What happened

Shares of just about every oil and gas stock are down more than 10% today after an emergency OPEC meeting ended in an impasse over the weekend. The result is that Saudi Arabia and Russia will no longer adhere to quotas, leading to a likely price war. At the time of this writing, the price of a barrel of Brent crude oil is down 18.6% to $36.85. Loads of companies are getting hammered, but let's focus on some big offshore companies for now. Here are their recent price changes as of 11:30 a.m. EDT.

| Company | Price Change | Industry |

|---|---|---|

| Core Laboratories (CLB +0.00%) | (30.9%) | Oil services |

| Oceaneering International (OII +2.90%) | (38.8%) | Oil services |

| TechnipFMC (FTI +1.58%) | (20.2%) | Oil services |

Source: S&P Global Market Intelligence.

So what

There will likely be dozens of articles written on what happened in that meeting over the weekend, but to avoid the backroom drama, let's look at what's on the table here. With both Saudi Arabia and Russia saying that they will not adhere to quotas, there is a lot of production capacity in the global oil market. According to CNBC, the most recent estimate of Saudi Arabia's production is 9.7 million barrels per day. The kingdom has said it intends to increase production to more than 10 million barrels per day and has the overall capacity to grow to 12.7 million barrels per day.

Image source: Getty Images.

That much extra oil sloshing around in the global market is bound to lead to a significant price drop for both a barrel of oil and the companies associated with it.

In the case of Core Labs, Oceaneering International, and TechnipFMC, none of these companies actually generate revenue from the production of oil but instead from contracts with production companies for various services. Core Labs specializes in laboratory analysis of drilling samples to maximize production and reservoir life, Oceaneering leases remotely operated underwater vehicles, and TechnipFMC manufactures a variety of equipment used in offshore oil production.

Offshore oil is a higher-cost form of oil production, so the thinking goes that with low oil prices, there will be little incentive for producers to spend on new production. Some of the first things that will get cut are higher-cost barrels like offshore, and the contract revenues these companies were looking to secure will dry up.

Now what

Saudi Arabia and OPEC in general just threw the oil market a real curveball. The combination of a supply surge combined with a potential demand shock as countries deal with the COVID-19 coronavirus will likely lead to a persistent oversupply issue. How long that will last, though, is anyone's guess.

What's worse is that the oil market has been limping along for quite some time, and few companies have the balance sheet strength to handle another prolonged oil slump.

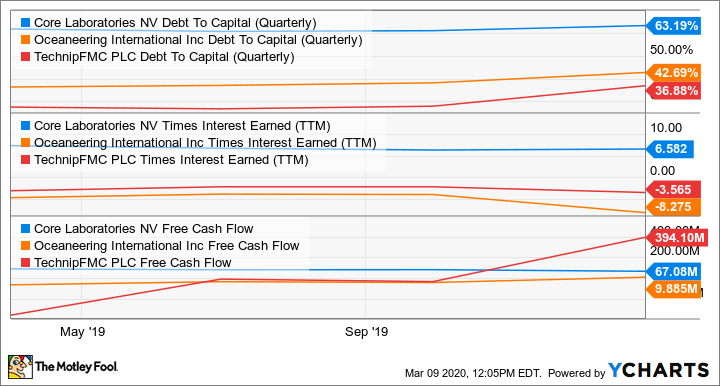

CLB Debt To Capital (Quarterly) data by YCharts.

The one saving grace for these three companies is that all three have reasonable balance sheets or have been able to generate modest amounts of free cash flow recently. This isn't to say that it will be enough to let them thrive in low oil prices, but it does increase their chances of keeping the lights on when others might need to close up shop.

To make any prediction of what will happen at this point would be reckless and a disservice to everyone. So instead, let's just say that sometimes it's better to do nothing when everyone else is making rash decisions.