If you are an income-focused investor, then the master limited partnership space is a good place to examine for investment ideas. But all partnerships are not created equal. This is why you can't simply look at midstream players Magellan Midstream Partners (MMP +0.00%) and NuStar Energy (NS +0.00%) and compare their respective yields of 6.5% and 9%. There's more to understand. Here's what you need to know before you pick between these two midstream players.

1. The business

Magellan is a $14 billion market cap entity that operates largely in the pipeline space. It has a little bit of storage in the mix, but not too much. Roughly 85% of its business is fee-based. It is largely a domestic player. The partnership has a long history of successfully expanding its business, largely via ground up construction with a few relatively small acquisitions thrown into the mix.

Image source: Getty Images.

NuStar is a roughly $2.9 billion market cap partnership. It appears to be nearing the end of a difficult transition in which it shifted from a largely storage-focused partnership with material foreign assets to a more pipeline-focused business model with heavier concentration on domestic expansion plans. Today it has a mix of storage and pipelines, with growth coming largely from pipeline investment. It still has foreign exposure, with pipelines in Mexico recently coming on line.

2. Distribution history

NuStar's transition was hard because it involved a distribution reset. In mid-2018 the partnership trimmed its disbursement by 45%. The goal was, basically, to free up cash for capital spending and debt reduction. It was probably the right call for the partnership, but a tough one for any investors who were counting on that income. The distribution hasn't been increased since the cut.

Magellan, on the other hand, has increased its distribution each and every quarter since its initial public offering in 2001. It has now increased its disbursement for 19 consecutive years.

3. Distribution safety

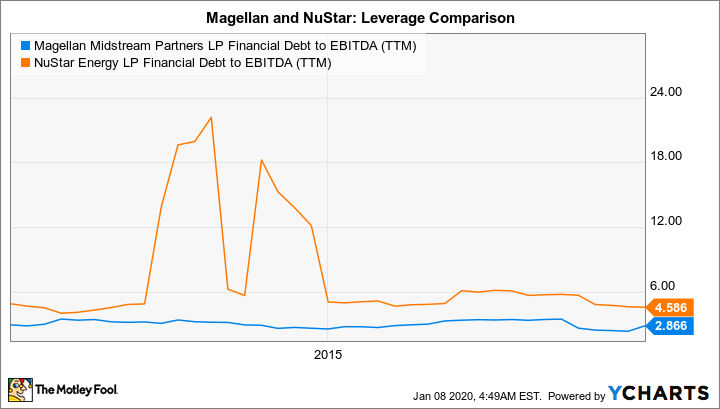

Magellan targets distribution coverage of around 1.2 times, which is considered strong in the midstream partnership space. That said, it expects that distribution coverage in 2019 will end up being around 1.3 times. Distribution coverage is obviously solid. So, too, is the leverage profile, where the partnership's financial debt to EBITDA ratio comes in at around 2.9 times. That's at the low end of the midstream industry, which is the historical norm here. Magellan tends to be very conservative.

MMP Financial Debt to EBITDA (TTM) data by YCharts

NuStar's distribution coverage is expected to be in the 1.3 times space in 2019, as well. However, that has to be taken with a grain of salt given the distribution cut in 2018. The distribution reset was important, of course, but it would be hard to suggest that investors should feel totally confident in the distribution's safety. NuStar still has a good deal to prove. It's working on that, noting that its financial debt to EBITDA ratio has fallen from over 6 times in 2017 to roughly 4.5 times. But, taking into consideration the distribution history, it still looks like a riskier option than Magellan.

4. Growth potential

Magellan spent around $1 billion on growth projects in 2019. That was the high water mark for the decade. Heading into 2020, it has plans for $400 million in capital projects. That's a pretty big drop-off, which has some investors worried about the partnership's growth. However, Magellan states that it has another $500 million worth of investment opportunities that it is examining. And given its solid growth history, it is probably appropriate to give the management team the benefit of the doubt. That said, it is worth noting that the distribution increased around 5% in 2019, which is about half of the partnership's annualized rate over the past decade. But it is a much larger partnership today than it was 10 years ago, so a slowdown isn't outlandish.

NuStar spent around $500 million on growth projects in 2019. Although that's half of what Magellan spent, the partnership is roughly a fifth the size (market cap wise). So NuStar spent more, relatively speaking. It has plans to reduce capital spending by about 35% or so in 2020. That's the same general trend as what's going on at Magellan, though, based on the business' size, NuStar is still spending more on a relative basis. A key difference here, however, shows up on the distribution front. NuStar is still a work in progress, as the partnership attempts to reduce debt and refocus its business (it sold some notable assets in 2018 and 2019). So, at this point, growth spending hasn't translated into distribution increases, even though it has been a key part of the partnership's improving leverage profile.

As the partnership rights the ship, though, NuStar should eventually be able to shift into a more consistent growth mode and start to increase the distribution. Its smaller size, meanwhile, should make it easier for it to grow the payment at a faster pace than Magellan. It just isn't at that point yet.

The winner?

NuStar is still something of a turnaround story. Management appears to be doing a good job of getting its house in order, which is impressive, but the process isn't quite over yet. The hefty 9% yield is probably ample compensation for more aggressive investors willing to wait the process out. However, conservative types should probably sit on the sidelines here until the distribution starts to see some growth.

Magellan, on the other hand, is among the most conservative names in the midstream space. Although distribution growth has slowed down, the 6.5% yield is still extremely generous and well supported. It is a good option for conservative investors. Yes, there's been a lull in the partnership's capital spending plans, but it has gone through ups and downs like this before. This isn't something to be overly worried about. Perhaps the days of double-digit distribution growth are over here, but slow and steady growth with a yield that's more than three times what you'd get from an S&P 500 Index fund is still pretty attractive. All in, Magellan looks like the winner of this matchup for most investors.