What happened

Shares of CoStar Group (CSGP 0.71%), which provides data and marketing services to the multifamily and commercial real estate industry, rocketed 77.4% in 2019, according to data from S&P Global Market Intelligence. That performance made it one of the year's better-performing large-cap tech stocks. For context, the S&P 500 index returned 31.5% in 2019.

CoStar stock is a superstar so far in 2020: It's up 7.9% through Jan. 10, compared with the S&P 500's 1.1% return.

Image source: Getty Images.

So what

We can attribute CoStar Group's strong 2019 stock rise to its robust financial performance and investor optimism about its future.

In the company's most recently reported quarter, the third quarter, its revenue jumped 15% year over year to $306 million. Under generally accepted accounting principles (GAAP), net income rose 18% to $79 million, which translated to a 20% rise in earnings per share (EPS) to $2.15. On an adjusted basis, net income jumped 22% to $96 million, which translated to a 21% increase in EPS to $2.61. That result beat Wall Street's $2.52 consensus estimate.

In October, CoStar completed its acquisition of STR Inc. and STR Global for approximately $450 million in cash. This acquisition expands the company's reach into the hospitality services industry.

Here's what founder and CEO Andrew Florance had to say in the earnings release:

We continue to deliver excellent results as we generated Companywide net new bookings of $50 million in the third quarter, an increase of 27% year over year. ... We are also very pleased with the continued growth of Apartments.com, which generated 20% year-over-year revenue growth in the third quarter of 2019 and is now at an annual revenue run rate of over $500 million.

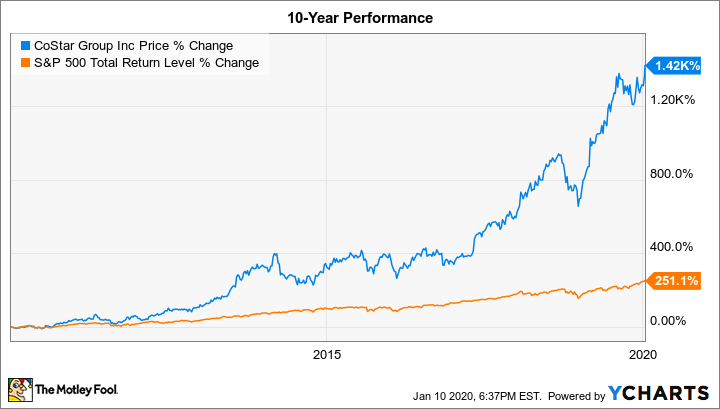

CoStar stock isn't just a one-year wonder, it's been a long-term winner, as this 10-year chart shows:

Data by YCharts.

Now what

Investors should be getting material news next month. While CoStar hasn't yet scheduled a date for the release of its fourth-quarter and full-year 2019 results, they should come out sometime in late February.

For the full year, Wall Street is expecting adjusted EPS of $9.99 on revenue of $1.39 billion, representing growth of 20.7% and 16.5%, respectively, year over year.