Big Lots (BIG +0.00%) and Costco (COST +0.04%) don't share many core investment characteristics even though they both operate in the big-box retailing space. Yet the two chains have recently been added to many investors' watch lists thanks to spiking sales volumes during the COVID-19 pandemic. Both Costco and Big Lots could see persistent sales lifts as consumers prioritize bulk shopping and home furnishings in an era of limited in-person retailing and more stay-at-home time.

With that in mind, let's stack these two retailers against each other to see which might make the better long-term investment.

Image source: Getty Images.

Costco is the more consistent winner

Big Lots easily wins the matchup with respect to short-term growth rates. The home furnishings specialist announced a 10% spike in comparable-store sales in the first quarter, which marked its best performance in nearly two decades. Management sees those gains accelerating into Q2, too, with comps reaching into the mid-20s percentage.

Costco is growing at a more modest 11% rate today, according to its June report. But step back and you'll see much more to like about its long-term performance. It grew comps by 6% in the last full fiscal year compared to Big Lots' 0.3% uptick. The warehouse retailing giant has been steadily winning market share for decades, in fact, which has helped establish it as the second-largest industry player behind Walmart (WMT +0.18%). Big Lots is still struggling to maintain consistently positive sales in a brutally competitive niche.

A clear financial picture

The financial picture also points to Costco as the real winner. While Big Lots enjoys a far higher gross profit margin (40% compared to 13%), it is Costco that generates the stronger earnings. Annual net income has improved to over $3.5 billion from $1.3 billion a decade ago. Big Lots is still producing about the same $220 million of profits it did back in 2010. That annual haul has also vacillated more wildly since most of its profits come from sales markups, while Costco can count on a steady stream of membership income as a buffer.

Costco is also in a league of its own when it comes to cash flow and direct shareholder returns.

Valuation goes to Big Lots

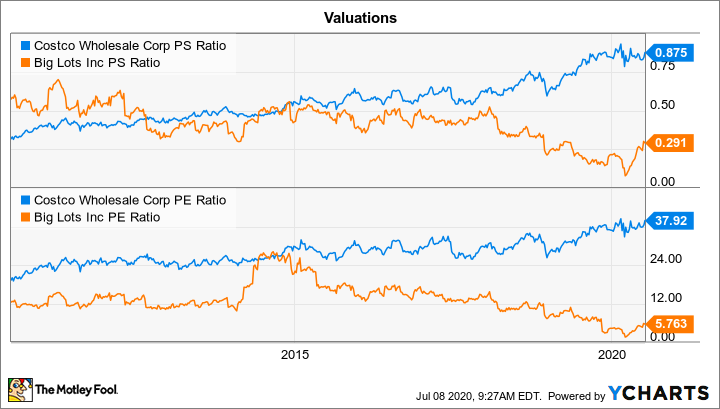

Investors have incorporated these differences into sharply divergent valuations for the two businesses. While they were valued about equally when Big Lots was enjoying some of its best growth in 2013 and 2014, investors now must pay over 37 times earnings for Costco compared to six times earnings for Big Lots. The story is the same with respect to sales, with Big Lots trading for 0.3 times revenue while Costco is valued at nearly 0.9 times its annual revenue haul.

COST PS Ratio data by YCharts.

That valuation gap is well deserved, in my view. Whether it is market share, customer traffic, financial strength, or efficiency, Costco is the stronger retailing business. And with over 90% of its members renewing their subscriptions, the chain is set to continue closing the gap with Walmart as it climbs toward $200 billion of annual revenue.

Yes, you'll have to pay up to own a high-performing business like that. But Costco's premium price has been the worst-kept secret on Wall Street for years -- and it hasn't stopped investors from earning solid returns even over the last decade.