In December 1980, if you had invested $1,000 in Nike's (NKE 2.37%) initial public offering (IPO) -- or a parent or other person had gifted you the stock -- your investment in the athletic shoe, apparel, and equipment giant would be worth approximately $900,000, as of Friday. This princely total assumes you had reinvested your dividends. By contrast, the broader market would have turned that grand into just shy of $24,000 over this period.

If you hadn't reinvested your dividends, your Nike investment would now be worth $583,255, and you'd be collecting $5,702 annually in dividend income.

(Ignore the couple of articles -- all on major sites -- that erroneously claim a $1,000 investment in Nike's IPO would be worth more than $50 million as of late last year, as well as the plethora of articles that state the stock's IPO price was $0.18. That's the split-adjusted price.)

Now let's dig into why Nike stock has been such a winning investment, and explore some bigger-picture investing takeaways along the way.

Image source: Getty Images.

Nike's business gets kick-started by the 1970s running and fitness boom

Nike began life in 1964 as Blue Ribbon Sports. It was founded by University of Oregon track athlete Phil Knight (who was the company's CEO until 2004 and its board chairman until 2016) and his former coach, Bill Bowerman. The company was initially a distributor for Japan's popular Tiger athletic shoes.

In 1971 the company changed its name to Nike, after the winged Greek goddess of victory. This was a wise early branding move, as the name association is a wonderful one. (Would Nike have been equally successful as "Blue Ribbon Sports?" We'll never know, but I doubt it.) That same year, the company began using its now-iconic "swoosh" logo. And a year later, during the 1972 Olympics, Nike launched its first shoe under its own brand: the Nike Cortez, which is still available today.

Nike rolled out shoes under its own brand at a fantastic time -- just before the running and fitness boom of the late 1970s in America. Jim Fixx is widely credited with spurring this physical activity upsurge with his 1977 best-selling book The Complete Book of Running. Folks of all ages, body types, and genders were increasingly taking up running, along with other types of aerobic exercises.

You can count me as an early mover (no pun intended). Not long after Fixx wrote his book, I became hooked on running, thanks to joining the cross-country team in high school. Soon after, my father started regularly running with me, and one of my siblings followed. A second sibling would start running later. For my family of origin, that's four out of six -- and if you believe singer Meat Loaf's lyrics (from the same year Fixx wrote his book), two out of three ain't bad!

My experience itself isn't relevant, but the fact that it mirrored that of throngs of people across the world was extremely relevant to Nike's robust early growth. All those new runners -- and new walkers and new aerobic fitness class participants and so on -- mostly needed just one piece of equipment: good athletic shoes. And the beauty of selling athletic shoes is that they wear out pretty darn quickly, so these are purchases people make over and over again.

A related and probably even bigger factor in Nike's early success was the huge cultural influence exerted by the growing popularity of running, other fitness activities, and sports in general. More people began wearing athletic shoes of various types as everyday shoes. This factor would also eventually spawn the rise of athleisurewear.

Image source: Getty Images.

Nike sprints by Adidas and goes public in 1980

Nike grew phenomenally from the launch of its first branded shoe in 1972 through 1980, when it sprinted by Adidas (ADDY.Y 0.21%) to become the market share leader in the United States.

The company went public in the same year, on Dec. 2. At that time, about 39 years ago, Ronald Reagan had just won the U.S presidential election, Kenny Rogers' "Lady" was topping the U.S. music charts, NBC News anchor Jessica Savitch was captivating viewers, and the U.S. prime interest rate was weeks away from reaching its all-time record high of 21.5%.

Nike stock went public at $22 per share. Since then, there have been seven 2-for-1 stock splits. So investors who bought one share at the IPO now have 128 shares, assuming they did not reinvest their dividends. So a $1,000 investment at the IPO with dividends not reinvested would now be worth $583,255. (That's 5,818 shares at Friday's closing price of $100.25.) The stock pays a quarterly cash dividend of $0.245 per share, which comes out to $0.98 annually. So the annual dividend income on these shares would now be $5,702.

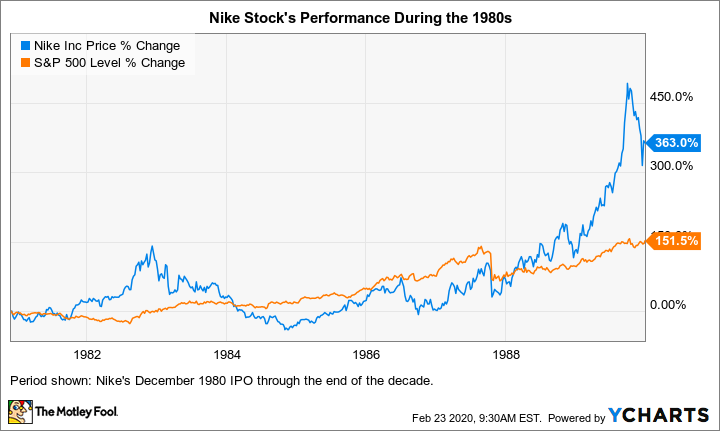

Data by YCharts.

Nike stumbles in the mid-1980s: The importance of patience

Nike's business continued to perform well during the first few years of the 1980s, but then its sales slowed down significantly. Its struggles largely stemmed from consumers' changing taste in footwear. Fashionable and traditional styles of shoes were in, and sneakers were out. During the period from November 1982 through mid-December 1984, Nike stock plunged 73%.

Surely many investors lost their patience and sold their shares. Those who hung on have been richly rewarded, of course. In general, investors would be wise to adopt Warren Buffett's long-term investing philosophy. The CEO and chairman of holding company Berkshire Hathaway -- and one of the richest people in the world -- has famously said, "Our favorite holding period is forever."

Image source: Nike.

Nike's branding prowess powers it to the front of the competitive pack

How did Nike come back from its troubles in the mid-'80s? Well, sure, it had help from its technical innovations over the years, such as its Waffle sole and patented Air-Sole. Moreover, it was the first company to make shoes with full-length cushioned midsoles and lightweight nylon uppers.

But with any consumer product, branding, marketing, and style are at least as important as the quality of a company's products. Nike's "swoosh" logo and "Just Do It" signature marketing slogan -- which first appeared in marketing campaigns in 1988 -- are brilliant in their simplicity. On the aesthetics front, Nike knows how to make shoes that appeal to the masses. While a shoe's appearance probably isn't important to most serious athletes, style is probably anywhere from somewhat important to very important for most weekend warriors and people who wear athletic shoes as everyday shoes.

Of course, a giant part of Nike's success stems from associating its shoes with famous athletes across various sports. These athletes act as spokespeople for the brand and don Nike shoes while they dunk ball after ball, run at the speed of light, and perform other athletic feats better than 99.9999% of their fellow humans.

The biggest catalyst behind Nike's comeback was probably the company's signing of basketball great Michael Jordan. In 1984, the company lucked out a bit when it signed the rookie to the National Basketball Association (NBA). Jordan quickly became a superstar, lighting a fire under sales of the Air Jordan 1, released in 1985, and spurring Nike's business turnaround.

Nike stock has been a better long-term performer than Apple stock!

Investing takeaway: There will always be many huge stock market winners, and reinvesting even modest dividends can make a big difference over the long term.

Consumer tech darling Apple (AAPL 0.11%) went public just 10 days after Nike, on Dec. 12, 1980. It might shock many folks to learn that Nike stock has performed better than Apple stock since Apple's IPO. Of course, Apple has been the much bigger winner in more recent years, but it was a slow starter and languished for many years.

The fact that two superb long-term winners went public just 10 days apart is evidence that there will always be plenty of huge winners in the stock market. No need to beat yourself up for missing a fantastic performer.

Data by YCharts.

This chart clearly shows how important dividends can be in powering a stock's total return over the long term. On the basis of price performance alone, Nike stock barely edges out Apple stock. But when we consider total return, which includes reinvested dividends, Nike stock beats Apple stock by a significant margin. That's because for most of its existence, Apple has not paid a dividend. As of Feb. 21, shares of Nike and Apple have dividend yields of 0.96% and 0.98%, respectively.

Playing it safe doesn't always turn out as planned

In December 1980, most folks interested in investing new money in the stock market probably shunned Nike's IPO, considering it too risky. (On that note, many investors probably didn't even know about the IPO -- the internet has done a wonderful job of democratizing information.) Investors likely favored stocks that were considered "solid" and "safe," such as industrial giant General Electric (GE 0.64%) and old-guard technology company IBM (IBM +0.35%).

GE stock has only slightly outperformed the market since Nike's IPO, but that's only thanks to its super performance through late 2000. The stock has been a clunker over the last nearly two decades. Meanwhile, IBM stock has underperformed the market since Nike's IPO by about about 20% because of its subpar showing over the last seven years.

As in life in general, in the stock market, it can be a wise move to occasionally take a calculated risk. So next time there's an IPO that greatly interests you, you may want to tell yourself, "Just do it" -- that is, as long as you don't invest more than you can afford to lose.