3D Systems (DDD 3.33%) is slated to report its third-quarter 2020 results after the market closes on Thursday, Nov. 5. Its analyst conference call is scheduled for the following day at 10 a.m. ET.

Investors are probably approaching the 3D-printing company's report with some trepidation. Last quarter, 3D Systems missed Wall Street's expectations for both the top and bottom lines. The COVID-19 pandemic has been hurting 2020 results, but the company had been struggling to grow revenue before the global crisis began.

In 2020, shares are down 18.4% through Oct. 20, while the S&P 500 has returned 8.2% over this period.

Here's what to watch when 3D Systems reports.

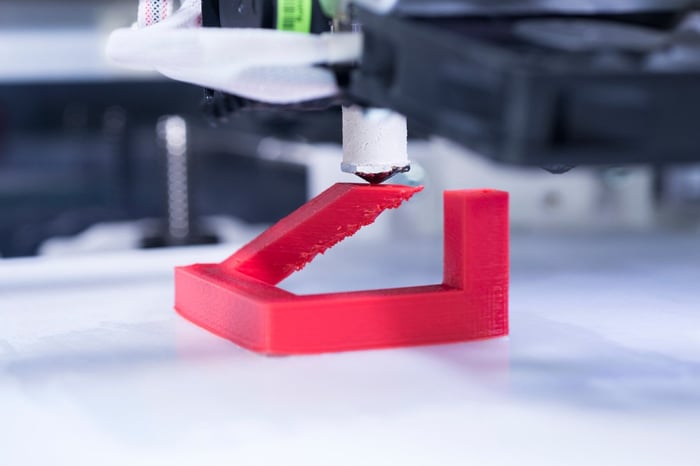

Image source: Getty Images.

Key numbers

Here are the company's results from the year-ago period and Wall Street's consensus estimates to use as benchmarks.

| Metric |

Q3 2019 Result |

Wall Street's Q3 2020 Consensus Estimates | Wall Street's Projected Change YOY |

|---|---|---|---|

|

Revenue |

$155.3 million |

$114.7 million |

(26%) |

|

Adjusted earnings per share (EPS) |

($0.04) |

($0.08) |

Loss expected to widen 100% |

Data sources: 3D Systems and Yahoo! Finance. YOY = year over year.

For context, in the second quarter, revenue fell 29% year over year to $112.1 million, driven heavily by a slowdown in demand from industrial customers. That result fell short of the $117.9 million that Wall Street had been expecting. Adjusted for one-time item, net loss per share landed at $0.13, down from a breakeven result in the year-ago period. Analysts had been looking for an adjusted loss per share of $0.10.

Liquidity

3D Systems burned through $69.7 million in cash in the first half of 2020. At the end of the second quarter, it had cash of $63.9 million (and total debt of $21.5 million). So, if the cash-burn rate remained stable, its cash would be gone by year end. (The company could, however, tap its revolving credit facility, which has approximately $24 million available.)

That said, it's seems highly likely the cash-burn rate slowed down in the third quarter. That's because last quarter, the company announced an aggressive restructuring plan aimed at reducing operating expenses by $100 million by the end of 2021. Highlights of this plan include a 20% reduction in the workforce, with most of the layoffs completed by the end of this year; a reduction in the number of facilities; and possible divestitures.

3D printer and material sales

Investors should home in on sales of 3D printers and print materials. That is, assuming management provides this data during the earnings call if asked by analysts.

Before last quarter, this data was provided during the management presentations on the earnings call. Last quarter, it was not, with the reason given that the company had restructured its revenue categories into two target verticals, healthcare and industrial.

This development is unfortunate for investors. The two data points that weren't provided last quarter reflect how well the company's razor-and-blade-like strategy is working. Sales of 3D printers (the "razor") are more important than suggested by their contribution to total revenue because they drive future sales of print materials (the "blades"), which sport high margins.

Tread carefully

3D Systems stock is best suited to speculative investors. There is no guarantee the company's turnaround will be successful. For less speculative investors, Proto Labs stock remains the better way to bet on the growth of 3D printing.