When it comes to the cannabis industry, you'll need to make a few compromises if you want to make an investment. Few companies have the right combination of increasingly wide margins, rising revenue, and diligent control over expenses to make their stock a must-buy.

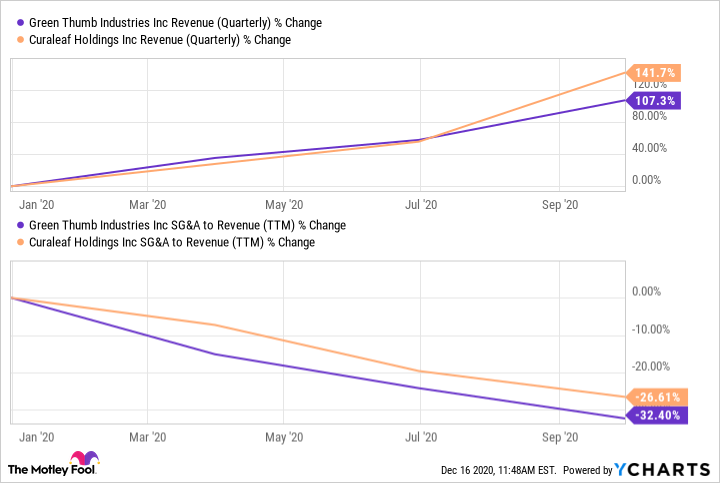

Green Thumb Industries (GTBIF -0.36%) and Curaleaf (CURLF 0.77%) are on the verge of breaking out of this mold, which means that they're worth paying attention to. They have earned around the same amount in revenue over the past 12 months, and they are both expanding quarterly revenue at a rate exceeding 100% year over year. And, they're both racing toward posting a profit, even if they aren't there quite yet. Picking a clear winner will be tough, but let's dive in and see who has an edge.

Image source: Getty Images.

The case for Green Thumb

Green Thumb's recreational marijuana products are distributed in 11 states across a handful of branded retail locations, with more to come as it sets up new cultivation and distribution facilities. Its portfolio of products runs the gamut from its Dogwalker pre-rolled blunts to Dr. Solomon's cannabis-infused skin lotions.

If cannabis is legalized federally in the U.S., expect the company to expand rapidly. In the meantime, management has indicated that New Jersey is the most exciting opportunity among the recent crop of states to legalize recreational cannabis.

Green Thumb's trailing-twelve-month profit margin is negative, but at negative 4.73% it's within spitting distance of breaking even. In fact, in the first and second quarters of this year, it reported small but positive free cash flow. Management has worked to reduce selling, general, and administrative (SG&A) costs, and over the course of the last 12 months it has succeeded, reducing trailing SG&A expenses sharply to reach just over 42% of revenue from its starting point of over 60%. This means that if it can replicate these successes consistently next year, Green Thumb could commence posting regular earnings, which would be highly encouraging for potential investors.

Finally, the company has around $78 million in cash and just over $204 million in total debt. This is a manageable amount to pay off, especially if it can keep increasing its revenue.

The case for Curaleaf

Curaleaf claims to be the largest cannabis company in the U.S., and it has a larger reach than Green Thumb. It operates in 23 states, with plans to expand into six additional states. It also targets the medicinal marijuana segment as its first priority rather than recreational use, which it sees as an opportunity for expansion. The company sells everything from bulk cannabis flower to pre-rolled blunts, vapes, lotion, and oils.

Curaleaf has some work to do before it can improve its profit margin of negative 11.05%. Part of the reason for this is its substantial retail dispensary footprint, which it plans to continue expanding. Thus, its revenue is growing somewhat faster than Green Thumb's, but its stock has grown a bit slower. This may be because it has about $579 million in debt, which looms large against its cash holdings of $84.59 million and its persistently negative free cash flow. Importantly, management has focused on building vertical integration with many of its newest cultivation facilities, which implies higher up-front costs in exchange for greater efficiency and hopefully greater cash flow down the line.

GTBIF Revenue (Quarterly) data by YCharts

In the meantime, Curaleaf's management has also been working to reduce SG&A expenses, but it hasn't driven costs down quite as aggressively as Green Thumb. SG&A costs are 45.7% as a proportion of its trailing revenue, so the companies aren't too different. Interestingly, this is probably because of slight differences in the way it runs its retail locations in different states. Some of its state-level operations generate cash flows, but others do not, potentially because some are already experiencing the benefits of vertical integration whereas others are still in the process of building up that integration.

The verdict

Overall, Green Thumb is a better pick because it has been slightly more effective at driving down its costs while increasing its revenue and its market penetration. Furthermore, Green Thumb has a smaller debt load, which means it won't need to pay as much interest to stay current. But Curaleaf isn't a bad stock by any means. If Curaleaf can succeed with its ambitious plans for expansion, it may well outperform Green Thumb in the future.