What happened

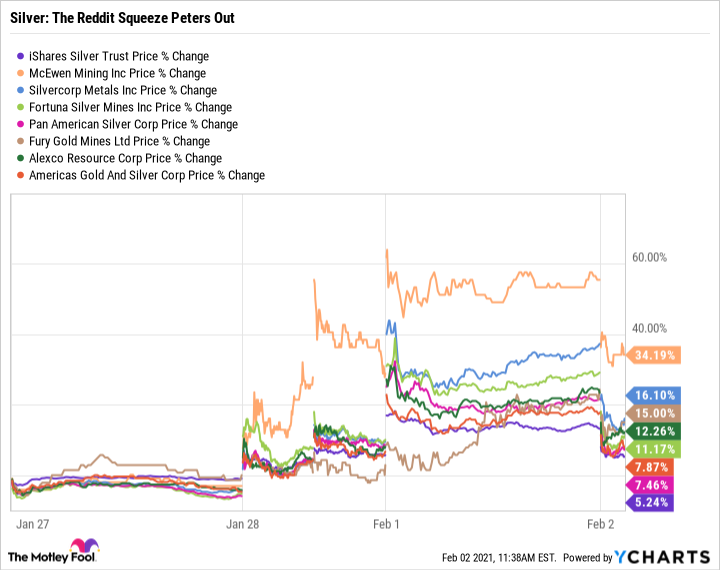

By 11 a.m. EST today, shares of precious metals miner Silvercorp Metals (SVM) had fallen as much as 18%. And it was hardly alone. Fortuna Silver Mines (FSM -4.70%) was off by 17% at its worst point in the first 90 minutes of trading. McEwen Mining's (MUX -0.73%) nadir was roughly 16%.

But that's just three names in what was a broader industry sell-off. For example, at its lows Pan American Silver (PAAS -1.91%) was off by 13%. Fury Gold Mines (NYSE: FURY) and Alexco Resource (AXU) were both down by as much as 12%. And the decline at Americas Gold and Silver (USAS -4.10%) was just over 10% at its worst. All these precious metals stocks pared their early losses a little bit, but continued to languish near their lows. That, however, comes after a few days of outsize gains. You can thank a Reddit message board for the crazy.

Image source: Getty Images.

So what

The price gains in precious metals miners, particularly those with a heavy silver focus, started late last week. That was when members of Reddit's WallStreetBets board started to shift their attention away from troubled companies like video game retailer GameStop and movie theater operator AMC Entertainment. The board members had successfully driven the shares of those stocks, and others, hyperbolically higher in a short squeeze, and they were looking for the next name to take on. Silver and silver miners came up as a target, and the fun began.

Only silver and silver miners aren't the same as piling into a single company facing material financial headwinds. For starters, silver is a rather large global market, and there are a lot of companies that mine for it. In fact, some names that are more heavily focused on gold even got caught up in the drama here, likely because they are small companies where a trading volume spike could cause the price to move dramatically.

Size was, actually, a notable issue across the board. For example, McEwen Mining, Fury Gold, Alexco Resource, and Americas Gold and Silver all have market capitalization below $1 billion, some well below. Even Fortuna and Silvercorp have market caps only just above $1 billion. The largest stock here, Pan American Silver, has a market capitalization of around $6.5 billion, but even that's not very large when you consider that the biggest precious metals miners weigh in at around $40 to $50 billion.

But size plays another role here. Not only are the precious metals markets huge compared with the markets for GameStop and AMC, but they are also more opaque. It is, thanks to technology, very easy to see who is short an individual stock (including miners). But it is much harder to determine what the short position looks like in precious metals. And because miners and the metals they produce are so tightly entwined, it is hard to consider the metal without considering the stocks, and vice versa.

Normally, in fact, investors would look at things like precious metals prices, production costs, production levels, and exploration efforts, among others, when considering a precious metals company. But Reddit investors' only thought likely was, "Can we push up prices to take out material short positions?" Only those shorts may or may not have actually existed. It looks like this effort had too big a target compared with the board's successful campaigns on other stocks.

Now what

What has been taking shape the last few days is pure speculation, and it seems like the trends have already reversed. Though, to be fair, emotions are fickle, and it is entirely possible that mining stocks and silver start to move higher again. Perhaps obviously, long-term investors should stay on the sideline until this craziness has passed. However, it is worthwhile to step back and look at what is transpiring today so you can put it into perspective. Wall Street can, and does, lose its way at times. This, while exciting in the moment, is what it looks like.