Chipotle Mexican Grill (CMG -2.53%) rang up another quarter of solid growth to close out 2020, even as the pandemic continued to weigh on sales. Furthermore, management said that sales growth has improved in January and will likely accelerate further as year-over-year comparisons ease starting in March.

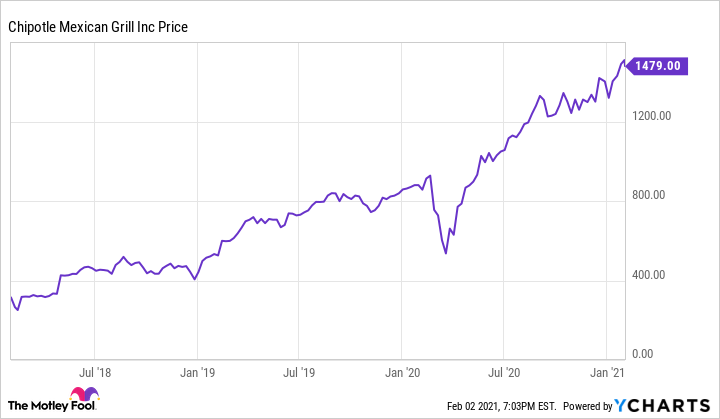

Indeed, investors can expect Chipotle to post strong growth and meaningful margin expansion over the next two years as the pandemic recedes. Nevertheless, Chipotle stock appears to be dramatically overvalued after roughly quintupling over the past three years.

Chipotle Mexican Grill stock performance, data by YCharts.

Growth slows a bit in Q4

Chipotle's revenue rose 11.6% to $1.61 billion in the fourth quarter. That marked a slowdown from the company's 14.1% revenue growth in the third quarter, but the result matched the average analyst estimate. Comparable restaurant sales grew 5.7%, driving about half of the total sales increase. Chipotle also grew its total restaurant count (net of closures and relocations) by 146 units in 2020, ending the year with 2,768 locations.

Despite margin pressure from a higher mix of delivery orders and other pandemic-related cost headwinds, Chipotle managed to increase its operating margin to 7.3% last quarter, up from 6.8% a year earlier. That caused adjusted earnings per share to jump 22% year over year to $3.48. Analysts (on average) had expected EPS to reach $3.76 last quarter. That said, Chipotle estimated that pandemic-related costs and higher bonus accruals reduced fourth-quarter adjusted EPS by $0.41. Excluding those headwinds, the company would have modestly exceeded analysts' expectations.

Better days ahead

Chipotle's fourth-quarter results were strong in light of the pandemic but not especially impressive by the company's usual standards. However, Chipotle expects growth to accelerate this quarter. Comparable sales grew about 11% in January. Moreover, the company will face easier comparisons in March as it laps the beginning of the pandemic in the U.S. As a result, management anticipates that comparable restaurant sales will grow at a mid-to-high teens pace for the full quarter.

Growth should accelerate further in the second quarter, considering that Chipotle's comparable restaurant sales fell 9.8% in Q2 2020, compared to a 3.3% increase in the first quarter. And while year-over-year comparisons will get tougher in the second half of 2021, the pandemic is likely to be more under control by then, giving sales a boost.

Image source: Chipotle Mexican Grill.

Similar trends could help Chipotle in 2022. Pandemic-related headwinds should be fading, allowing Chipotle's traffic-driving initiatives to shine through. Sales per restaurant could hit a new record (surpassing the high of $2.5 million reached in 2015), driving meaningful margin expansion. Indeed, analysts expect the company to post EPS of approximately $29 in 2022: up from $10.73 last year and $14.05 in 2019.

The valuation doesn't make sense

Chipotle has a good chance to meet or even exceed analysts' lofty earnings growth targets for the next two years. However, even if EPS were to reach $30 next year, Chipotle stock doesn't look like it's worth anything close to its recent trading price of approximately $1,500.

By the end of 2022, Chipotle will have captured most of the sales and margin opportunity from recovering business lost during the pandemic. Between mid-single-digit long-term comparable sales growth and steady growth in the store base, Chipotle may be able to grow revenue at a low-teens pace. However, that's not much faster than what Starbucks expects: only Starbucks stock trades for less than 30 times its projected 2022 earnings, compared to 50 times 2022 earnings for Chipotle stock.

Some analysts think Chipotle will be able to continue expanding its margins well beyond 2022, keeping EPS growing rapidly for many years to come and supporting a higher share price today. That's certainly possible -- but it would be hard to pull off. Rising wage levels and the growing prevalence of lower-margin delivery orders will likely keep Chipotle's operating margin below the prior high of nearly 19%.

Investors should wait until this hot burrito stock cools off before taking a bite.