Intuitive Surgical (ISRG +4.61%) has provided market-beating returns since it first went public back in 2000, but at the moment, many investors are skeptical of the company's prospects. The medical device maker hasn't had the best year, with the COVID-19 pandemic seriously disrupting its operations (more on that below). Even with the recent headwinds it has encountered, though, there are good reasons to buy shares of Intuitive Surgical. Here are three.

1. Elective surgeries will pick up again

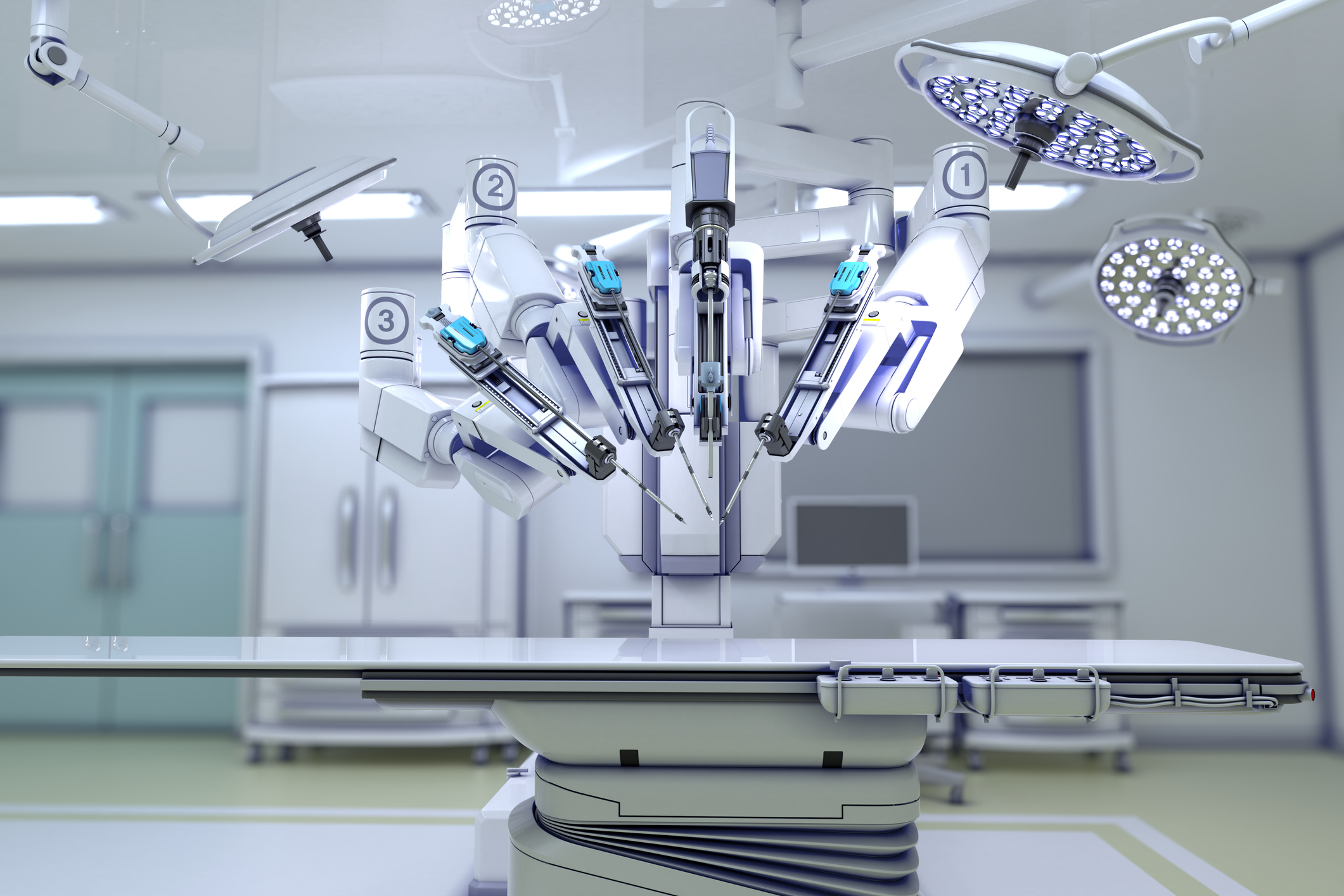

Intuitive Surgical generates much of its revenue from the sale of instruments and accessories for its da Vinci Surgical System, which is used in a number of procedures performed at hospitals. However, the number of elective surgeries declined in the first quarter due to the COVID-19 pandemic. As a result, Intuitive Surgical's first-quarter results took a hit, and the company opted to withdraw its full-year guidance. Yet the near-term decline of elective surgeries is likely to be temporary. The company argues that, while elective, these procedures aren't necessarily optional.

"While these procedures may be delayed in the short term without treatment of some sort, the disease and its impairment persist and often worsens. Said simply, the vast majority of these patients will ultimately seek treatment," Intuitive Surgical CEO Gary S. Guthart said on the first-quarter earnings call. While the healthcare giant may continue to face obstacles as the outbreak drags on, Intuitive Surgical should be able to pick up right where it left off before the crisis.

2. The market for robotic-assisted surgery is ripe for growth

Intuitive Surgical has made significant headway in the market for robotic-assisted surgery. As of March 31, the company boasted 5,669 installed bases of its da Vinci System around the world, which represented an 11% increase compared with the prior-year quarter. But there's still a lot of room for this market to grow. Last year, Medtronic -- one of the world's largest medical device manufacturers -- estimated that robotic-assisted surgeries account for roughly 2% of the total number of procedures worldwide.

Even assuming this estimate is a bit conservative, it seems reasonable to believe that the market remains severely underpenetrated, which is good news for Intuitive Surgical and its peers. It is worth noting that one of the reasons why robotic-assisted surgeries aren't more widespread is because robotic-assisted devices typically cost a lot of money. Intuitive Surgical's da Vinci System costs anywhere between half a million dollars to $2.5 million. Many healthcare facilities simply cannot afford that price tag. In light of this, the company established a leasing program back in 2013 that allows hospitals to acquire a da Vinci System without paying the entire price upfront. The company's flexible payment system will likely allow it to attract even more buyers.

3. Ahead of the competition

Naturally, Intuitive Surgical isn't the only company looking to profit from the lucrative market for robotic-assisted surgeries. But it has successfully built a competitive advantage around its business. The company has spent years building instruments and accessories for its da Vinci System, acquiring regulatory clearance, training medical professionals, and marketing its products to healthcare facilities. All of these efforts take time and money, and they have played a critical role in Intuitive Surgical's success. The company's competitors will need to produce similar feats to catch up to -- let alone surpass -- Intuitive Surgical, and it's not like the medical device maker will be sitting on its laurels in the meantime.

The key takeaway

Intuitive Surgical may not be having the best year, but the long-term prospects of the company remain more or less intact, in my view. As such, investors who opt to buy shares of this healthcare giant today -- and hold these shares through thick and thin -- won't regret it.