Giant U.S. electric and gas utility Duke Energy (DUK 0.91%) is a very boring company. However, with a generous 4.7% yield backed by 15 consecutive years of annual dividend increases, there are a lot of investors who would be very pleased to be bored here. But there's more to understand before you jump into Duke's stock. Here's a primer to help you decide if Duke is a buy or not.

Loving the regulated life

Duke has three main lines of business that are all tied tightly together. Its largest is operating regulated electric utilities in six states, serving 7.7 million customers. Next up is its regulated natural gas distribution business, which serves 1.6 million customers across four states. The third business is a merchant power operation that generates and sells energy, increasingly solar and wind power, under long-term contract to others. Electricity is by far the largest business, and is expected to generate seven times the income of the natural gas operation in 2020. Natural gas, meanwhile, is about twice the size of the merchant power business.

Image source: Getty Images

The big takeaway here is that electricity and natural gas are the core focus areas for Duke, and both are highly regulated. Essentially, the utility company has monopolies in the areas it serves, which lock customers in for these vital energy sources. However, in exchange, it has to get government approval for the rates it charges. That effectively puts a cap on the growth the company can achieve over time. This can be seen as positive or negative. The downside is that Duke will never be a high-growth company as it is currently structured. If growth is what you are looking for, then peer NextEra (NEE 0.42%), which has a much larger merchant power operation, might be a better fit.

However, if slow and steady is your speed, then Duke will be pretty interesting. Essentially, regulators examine things like reliability, customer growth, and, increasingly, environmental stewardship when they consider rates. To ensure that it is hitting all of these points, Duke needs to spend money on its systems for upgrades, general maintenance, and capacity expansions when needed. Thus, Duke's spending is key to its long-term growth. Over the next five years or so Duke plans to spend roughly $56 billion dollars. It expects that to lead to 4% to 6% annualized earnings growth over the span. Dividends should rise at around the same amount. That's not exciting, but add it to the current 4.7% yield (more than twice the level of the broader market) and it's not a bad combination.

And keep in mind that the spending plans and rate structure live outside of the ups and downs on Wall Street. That's not to suggest that bull markets, bear markets, and economic recessions don't have any impact on Duke's business. But the regulated nature of the operation provides some protection from these broader vagaries.

And now for some negatives

The fact that Duke is a tortoise and not a hare has already been discussed, but for some that will be a clear negative. For example, dividend growth in the low- to mid-single digits is probably the best you should ever expect here. That's enough to keep the buying power of your dividends up with the historical rate of inflation growth, but not much more. NextEra, by comparison, is projecting 10% dividend growth, which will actually grow your buying power -- but the yield is a far more modest 2.1%. It's a trade off either way.

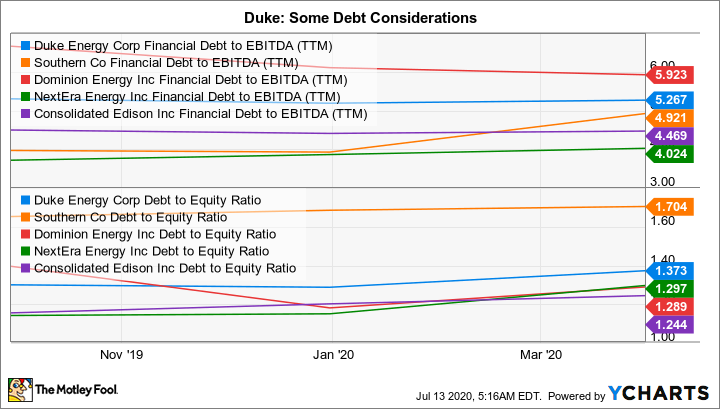

The next compromise with Duke is on its balance sheet. Duke's financial debt to EBITDA ratio is toward the high end of its peer group at around 5.3 times. The same is true for its debt to equity ratio, which is roughly 1.4 times. In fairness, the utility business is capital-intensive, so leverage is not unusual. And with a large number of small customers locked in because of the monopoly nature of the business, it has a fairly reliable income stream to support that debt. But if debt bothers you, Duke might not be the best option.

DUK Financial Debt to EBITDA (TTM) data by YCharts

The last issue is the payout ratio. Duke's dividend eats up about 75% of its earnings. That's a material number, though not out of line with peers. However, it is part of the reason why dividend growth is likely to be slow. There's just no extra room to speed that up, even if management wanted to, because it would put the safety of the dividend in jeopardy. In fact, if you buy Duke, you'll want to keep tabs on the payout ratio to make sure it doesn't get too much higher than it is today.

It depends

Sadly, there's no perfect investment, and Duke is another example of the trade-offs that need to be made. If you are a dividend growth investor, this utility will not be your cup of tea. However, if you are looking to maximize the dividend income your portfolio generates right now and are willing (maybe even happy) to accept slow and steady, then it will likely be of interest. You'll just want to keep in mind the debt and payout ratio issues, perhaps checking in on the numbers once or twice a year to make sure you're still comfortable with what you see.