Scotts Miracle-Gro (SMG +2.84%) is a lawn care company and a little bit more, having started to sell hydroponic products just a few years ago. That makes it a supplier to the marijuana sector, where hydroponics are a key growing method. Taking on this new business didn't go as smoothly as management might have wanted, but progress started to improve in fiscal 2019. Now, as fiscal 2020 gets under way and the new unit starts to settle into a groove, is Scotts worth buying?

Change is a good thing

Scotts Miracle-Gro is probably best known for its namesake brands, Scotts and Miracle-Gro. Both are staples in the highly seasonal lawn care market, a slow-growing, boring, and fairly consistent business. A few years ago, though, as marijuana started to become legal in an increasing number of U.S. states and Canada, Scotts decided to expand into a new market: hydroponics. Management believed that pot would end up being a growth sector, while still a business that was very close to the company's core operations. It seemed like a natural fit.

Image source: Getty Images

Using the lawn care business as a cash cow, Scotts bought its way into the hydroponics space. It built up what it calls its Hawthorne business through a series of acquisitions. In fiscal 2019 this division accounted for roughly 21% of sales. However, that's not the metric that really matters. In fiscal 2019 Hawthorne's sales increased roughly 95%, helped along by the aforementioned acquisitions, compared to the company's core lawn care operation, where sales were up just 8%. Pulling out the impact of acquisitions Hawthorne's growth was still impressive, coming in at a hefty 24% for the year. Comparable sales in this division, meanwhile, were up 38% in the fiscal fourth quarter.

So Scotts' efforts here appear to be worthwhile, with success here extending into the first quarter of fiscal 2020, when sales were up 41%. All of that growth was organic, with no major acquisition activity helping to boost the numbers. The strength from this division helped the company beat analyst earnings expectations for the quarter, leading to a swift jump in the share price. The massive growth expectations for the marijuana sector are clearly translating into strong growth for Scotts Miracle-Gro.

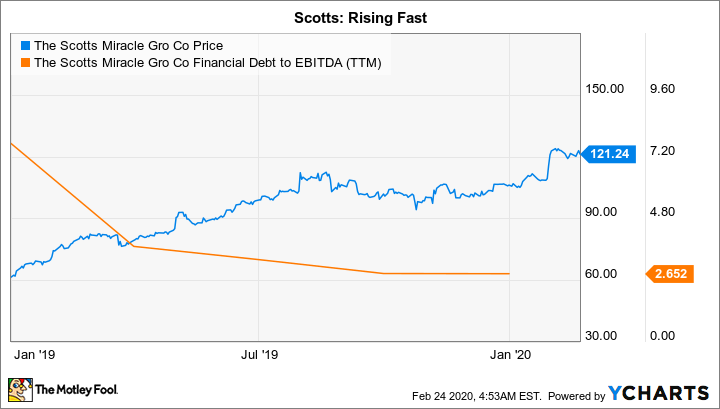

That's a good thing, because it entered fiscal 2019 with a worrying level of leverage. Driven by the acquisitions used to build Hawthorne, Scotts' financial debt to EBITDA ratio spiked from around 3.5 times in late 2018 to over 7.5 times at the end of the first fiscal quarter of 2019. An asset sale in 2019 and growth in the Hawthorne business helped bring that number down to roughly 2.7 times by the end of the fiscal year. So while growth in the marijuana business was a key highlight for Scotts, reducing leverage was equally important. At this point, the company looks like it is on very solid financial ground again.

Where to now?

Investors looking at Scotts today are looking at a very different company, but the change hasn't gone unnoticed by Wall Street. Since Jan. 2019 the stock has roughly doubled in value. That's a huge move, particularly when you note that the stocks of many marijuana growers fell in 2019. As a supplier to the industry, Scotts was able to sidestep many of the issues facing growers (including unrealistic investor expectations). But the swift advance over the past year or so has left Scotts with a relatively rich valuation.

For example, the company's price to sales, price to book value, and price to cash flow ratios are all above their five-year averages. The price to earnings ratio is below its five-year average, but the P/E numbers here are biased by some one-time items related to the company's marijuana expansion efforts. Based on the company's history, it doesn't look like a good deal today. Backing that up, the stock is trading at all-time highs, and the dividend yield, at roughly 1.9%, is toward the lower end of its recent historical range.

The question investors need to ask, however, is whether or not Scotts' new business changes the long-term outlook enough to justify a higher valuation. The company's full-year fiscal 2020 earnings guidance suggests earnings will grow around 12% or so, with sales up between 4% and 6%. That's not bad growth for a lawn care company, but with a price to forward earnings ratio (which looks at earnings estimates and not historical numbers) of 23.5 times, a lot of good news appears to be priced in here. And it is worth noting that the huge growth Hawthorne has shown over the past year or so is expected to come back down to Earth, with sales growth in the division projected to be between 12% and 15% for the full fiscal year. If the Hawthorne division doesn't maintain a lofty level of growth, which management's projections suggests it might not, it is likely that investors will rethink Scotts' valuation.

For believers only

At this point, anyone with even a modest focus on valuation should probably step aside here. Scotts Miracle-Gro's marijuana push has proven itself to be a prudent move, but growth appears set to slow compared to recent years now that the acquisition binge is over. Only investors that believe marijuana is going to grow even faster than the already robust projections for the sector should be jumping in here right now.

That said, with leverage back under control, the stock is probably worth putting on your wish list in case of a price pullback.