Warren Buffett has recently taken some heat over his holdings in Visa (V +0.32%) and Mastercard (MA +0.44%) -- or rather, over not owning more of each. While Mr. Buffett is a fan of American Express, Berkshire Hathaway's (BRK.B +0.88%) comparatively tiny investments in two of the best war-on-cash stocks of the last decade were a missed opportunity, with Buffett himself admitting the small positions are the responsibility of two of his portfolio managers, Todd Combs and Ted Weschler.

When it comes to investing, though, do-overs are allowed. Likely again because of his portfolio managers, Buffett is an owner of 8% of Brazilian digital payments company StoneCo (STNE +1.06%), one of the top performers in Berkshire's stable in 2019. This Buffett stock is akin to Square, and its liftoff could still be in the early innings.

E-commerce and digital payments are small potatoes in Brazil

As in many emerging market economies, cashless transactions are a fast-growing industry in Brazil with lots of potential. StoneCo operates in this large country, although it could expand into other Latin American countries as fellow Brazilian company Mercado Libre has. In Brazil, 85% of transactions are done in cash, and some 55 million people don't have a bank account.

That's where e-commerce and digital payments companies like StoneCo come in, as they are helping businesses and consumers alike get around the difficulties of transacting in cash using technology. Cashless payments are a growth industry, averaging gains of 12% a year for the foreseeable future in Brazil, and a double-digit-growing industry in the rest of Latin America as well. Thus StoneCo's physical and digital point-of-sale systems (the green card terminals, if you happen to find yourself in Brazil) and other financial management tools are worth a further look.

Image source: Getty Images.

StoneCo since IPO

The Brazilian fintech stock made its debut in 2018, and since then is up 26% -- good for a market cap of just $10.9 billion. That includes a big dip post-IPO -- perhaps hastened by the stock market sell-off during the fourth quarter of that year. It doubled its top line in 2018, and revenue is up another 71% through the first three quarters of 2019 (reported in Brazilian real, but converted from here on out in U.S. dollars based on the exchange rate of $1 to 4.06 reals on Dec. 16, 2019).

|

Metric |

Nine Months Ended Sept. 30, 2019 |

Nine Months Ended Sept. 30, 2018 |

Change |

|---|---|---|---|

|

Revenue |

$441.7 million |

$258.6 million |

71% |

|

Gross profit margin |

83.3% |

78.9% |

4.4 pp |

|

Operating expenses |

$188.8 million |

$139.1 million |

35.7% |

|

Adjusted net income |

$143.4 million |

$46.03 million |

212% |

Data source: StoneCo. Pp = percentage point.

Growth is being driven by new merchants signing up to the platform as well as by higher take rates (the company's cut when a transaction is processed). In Q3 there were 68,700 net customer additions, bringing the total up to 428,900. Take rate through the first nine months was 1.87%, compared with 1.81% last year. Thanks to high profit margins and operating expenses growing far slower than the top line, StoneCo's profits are soaring.

High valuation, currency, and economic risks are worth keeping an eye on

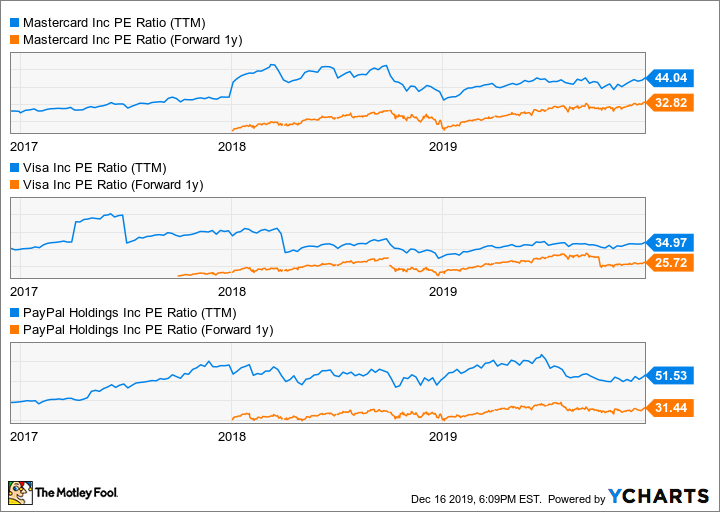

As with many other high-growth technology plays, shares of StoneCo don't come cheap. The stock trades for 64.2 times earnings over the last four quarters and 39.6 times expected one-year forward earnings. Thus the massive rate of expansion -- especially on the bottom line -- is expected to continue for some time. However, based on expected profits, that price could be a relative steal. Visa, Mastercard, and PayPal (PYPL 18.65%) are growing profits at a slower rate but don't trade for much less.

Data by YCharts.

So why the discount on this fast-growing Brazilian fintech company? For one, it isn't without competition. Early in 2019, Brazilian bank Itau Unibanco Holding said it was getting into small merchant digital transactions, too. It could run into headaches if and when it decides to start expanding beyond its home market. Plus, there is a currency exchange rate issue. The U.S. dollar has gained 21% in value compared to the Brazilian real over the last three years. If that trend continues, that would reduce StoneCo's profits for investors based here in the States. General economic concerns could also unsettle the stock. Brazil's economy has only just begun to recover from a deep recession in 2015 and 2016, and social and economic unrest have persisted.

But investing is never without its risks, and given StoneCo's impressive performance in its brief history as a public concern, the Latin American war-on-cash stock is certainly worthy of consideration for investors who don't mind the ups and downs. For those interested, my usual advice applies: Start with a small purchase and plan on adding a little more over time -- such as monthly, quarterly, or after a double-digit percentage dip -- while building up to a larger allocation.