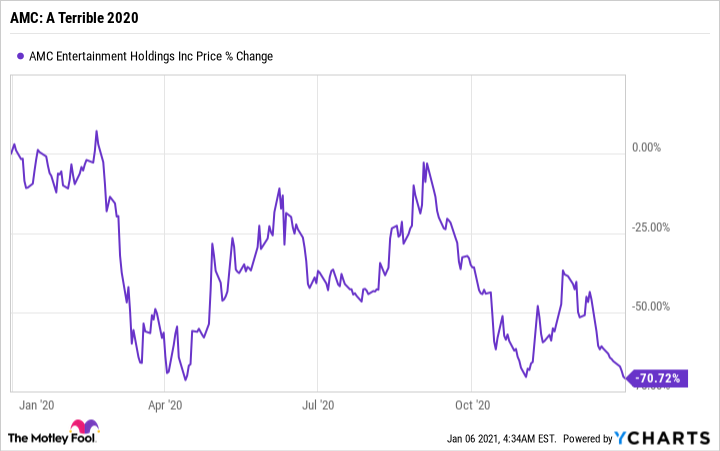

Shares of AMC Entertainment (AMC 2.08%) fell 70% in 2020. That's a disastrous decline, but one that makes complete sense given the coronavirus headwinds the movie theater industry has been dealing with. As 2021 gets underway and vaccines are more widely distributed, investors might be expecting the situation to quickly improve.

Don't get too excited just yet, however. Here are three troubling issues you need to think about before investing in AMC Entertainment's stock.

1. Look closely at the numbers

With revenue down an incredible 90% in the third quarter of 2020, almost any improvement in AMC's business will look pretty impressive on a percentage basis. In normal times percentages would be enough to consider, but not now. Coming from such a low base, percentage changes could be wildly misleading.

Image source: Getty Images.

Right now, investors need to consider the absolute values here. For example, third-quarter 2020 revenue was a paltry $120 million or so. The company's rent costs alone were $214 million in the quarter. If AMC brought in just enough to pay its rent, that would result in a huge 78% revenue increase. But that still wouldn't be nearly enough to keep the business going over the long term, since all of its other expenses wouldn't get paid.

Basically, as 2021 unfolds, it is highly likely that AMC will start to lap truly terrible performance with improved quarterly results. But those improvements may not be meaningful enough to signal a sustainable business recovery.

2. A slow process

Another key issue to think about is the pace of the business recovery AMC might see. Even as the theater chain starts to get people back into the movie theater, which is highly likely in 2021, investors need to consider how long it will take to get back to a level of attendance that can sustain the business. Indeed, the vaccine rollout that's currently unfolding is very encouraging. But it is a logistical nightmare to vaccinate 330 million U.S. citizens, especially when some vaccines require that you stick them twice and some of the vaccines have very specific (and expensive) handling requirements.

Getting to the point where the vaccines have a material impact on the trajectory of the pandemic is not going to happen quickly. It will likely take several quarters, and the process could even spill into 2022. That means that any improvement in AMC's attendance in 2021, and thus business performance, is likely to be slow and drawn out.

3. Desperation

That brings up the very big issue of AMC's ability to survive as a going concern. It is far from clear that AMC can support its business through this downturn while it waits for a business recovery to unfold. In fact, AMC CEO Adam Aron recently discussed just how bad the situation is with a major business news outlet. He explained that the company needs $750 million to get through 2021. But so far it has only managed to raise $200 million, leaving it drastically short of its goal.

AMC's stock price is hitting all-time lows, and recent rounds of debt financing came with interest rates as high as 10.5%. Clearly Wall Street is worried that the risks outweigh the rewards here. And that is making it very hard for AMC to raise the cash it needs. As it gets more and more desperate for cash, look for it to take increasingly aggressive actions. That could easily include moves that are not very shareholder-friendly, like selling huge numbers of additional shares at historically low prices that end up materially diluting the stakes of current shareholders.

On that front, AMC has already gotten pretty aggressive, selling 30 million shares in September and October of 2020. Compared to the average share count at the end of the third quarter, that represents a roughly-30% increase in the company's share base. So management has already made material moves that are less than shareholder-friendly, but perhaps necessary if it wants to survive. More such desperate moves are likely to come.

On the brink

AMC is, at best, a turnaround stock, but is more likely a special situation. The difference is subtle but important. A turnaround is a company that's working its way back from a difficult time. A special situation, in this case, is a company that's teetering on the edge of insolvency as it looks to survive through a difficult time. AMC is facing a very difficult environment that will likely see only slow improvement in 2021, even though the depth of the industry downturn will make even a modest recovery look like a substantial change. Meanwhile, it desperately needs cash to keep itself afloat. And that means more and more aggressive financing moves are likely as the new year unfolds. Only the most aggressive investors should be looking at this stock.