What happened

Shares of Workday (WDAY 0.79%) have popped today, up by 12% as of 1:13 p.m. EDT, after the company reported second-quarter earnings. Workday also promoted executive Chano Fernandez to co-CEO, joining co-founder and current CEO Aneel Bhusri.

So what

Revenue in the fiscal second quarter increased 20% to $1.06 billion, topping the consensus estimate of $1.04 billion. That resulted in adjusted earnings per share of $0.84, ahead of the $0.66 per share in adjusted profits that Wall Street was expecting.

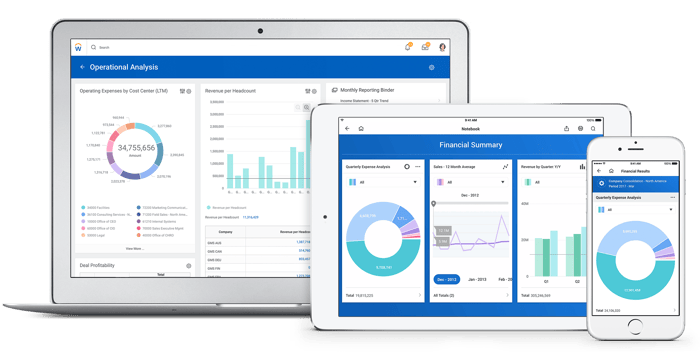

Image source: Workday.

"It was a strong quarter despite the environment, with continued demand for our products as more organizations realize how mission critical cloud-based systems are in supporting their people and businesses through continuous change," Bhusri said in a statement. "As we navigate this unique time, we will continue to deliver new solutions that extend the power of Workday to help customers make more informed people and finance decisions, including how to safely return to work."

Now what

The enterprise software company, which provides a cloud-based HR platform, boosted its full-year guidance. Workday now expects fiscal 2021 subscription revenue to be in the range of $3.73 billion to $3.74 billion, up from the prior forecast of $3.67 billion to $3.69 billion. Subscription revenue in the third quarter should be $948 million to $950 million.

Under the new leadership arrangement, Bhusri will be in charge of product and technologies and other general corporate functions while Fernandez will handle the entire customer relationship cycle.