Soft drink giant Coca-Cola (KO +0.90%) entered the public market nearly 101 years ago. The blue-chip stock has tracked just ahead of the broader market over the decades, but you won't find many companies with this extreme longevity. Moreover, Coke has a long-standing history of returning lots of cash profits to shareholders through dividend checks and share buybacks.

Image source: Getty Images.

Splits and stock gains

A single share in the company cost $40 at the IPO on September 5, 1919. A century (and change) later, a $100 investment in Coca-Cola would be worth at least $1.1 million today. If you reinvested your dividend checks along the way, the return would have doubled again.

Coca-Cola's stock has split 13 times over the years. One original share from 1919 has now grown into 9,216 stubs, and each one was worth $47.80 at the close of Friday's trading. That works out to $1.1 million for a $100 investment. That single share from 1919 is going to produce $1,511.42 of dividend payouts this year.

Inflation cuts into your returns on a long time scale like this one, but Coke absolutely pulverized the inflation effect. An item that cost $100 in 1919 would cost approximately $1,500 today, according to data from the U.S. Bureau of Labor Statistics.

Coke's dividend history

Coca-Cola raised its quarterly dividend payout by a penny in February. That modest increase extended the company's uninterrupted streak of annual dividend boosts to 58 years.

The company spent $6.8 billion on dividends in 2019, fueled by $9.4 billion in free cash flows. Coca-Cola's market cap passed that level in the summer of 1985. In other words, Coke sent out enough dividend payments last year to cover the company's entire market value at the introduction of New Coke.

This strong commitment to annual dividend increases has allowed Coca-Cola's dividend yield to hover between 1.5% and 3.5% for decades:

KO Dividend data by YCharts

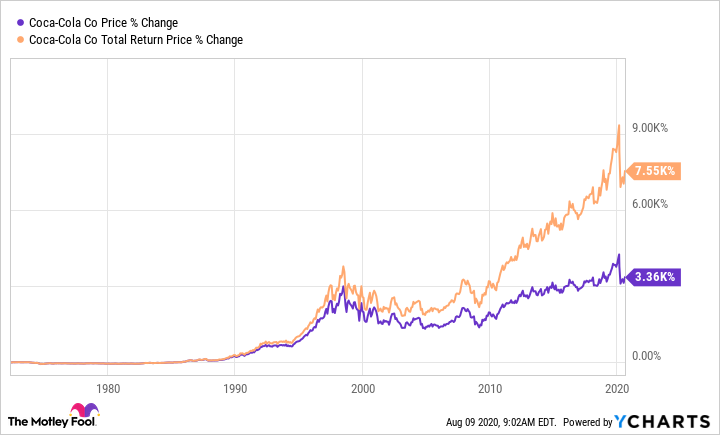

3% might not sound like much but these humble dividend checks add up to big returns over the long haul. Let's say you caught on to the genius of dividend reinvestment in the mid-1970s. Switching on a dividend reinvestment plan (DRIP) for your Coca-Cola holdings at that point would have doubled your returns by now:

That $1.1 million return from a single share in 1919 would be worth $2.47 billion under these circumstances. Starting up a DRIP earlier would have boosted your returns even further but my data sources make it difficult to create nifty charts for ancient dividend returns.

Coca-Cola is an absolute dream stock for long-term investors. The company's centennial history of successful business operations is hard to match, and the stock is a textbook example of shareholder-friendly dividend policies.