Investing legend Warren Buffet loves it when the stock market goes crazy. "The sillier the market's behavior, the greater the opportunity for the business-like investor," he wrote in the preface to Ben Graham's The Intelligent Investor, fourth edition.

The COVID-19 pandemic has triggered a massive wave of irrational behavior in the stock market. Investors who can cool their cool in this environment, with a "business-like" focus on finding excellent businesses, can often pair their finds with fantastic buy-in prices. You can find great companies in Wall Street's bargain bin right now.

Sure, the market might take another dive if the coronavirus crisis sticks around much longer. But you don't have to time the market bottom with scientific precision. Not even Warren Buffett tries to do that, because it's an impossible task that depends on a plethora of variables beyond the investor's control. You should simply keep some dry powder to burn in the next market dip, if it ever comes, and get started with a couple of top-shelf companies whose stocks already trade at very attractive prices. Here are two great stocks to buy today.

Image source: Getty Images.

A longtime iPhone supplier

Cirrus Logic (CRUS 1.46%) designs audio controllers and voice processors. The company's chips are found in smartphones, smart home devices, noise-canceling headphones, and wearable computing gear. Last year, iPhone maker Apple (AAPL -2.51%) accounted for 78% of Cirrus' total sales. Cupertino and Cirrus have been joined at the proverbial hip since the early days of the smartphone era -- Apple has been this company's largest client since 2009.

I can hear the gears grinding already. If Cirrus is such a great investment, and its business depends almost entirely on Apple, why not simply invest directly in Apple stock instead?

Cirrus is actually expanding its presence in modern iPhones. When Apple dropped the headphone jack and introduced wireless AirPods instead, the company used Cirrus chip in both the earbuds and the smartphone to make it happen. The company has also leaned on its signal-processing expertise to develop haptic sensors and closed-loop controllers, both of which are finding their way into recent and upcoming Apple products. If Cirrus provided components worth a total of $1.50 per unit of the iPhone 11 generation, a $2 contribution to this year's flagship would boost Cirrus' iPhone revenues by more than 30% with a trifling effect on Apple's manufacturing costs.

Furthermore, nothing is stopping Cirrus from extending beyond its Apple relationship. The company already supplies audio circuits for a handful of Android-based devices and audiophile equipment, and management is always open to winning new business elsewhere. I'll admit that the non-Apple business has been rather sleepy for more than a decade, but that could change in a hurry.

And if not, all you're getting is a trusted Apple supplier whose presence in Cupertino's gear keeps growing over time. Cirrus can grow even if Apple simply holds steady over time. That's a fantastic baseline even if the market-expansion home run never comes, and Cirrus shares are trading 25% below January's all-time highs.

These stripes don't run

Zebra Technologies (ZBRA -1.06%) makes scanners, printers, and data management tools related to barcodes and RFID tags. The stock is trading 23% below the all-time highs it established in early February, providing a discount that should feel familiar to Cirrus investors. Both stocks also change hands at a reasonable 17 times free cash flows at the moment.

The COVID-19 pandemic hangs heavy over this company. The health crisis is keeping shoppers away from stores and the supply chains that bring consumer electronics, clothing, and everyday staples from the factory to the store shelf are largely frozen. Zebra's role in the business world is to help other companies track and manage their supply chains and inventories, so this is a dark time indeed.

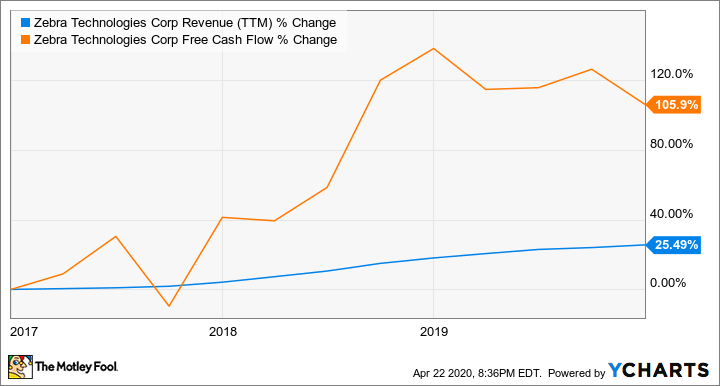

However, Zebra was in the middle of an explosive growth spurt when the virus crisis appeared. Free cash flows have doubled over the last three years while Zebra's annual revenues increased by 25%:

ZBRA Revenue (TTM) data by YCharts

This period has also been very kind to Zebra's investors, producing a market-crushing 120% return in three years. The company is an efficient cash machine, generating $620 million of free cash flows out of last year's $4.5 billion in top-line revenues. The virus will damage these pristine financial trends, but Zebra also sports a pristine balance sheet with lean inventories and a manageable debt load of just $1.3 billion.

Importantly, Zebra's clients are in the midst of a generational upgrade cycle as Microsoft (MSFT -1.75%) is ending support for the mobile Windows CE operating system in 2020. Zebra's latest barcode scanners and rugged portable computers are based on the vibrant Android platform from Alphabet (GOOG -1.51%) (GOOGL -1.45%) instead. Moreover, Zebra should enjoy reasonably stable revenue flows from a recently signed multi-year equipment deal with the U.S. Postal Service. All told, the interrupted revenue growth and accompanying cash flows should get back on track in short order once the health crisis has passed.