The stock market is no stranger to volatility, but this year has been particularly brutal. After experiencing record highs over the last few months, the market took a turn for the worse in early September and entered correction territory.

This downturn can be concerning for investors, and you may be tempted to hold off on throwing more money into the stock market until it begins to stabilize. However, there are a few good reasons to keep investing even when the market is on shaky ground.

Image source: Getty Images.

1. It's the perfect opportunity to load up on stocks

Stock market downturns may not be great for your current portfolio but are fantastic opportunities for buying stocks at bargain prices. When stock prices drop, the market is essentially on sale.

If there's a particular stock you have your eye on, you may be able to buy it for less if you invest when the market is volatile. Even if you're investing in index funds, mutual funds, or ETFs rather than individual stocks, you can still get more for your money when stock prices are lower.

Investing during periods of volatility can pay off down the road, too, once the market eventually recovers. Any investor's ultimate goal is to buy low and sell high, and downturns are great opportunities to buy when stock prices have come off their highs. Then, once the market bounces back and stock prices increase, your investments will be more valuable when you're ready to sell.

2. Time is your most valuable asset

Investing is playing the long game, especially if you're saving for retirement. It can take decades to build a robust retirement fund, so there's no time to waste.

If you stop investing every time the market is rocky, you're missing out on valuable time to save. That, in turn, will make it more challenging to reach your retirement goals.

That's not to say it's impossible to retire on time, even if you stop investing during periods of volatility, but you'll need to save more each month to catch up. Compound interest helps your savings grow exponentially when you save consistently, so if you're taking breaks from saving every time the market falls, it will be tougher for compound interest to do its job. As a result, you'll need to work harder and save more.

3. It's very likely the market will recover

It can be intimidating to invest when stock prices are dropping by the day, but try to focus on the long term rather than the short term.

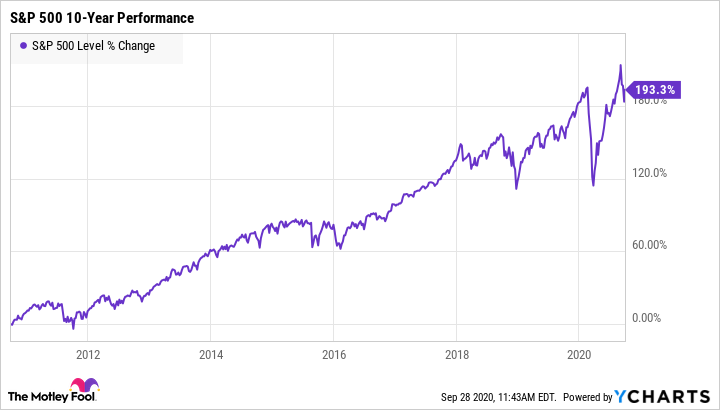

Historically, the stock market has recovered from each and every crash it's experienced, making it highly likely it will bounce back from this downturn, as well. It could take time, but if you're investing for the long term, it won't matter what the market is doing at the moment.

Although the market experiences loads of short-term ups and downs, the overall trend over time is positive. As long as you're investing in solid companies and funds that have a proven track record of success, there's a good chance your investments will bounce back eventually. By riding out the storm and continuing to invest when the market is rocky, you'll reap the rewards once it recovers.

Investing in the stock market can be nerve-wracking during strong economic times, but it's even more intimidating during periods of volatility. However, by taking advantage of this stock market slump and continuing to invest, your investments can come out the other side stronger than ever.