What happened

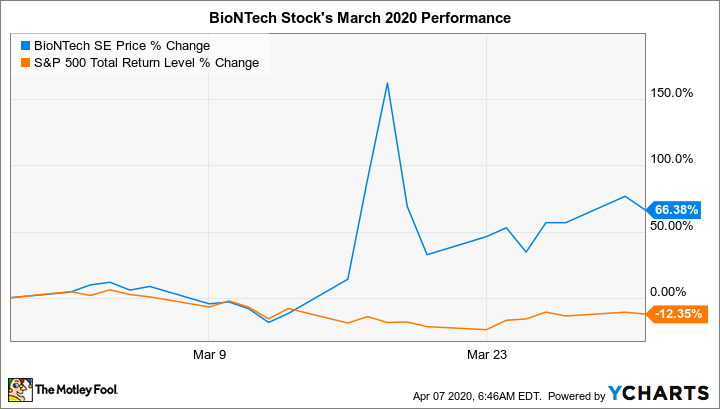

Shares of German clinical-stage biotech BioNTech (BNTX +0.48%) skyrocketed 66.4% in March, according to data from S&P Global Market Intelligence.

For context, last month the S&P 500 index returned negative 12.4%. The market sell-off is being driven by the coronavirus pandemic, which is in the early stages of negatively affecting the U.S. and world economies.

(This month, BioNTech stock has sunk 15.8% through April 6, compared to the broader market's 1.5% gain.)

Image source: Getty Images.

So what

We can attribute BioNTech stock's robust performance last month to investor enthusiasm about the company's partnership with pharmaceutical giant Pfizer (PFE +4.08%) to develop and distribute a vaccine to immunize people against COVID-19. Following this March 17 announcement, BioNTech stock soared 66.5%. (Pfizer stock rose 6.6%, but that was just in line with the broader market, which gained 6% that day.)

Data by YCharts.

This announcement came just a day after fellow clinical-stage biotech Moderna (MRNA +1.27%) announced the start of the phase 1 clinical trial for its vaccine candidate for COVID-19, which resulted in its stock jumping more than 24%. Both Moderna's and BioNTech's COVID-19 vaccine candidates are messenger RNA (mRNA) based.

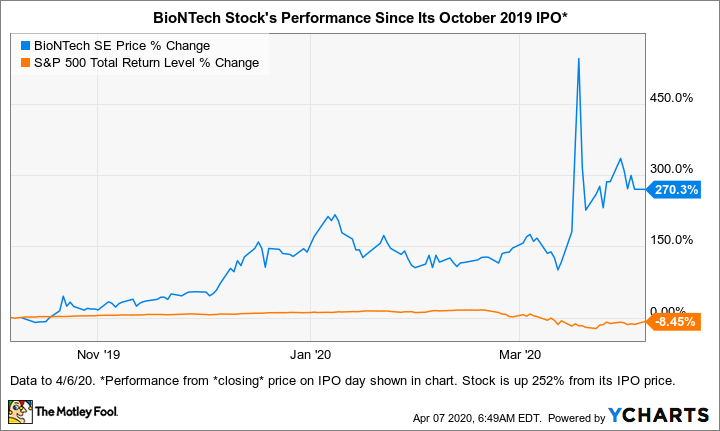

Moving our time lens out further than a month, the chart below shows how BioNTech's stock has performed since its initial public offering (IPO) in October. It's rocketed 252% from its IPO price of $15 (see chart's footnote), which is about twice Moderna stock's 124% gain over this period. The S&P 500 returned negative 8.5% over this same period.

Data by YCharts.

Now what

At the time the Pfizer-BioNTech partnership was announced, the companies said that they expect BioNTech's COVID-19 mRNA vaccine candidate, BNT162, to enter clinical testing by the end of April 2020.

BioNTech has more irons in the fire than just its vaccine development partnership with Pfizer. The company's main focus in on developing individualized cancer drugs, though it also "leverages its technologies for treatment and immunization against rare and infectious diseases," according to its investor website.

It currently has 20 product candidates, 10 candidates in 11 ongoing clinical trials, and seven partnerships with pharmaceutical companies. Along with mRNA-based immune activators, its development platforms leverage three other drug classes.