Two years after Canada officially legalized recreational marijuana, investors are still searching for the winners. But investors looking to build lasting wealth in the sector have a better base to research which investments could make them rich today than they did two years ago.

A speculative sector like cannabis will particularly take time to play out, as government regulations play a large role in the business thesis. But there is more clarity -- and some lower share prices -- this long after the Canadian decision in October 2018. Along with disappointing returns, some businesses continue to struggle. But Canadian grower Aphria (APHA) isn't one of them.

Image source: Getty Images.

Do it Buffett's way

Becoming a millionaire from your investments is most likely accomplished by holding good businesses for many years. Warren Buffett likes businesses with large moats that can help compound their earnings over time, and that trade at what he considers good valuations.

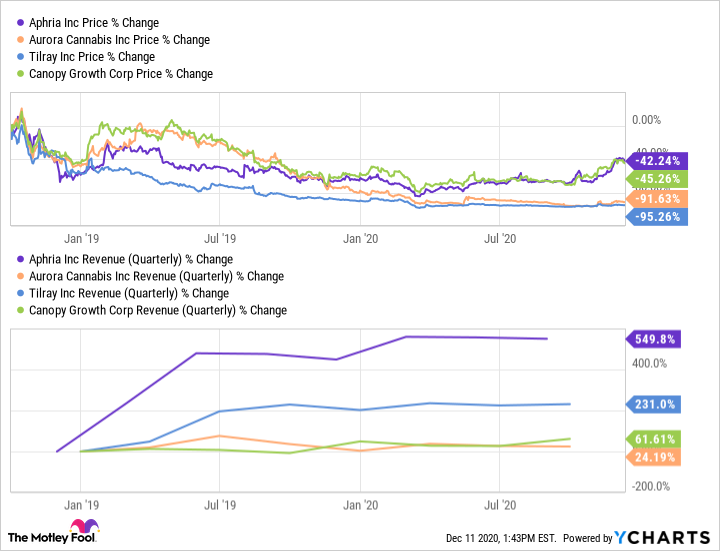

The marijuana sector is less about moats and more about speculating on the potential market -- so it's difficult, if not impossible, to invest exactly as Buffet would. But valuations have certainly improved since the original hype drove up shares two years ago. Aphria, for example, has a current price-to-sales (P/S) ratio of about 5, down from more than 75 in late 2018. And Aphria has grown its sales compared to some peers, even as its share price moved down.

A transformational acquisition

The thesis for an investment in Aphria hinges on growth in the recreational marijuana market. Supporters of legalization in the U.S. have had some success at the state level. Five U.S. states passed ballot initiatives concerning the legalization of marijuana in the recent election. Though federal legalization is still not a near-term likelihood, the investment thesis is based on it eventually occurring. Companies that want to be prepared are already building a framework. Beverage company Constellation Brands (STZ 0.05%), for example, added to its initial $4 billion investment in Canopy Growth (CGC 0.36%) with another almost $200 million invested through warrants earlier this year.

Aphria is also using a beverage company to grow in the U.S. It announced an important acquisition in the U.S. in early November. Behind the headlines of the purchase of craft brewer SweetWater Brewing Company is a path into the U.S. cannabis market. While the $300 million acquisition will be immediately positive for Aphria's business, it's the potential long-term benefits that really make the deal exciting for shareholders. SweetWater Brewing sells the most popular hemp-flavored beer in the country. In the announcement of the purchase, Aphria said that it provides "a platform and infrastructure within the U.S. to enable it to access the U.S. market more quickly in the event of federal legalization."

Ahead of the competition

Prior to the SweetWater acquisition, Aphria was already well-positioned in Canada, boasting the top market share in both Ontario and Alberta. Total revenue grew 15.5% in its quarter ending Aug. 31 compared to the prior year period.

That double-digit sales growth is likely to continue, especially considering the strong sales growth in the overall Canadian market. During the third quarter, for example, the cannabis market in Ontario grew 54% to be worth $700 million, according to the company.

But for Aphria to be a millionaire-maker, the U.S. market will have to be open to the company. Having the infrastructure in place with SweetWater puts Aphria ahead of its competition in the event of legalization. Not all cannabis companies will thrive even if the U.S. market opens. But Aphria has put the foundation in place to do so, and investors could have a millionaire-making stock in their portfolio if recreational marijuana is legalized in the U.S.