It's a truly wild time to be an investor. Since the stock market peaked on Feb. 19, 2020, the benchmark S&P 500 has:

- Logged 10 of its 13 biggest single-session point declines in history.

- Recorded its seven largest single-day point gains of all time.

- Screamed into bear market territory twice as fast as any previous bear market.

- Pushed lower by 30% in 22 trading days, which is about 10 times faster than it typically takes bear markets to lose 30%.

- Recorded its largest single-session percentage loss since 1987, and its biggest single-day percentage gain since 2008.

In other words, volatility has been the name of the game, with the spread of the coronavirus disease 2019 (COVID-19) squarely to blame.

Image source: Getty Images.

Investing during bear markets is always a smart move

As of Saturday, March 28, there were almost 658,000 cases confirmed worldwide, with over 30,400 deaths attributed to COVID-19, per Johns Hopkins University. The number of worldwide cases has doubled in a week. With stringent mitigation measures firmly in place in many developed countries, economic activity has ground to a crawl, with equity markets around the world paying the price.

However, there's always light at the end of the tunnel in even the most dismal situations when it comes to investing. That's because each and every stock market correction and bear market, no matter how steep or prolonged, has eventually been completely erased by a bull-market rally. This means that if you invest in high-quality businesses and hang on for the long run, thereby allowing your investment thesis to play out, you should come out a winner.

While we can't predict when the coronavirus crash will end or if we've already hit the bottom, we can say with a fairly highly degree of confidence that the stock market will be higher in the future. This means now is the time to take advantage of depressed stock valuations.

The question, of course, is which top stocks to buy?

Image source: Getty Images.

My single best investment idea for April

Although I've personally bought 12 new stocks during the coronavirus crash, as well as added to a handful of existing positions, one stock stands out head and shoulders above the rest. If you have $1,000 in disposable income to invest right now (i.e., not money you need to pay bills or for emergencies), then you should consider buying into what I view as my single best investment idea for April: Intuitive Surgical (ISRG 3.59%).

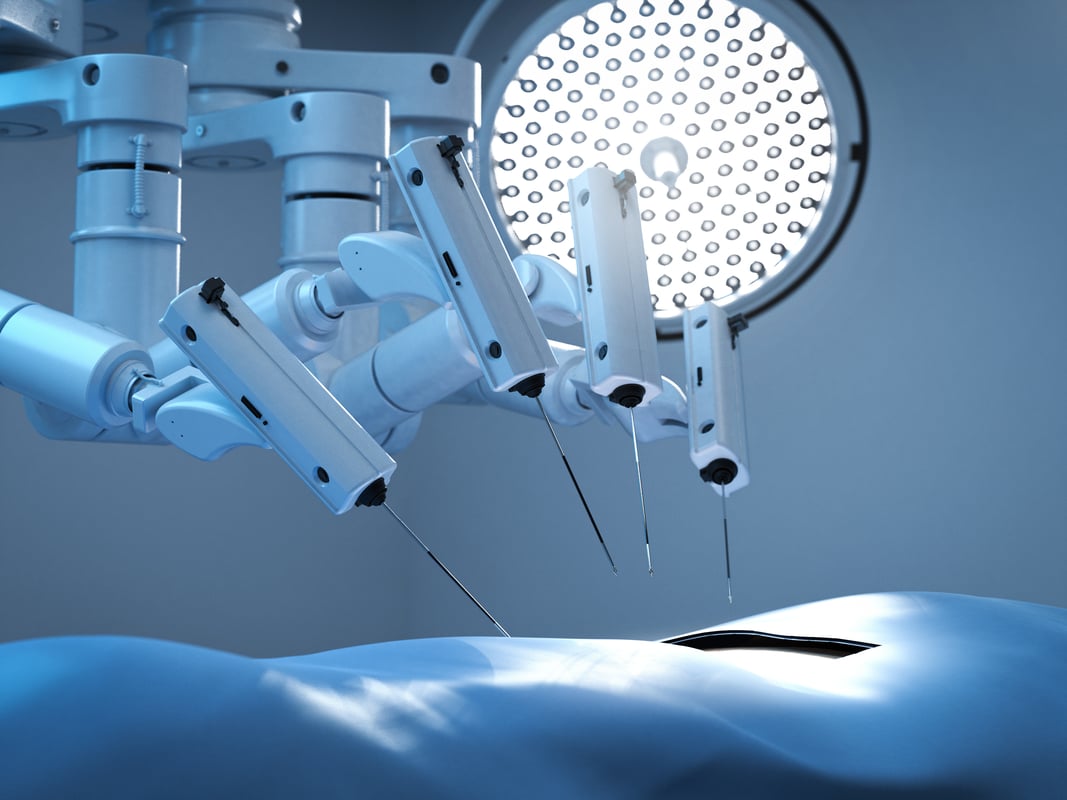

Intuitive Surgical is a manufacturer of surgical-assisted robotic systems. These systems help trained surgeons perform various types of soft tissue surgeries with finite precision, leading to potentially faster recovery times for patients.

As recently as last Monday, March 23, Intuitive Surgical's share price had lost over 40% of its value from its very recent all-time high. Like many companies wading through the uncertainty of the coronavirus pandemic, Intuitive Surgical warned Wall Street that this outbreak would have an adverse impact on its financial results. With many elective procedures being cancelled and pushed further down the road, this will, undoubtedly, hurt the company's very near-term growth potential.

However, COVID-19 is not going to be a long-term concrete weight on the global economy. Eventually, treatment options will be found and/or an antiviral discovered, and the corporate world will return to normal. When this happens, Intuitive Surgical's numerous competitive advantages will shine through.

Image source: Getty Images.

Three no-brainer reasons you need to own Intuitive Surgical's stock

The first clear-cut advantage can be seen in the company's sheer number of installed systems. Intuitive Surgical ended 2019 with 5,582 systems installed worldwide, up nearly 600 from the end of 2018. None of its competitors are anywhere close to having this many precision surgical systems installed around the world. When coupled with a lofty price tag of $0.5 million to $2.5 million for the da Vinci surgical system, and the training provided to surgeons, there's virtually no chance of client churn or lost business to a competitor.

Secondly, this is the perfect example of a razor-and-blades business model. In this instance, the razor is the pricey da Vinci surgical system. Even though these systems generated $1.35 billion in sales for the company last year, they don't generate beefy margins given how complicated they are to manufacture.

The bulk of the company's margins and growth are derived from its blades, which include the instruments and accessories sold with each procedure, as well as the servicing needed to keep these systems in perfect working order. Last year, $3.13 billion was derived from the combination of high-margin instrument, accessories, and service sales. As the number of da Vinci systems installed grows worldwide, the percentage of total sales being generated from these higher-margin revenue sources will climb. Or, put in another context, Intuitive Surgical's profit growth should continually outpace its double-digit sales growth.

Third and finally, Intuitive Surgical is still only scratching the surface on what its da Vinci system is capable of. The company is already a leader in gynecology and urology surgeries, but still offers a long runway to acquire market share in thoracic, colorectal, and general soft tissue surgeries. Since we've established that no surgical system developer has the geographic reach or rapport with the medical community as Intuitive Surgical, it's only a matter of time before its systems are more widely used in place of traditional laparoscopic procedures.

If you have $1,000 to invest right now, I'd suggest putting it to work in Intuitive Surgical.