifying via acquisition of late (making a number of deals in the meat space over the last few years), its debt-to-equity ratio is still an incredibly low 0.04 times. The payout ratio, meanwhile, is a solid 45% or so. Hormel isn't an exciting company (it's best known for making SPAM, after all), but it is a very rewarding dividend investment. That's particularly true if you want to add some dividend growth to your income portfolio.

3. A riskier proposition

Last up is real estate investment trust (REIT) Simon Property Group (SPG +0.37%), a stock that has been hit hard by the dreaded, if a bit overhyped, "retail apocalypse." That's the scary term given to the shift in consumer shopping habits toward buying over the internet. It is a real phenomenon, but in typical fashion, Wall Street is likely extrapolating the trend a bit too far into the future. Internet shopping probably won't eliminate shopping in stores; it will complement it. So well-located malls and outlet centers, like the kind Simon owns, will continue to be filled with shoppers and rent-paying retailers.

What's so interesting about Simon is that, within the enclosed mall peer group, it stands out for its financial strength and diversification. For example, financial debt to equity is among the lowest of its peers, and its ability to pay its interest expenses is among the best. Diversification-wise, it owns around 200 assets, including enclosed malls and outlet centers. The portfolio also includes properties in foreign markets, where Simon is still expanding (it has a number of foreign outlet centers under construction today). No other peer comes close to its financial strength and diversification.

SPG Times Interest Earned (TTM) data by YCharts

The yield, meanwhile, is a robust 5.8% today, nearly three times what you would get from an S&P 500 Index fund. Far from troubled, Simon's funds from operations (FFO), which is like earnings for an industrial company, payout ratio is expected to be a solid 70% or so based on its 2019 FFO guidance. This helps explain why the REIT was able to increase its dividend by roughly 5% in 2019, despite the market's worries about the retail apocalypse. To be fair, this is a bit of a contrarian play. But it is one of the best mall REITs around and could be worth the risk for more aggressive investors.

At least one should tickle your fancy

The three dividend stocks here are very different. Enterprise is a reliable tortoise, slow and steady. Hormel has a modest yield that is likely to grow its dividend pretty fast. And Simon is a well-positioned and financially strong landlord in a REIT niche that's changing gears today. It's highly unlikely that you'll find all three of these names appealing, but each is "perfect" in a different way, and at least one is likely to be of interest to you.