Retailers were under pressure before the coronavirus started to spread around the world and eventually led to the economic shutdown of the United States. Tanger Factory Outlet Centers (SKT 0.04%), a retail-focused real estate investment trust (REIT), took swift action. The decision has had major consequences for investors, but in the long run it will likely be the right move for the company and shareholders. Here's what happened and why.

Tough times

The retail industry has been dealing with the so-called "retail apocalypse" for years. The general logic is that consumers are increasingly buying things online, leaving brick-and-mortar retailers with falling customer traffic and sales. There's a grain of truth in this, for sure -- but a big part of the problem is that many retailers have simply under-invested in their businesses (notably on the internet), fallen out of step with consumer trends, and, perhaps most notably, allowed themselves to get over-leveraged.

Image source: Getty Images

It's hard to adjust when you have too much debt hanging over your head, as the bankruptcies of J.C. Penney and Neiman Marcus show. Although mall real estate investment trust Tanger doesn't count those two department store owners as tenants, it does have other troubled retailers in its factory outlet centers. A prime example is Ascena Group (ASNA +0.00%), which recently shut down its struggling Dressbarn brand in an effort to turn the overall company's fortunes around.

Shutting one of its poorest-performing brands was a solid decision, but it didn't change the fact that Ascena is heavily indebted. The company's debt-to-equity ratio was hovering around 8 at the end of 2019, which is a worrying number. Ascena, which continues to operate the Ann Taylor, LOFT, Justice, and Lane Bryant brands, was Tanger's second-largest tenant in 2019, accounting for 4.6% of its total rent roll. Gap was number one, at 5.9% of rents, and ended the year with a debt-to-equity ratio of roughly 0.4 -- much lower than Ascena's.

Dooming the dividend

And then COVID-19 hit, and the United States government effectively paused the economy by forcing non-essential businesses to close down and asking its citizens to stay home and socially distance. The impact on the retail sector has been swift and brutal, with the fashion retailers that are key tenants for Tanger taking among the worst hits. Tanger acted quickly to help its tenants, offering up to two months of rent deferral. There was no need to negotiate or prove a need -- Tanger believed that lending a hand was the right thing to do. The only requirement is that, when things are back to normal, the deferred rent gets paid back early in 2021.

Tanger has one of the strongest balance sheets in the mall REIT space, so it can afford to do this. Although it tapped a line of credit to ensure it has ample cash, the REIT believes it can survive without collecting rent for up to two years. The real benefit, however, is that Tanger has been able to use its financial strength to extend a lifeline to tenants when they most need it. The goodwill from this move is likely to be huge, as the REIT proves that it is a partner and not just a landlord, a sentiment that CEO Steven Tanger clearly expressed during Tanger's first-quarter 2020 conference call. Note that, once reopened, retailers are likely to be left holding excess inventory from a missed selling season, and outlets are a prime destination to unload it. Tanger wants to see its outlets get heavily involved in that process.

The only problem is that going two months without collecting rent is tough on the income statement. With basically no cash coming in the doors, Tanger didn't have the cash flow to pay a dividend. After 27 years of annual dividend increases, the board decided to eliminate the dividend this quarter. Technically the REIT used the term suspend, as it clearly hopes to bring the dividend back in the future. But the impact on investors is the same either way right now.

Without question Tanger is making the right call here, ensuring that its business has the best possible chance of recovering from this difficult time. That should serve investors much better than continuing to pay a dividend that would simply deplete the REIT's valuable cash balance when it's not collecting rent. The question now is what does the dividend look like when it comes back? It's too soon to tell, of course, but Tanger has made a hard call to focus on the long term. And it's the right call, even if it involves some near-term pain for the company and its shareholders.

Stay or go?

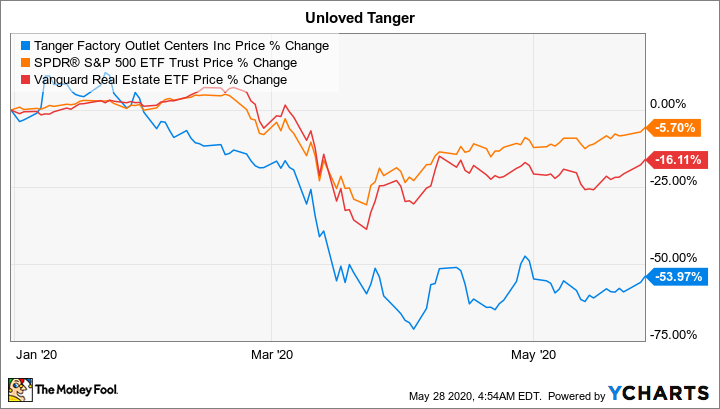

Tanger's stock has fallen dramatically at this point, losing more than 50% of its value this year alone. With the ability to last up to two years without collecting rent, though -- admittedly an unlikely scenario -- if you own the REIT you're likely to be better off letting the recovery play out before locking in the loss. The dividend cut hurt, but the game plan has been well articulated and makes good business sense. Getting back to some semblance of normalcy won't be easy for the U.S. economy, but when it does start to recover Tanger's tenants are likely to remember the lifeline it offered. And that should help get the dividend reinstated for investors.