Dividend stocks are a great way to supplement income, but, given the massive number of dividend-paying companies out there today, picking stocks isn't easy. Consider that of the S&P 500 companies, which include the 500 largest stocks in the U.S. by market capitalization, as many as 423 paid a dividend last year. Combined, these companies paid a whopping $485.4 billion in dividends in 2019, setting a new record. And these stats are for just the 500 largest stocks. Thousands of others, including mid- and- small cap companies, pay a dividend as well.

Understandably, many dividend stocks fly under the radar. But some of these have such a compelling investing thesis that income investors could be missing something big by not owning them. Here are three such relatively unknown but amazing dividend stocks.

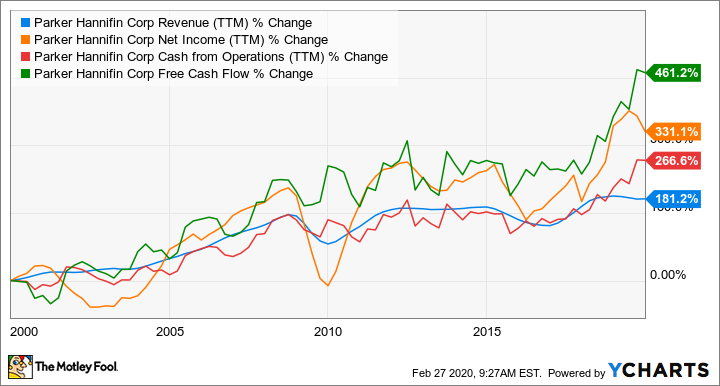

This dividend stock has more than tripled in a decade

Parker Hannifin (PH +0.89%) increased its dividend by 16% last year, marking its 63rd consecutive year of annual dividend increases. That dividend streak makes Parker one of the best dividend growth companies to own.

Parker is an industrials technology company that manufactures motion and flow-control products and solutions for various industrial applications. Think hydraulics, filtration, process control, pneumatics, and electromechanical products. Construction, oil and gas, transportation, power, aerospace, agriculture, mining, and life sciences are just some of Parker's key end markets.

Image source: Getty Images.

Automation, in its different forms, is rapidly gaining ground across industries, opening up plenty of opportunities for motion control. Parker manufactures thousands of products and has segregated them into two broad operating groups based on the industries they serve: diversified industrial and aerospace systems.

The company has nearly 459,000 customers globally with no single customer accounting for more than 3% of its net sales. Its global size and reach and the fact that Parker gets orders well in advance pretty much makes it a non-seasonal business. As of June 30, 2019, Parker's backlog value (orders from customers) was $4.2 billion, of which 90% would be deliverable in coming 12 months. Fiscal 2019 was a record year for Parker in terms of sales, operating margin, and operating cash flow.

PH Revenue (TTM) data by YCharts

In the five years through 2023, Parker expects EPS to grow at a compound annual growth rate (CAGR) of 10% and plans to convert all of its net income into free cash flow. With management prioritizing dividend growth, income investors can expect solid returns from Parker.

The king of dividend growth

Don't let American States Water's (AWR +0.13%) seemingly "boring" business and measly dividend yield of 1.4% deceive you. AWR tops even Parker's dividend increase streak: It has not just paid a dividend every year since 1931, but increased it every single year for the last 65 years, making it a Dividend King. The dividend growth has hugely magnified the stock's return.

American States Water provides water services to nearly one million customers in nine states. But don't underestimate the power of such a simplistic business: AWR's earnings per share shot up 33% in 2019 as it had won approval to charge higher water rates effective January of that year. Management pumped a record $136 million into capital projects and hiked the annual dividend by 10.9% in 2019.

There's one area where AWR has an edge over other water utilities. Its contracted services subsidiary, American States Utility Services, serves privatized military bases throughout the country under 50-year government contracts. So AWR takes care of all aspects of water distribution and waste water collection and treatment at these military bases. It's obviously an incredibly resilient and lucrative business to own.

Increasing military privatization is a great growth opportunity even as AWR earns steady cash flows from its primary defensive water utility. Management is confident in growing dividend at a CAGR of 7% in the long term, making American States Water a fantastic dividend stock to own.

A new, exciting Dividend Aristocrat

Have you heard about the Dividend Aristocrats? That's an elite group of dividend-paying companies that have increased their dividends for at least 25 consecutive years. Roper Technologies (ROP +0.67%) joined the league in 2017 when it raised its annual dividend by 18%, marking its 25th straight dividend increase. Roper's measly dividend yield hasn't attracted income investors, but its dividend growth has been incredible.

Often considered yet another boring industrial company, Roper is as much a technology company, which is where the money lies. Roper makes and distributes a wide range of business management software, process control systems, and instrumentation products. So from managing supply chains to SaaS-based services to data analysis and laboratory instruments, Roper has plenty of offerings for diverse industries. It runs four business segments: application software, network software and systems, measurement and analytical solutions, and process technologies, with the first three contributing roughly 30% each to Roper's total revenue in 2019.

An asset-light business model, combined with Roper's acquisitive strategy for growth, has proved a lucrative bet.

ROP Revenue (TTM) data by YCharts

Roper's dividend growth has hugely boosted share price over the years and could put the performances of some of the highest-yielding stocks to shame. An intriguing business, focus on innovation, and management's commitment to shareholders makes Roper a top dividend growth stock to consider.